INP-WealthPk

Amir Khan

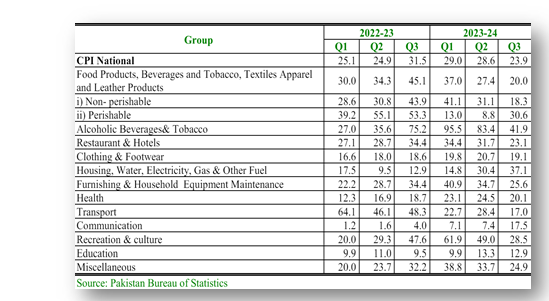

The Fiscal Year 2024 has witnessed a notable slowdown in the inflation rate of perishable food items, marking a significant trend attributed to various factors. These include lower global commodity prices due to improved domestic crop yields and enhanced market supplies. Talking to WealthPK, economic researcher at the Ministry of Planning, Development and Special Initiatives Aslam Javed said frequent adjustments in the administered prices had partly offset the decline in food prices. He highlighted concerns that the inflationary pressures could spread to other goods and services. Sectors such as clothing, footwear, and healthcare may face increased cost pressures, potentially unsettling inflation expectations among the consumers. Quarter-to-quarter data for Q1 to Q3 of FY2024 shows a gradual decline in food inflation, offering some relief to the household budgets within broader economic pressures.

Quarter-wise CPI National in percentage

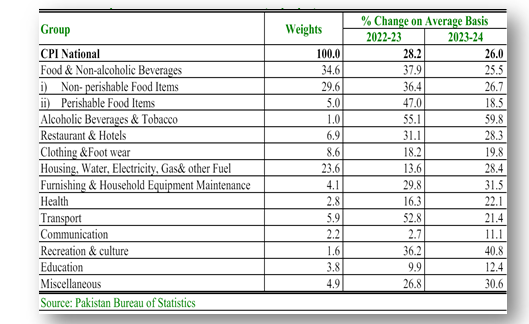

Moreover, Aslam Javed added that persistent increase in the energy prices had posed a significant barrier to more substantial inflation reduction efforts. This ongoing challenge underscores the complexities of managing inflation in a global economic environment marked by fluctuating commodity prices and geopolitical uncertainties. During July-April FY2024, headline CPI inflation was 26.0 percent, compared to 28.2 percent during the same period last year. The increase in inflation affected all categories, with double-digit inflation rates across the board. Notably, there was a significant surge of 25.5 percent in the prices of food and non-alcoholic beverages, driven mainly by a 26.7 percent increase in the prices of non-perishable food items, although perishable items also contributed to the rise.

Composition of CPI-National inflation (July-April)

Talking to WealthPK, Member of Development Projects, Planning Commission Rafiullah Kakar said the disparity in perishable food prices between local farm areas and urban markets persisted due to the high transportation costs and intermediary margins, exacerbated by inadequate storage facilities. The non-farm areas experienced elevated living costs, exacerbated by a 28.4 percent increase in essential consumer goods like housing, water, electricity, gas, and other fuels, compared to 13.6 percent in the preceding year.

He highlighted that currency depreciation, global oil price fluctuations, and increased energy tariffs were primary contributors to the rise in the domestic energy costs. These factors also increased inflation in other sectors such as housing, clothing, footwear, household maintenance, health, education, recreation, culture, and hospitality.

Credit: INP-WealthPk