INP-WealthPk

Ayesha Mudassar

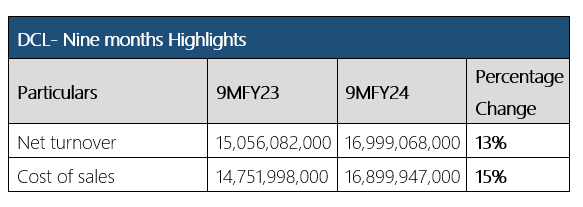

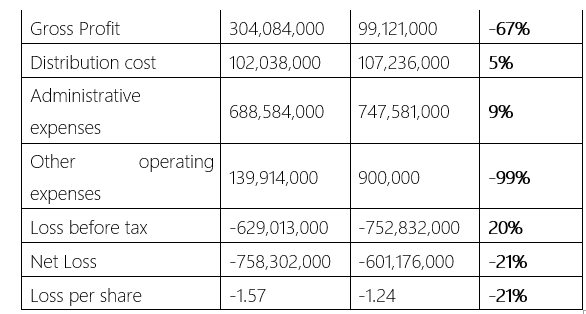

Dewan Cement Limited (DCL) reported a net loss of Rs 601.1 million during the nine months of the last fiscal year 2024 compared to a loss of Rs758.3 million in the corresponding period of the earlier year, reports WealthPK.

The company recorded a loss before tax of Rs752.8 million during 9MFY24 compared to a loss of Rs 629 million in 9MFY23. Furthermore, the gross profit plunged by 67% during the period under review. According to the results, the cement company’s net sales rose 13% to Rs16.9 billion against Rs15.05 billion in 9MFY23. On the expense front, the company observed an increase in administrative expenses by 9% year-on-year (YoY) while slashing other operating expenses by 99% YoY to Rs747.5 million and Rs9 million, respectively, during the review period. The company’s management has actively pursued cost-saving measures to mitigate losses. However, certain factors, including exorbitant input prices, escalating energy charges, currency exchange rate fluctuations, and uncertain political and economic conditions, have predominantly impacted the company’s performance.

Quarterly Review

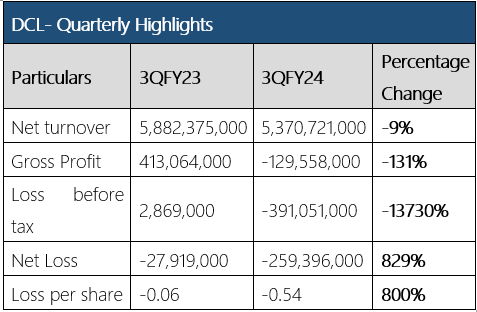

The DCL posted a net loss of Rs259.3 million for the third quarter ending March 31, 2024, an increase from Rs27.9 million loss recorded in the same period of the previous year. According to the quarterly report, the company incurred a loss before tax of Rs391 million in 3QFY24 compared to a loss of Rs2.8 million in 3QFY23.

In addition, the DCL’s topline contracted by 9% YoY to Rs5.3 billion compared to Rs5.8 billion in 3QFY23.

Historical operational performance (2018-2023)

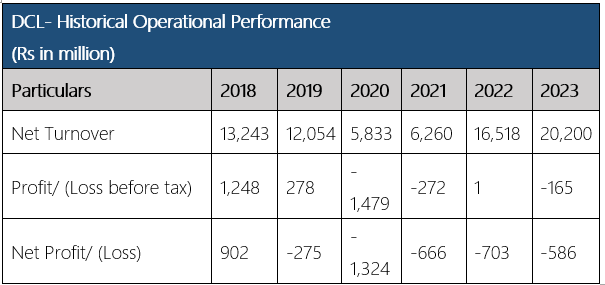

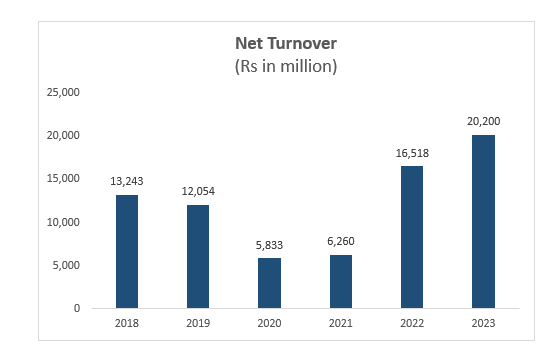

Over the years under review, the company’s top line has grown only thrice, while profit margins have generally declined, with some improvement observed in FY21. In FY20, the company witnessed a major revenue of nearly 52% with net turnover falling to a record low of Rs5.8 billion. This decline was primarily due to a slowdown in construction activities and low selling prices. With the production cost exceeding the net revenue, the company incurred a gross loss of Rs516 million and the net loss increased to an all-time high of Rs 1.3 billion.

In FY21, the revenue grew by 22% on the back of an increase in average selling price. However, the company's per ton cost of sales increased by 47.8% on account of continually escalating input costs. High production costs and operating expenses continued to consume a substantial portion of income, causing profit margins to shrink. During the Fiscal Year 2022-23, the company's revenue increased to Rs20.2 billion, largely driven by a higher average selling price. The cost of sales increased by 47.8% due to continuous increases in input costs including coal, power, raw materials, and imported consumables.

Challenges facing the cement sector

The cement industry faces two simultaneous but divergent challenges: Pakistan’s per capita cement consumption stands at 182 kilograms, which is lower than its regional counterparts, indicating untapped market potential. Besides, the cement industry’s heavy reliance on coal, which accounts for 66% of its energy consumption, exposes it to the fluctuations of global coal prices and diverges from the global trend towards sustainable energy sources.

About the company

Dewan Cement Limited was established as a public limited company in 1980. It is part of Yusuf Dewan Group of Companies. Dewan Cement manufactures and sells cement. It has two manufacturing units, namely Parkland Cement Limited, and Saadi Cement Limited.

Credit: INP-WealthPk