INP-WealthPk

Shams ul Nisa

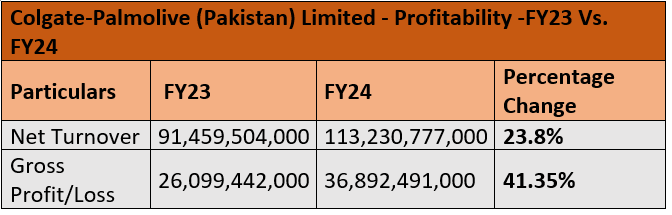

Colgate-Palmolive's net profit jumped by 66.1% to Rs17.2 billion in the fiscal year ended June 30, 2024 from Rs10.4 billion in FY23, reports WealthPK.

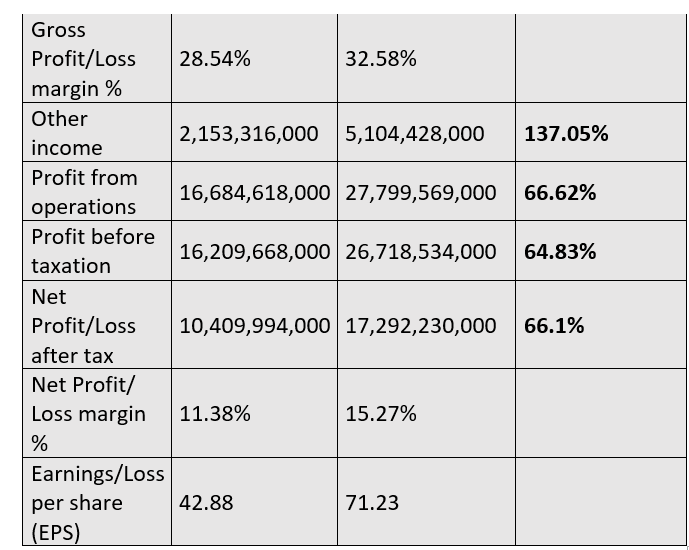

The company’s turnover also rose by 23.8% in FY24, driven by volume growth and favourable changes in the product mix. The gross profit increased 41.35%, raising the margin to 32.58% in FY24 from 28.54% in FY23. Other income shot up by 137.05%, reaching Rs5.10 billion compared to Rs2.15 billion in FY23. Furthermore, operating profit surged by 66.62%, highlighting the company's strong ability to convert sales into operational profit.

Additionally, the profit-before-taxation increased by 64.83% driven by lower commodity prices and stable exchange rate. The earnings per share rose significantly from Rs42.88 in FY23 to Rs71.23 in FY24, reflecting improved shareholder value and indicating higher returns for investors.

Food & personal care products sector

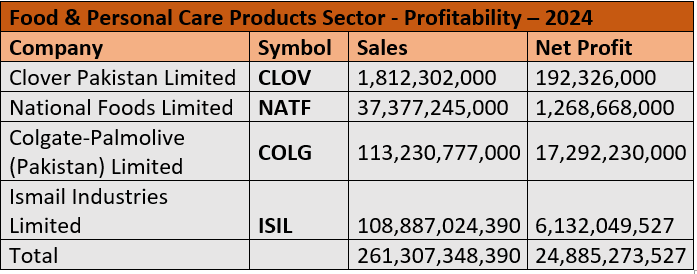

National Foods Limited led the food segment of the food and personal care products sector with sales of Rs37.38 billion in FY24, highlighting its strong market position. Colgate-Palmolive (Pakistan) Limited led the personal care segment with sales of Rs113.23 billion, showing its dominance in the segment. Ismail Industries Limited also posted solid sales of Rs108.89 billion, while Clover Pakistan Limited recorded the lowest sales at Rs1.81 billion, indicating potential difficulties in scaling operations.

In terms of net profit for FY24, Colgate-Palmolive led the sector with Rs17.29 billion followed by Ismail Industries with Rs6.13 billion and National Foods with Rs1.27 billion. Clover Pakistan reported the lowest net profit of Rs192.33 million, indicating challenges in cost management or market positioning. The total net profit for the sector amounted to Rs24.89 billion, reflecting overall strong profitability.

Investment ratios analysis

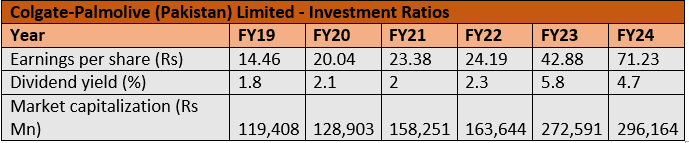

Colgate-Palmolive's earnings per share surged from Rs14.46 in FY19 to Rs71.23 in FY24, reflecting effective management of operations and profitability. The EPS growth is a positive indicator for investors seeking growth potential. The dividend yield varied over the years, peaking at 5.8% in FY23 before dropping to 4.7% in FY24, indicating that the company returned a larger portion of earnings to shareholders, particularly in FY23.

Additionally, the market capitalisation of Colgate-Palmolive grew significantly from Rs119.41 billion in FY19 to Rs296.16 billion in FY24. This growth points to strong investor confidence, likely fueled by the company's solid financial performance and promising growth outlook.

Future outlook

The remainder of the ongoing financial year 2024-25 is going to be tough for businesses as the country strives for macroeconomic stability through strict fiscal and monetary measures under a long-term IMF programme. The 2.5% advance income tax imposed on unregistered retailers with the manufacturers entrusted with the responsibility of collecting it has led to market distortions, thus bypassing the necessary reforms to integrate retailers into the tax net. As consumers face rising utility costs, food inflation, and increased living expenses, the company anticipates difficult months ahead, requiring substantial interventions to meet customer needs effectively.

Company profile

Colgate-Palmolive was established in Pakistan on December 5, 1977. The company primarily focuses on the production and sale of detergents, personal care products and related items.

Credit: INP-WealthPk