INP-WealthPk

Shams ul Nisa

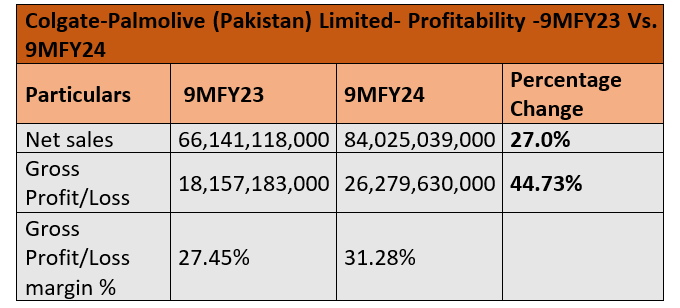

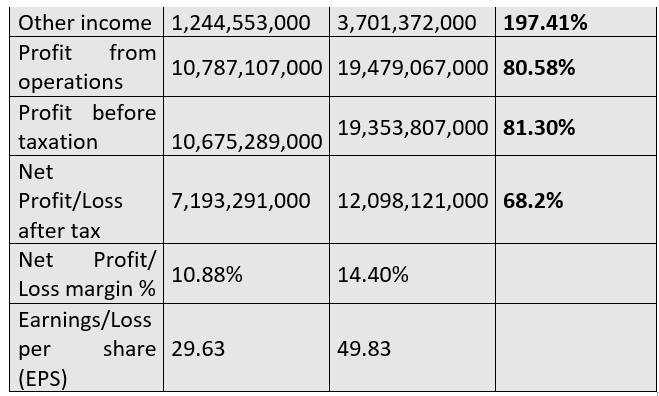

Net sales of Colgate-Palmolive (Pakistan) Limited increased by 27%, gross profit by 44.73% and net profit by 68.2% during the first nine months of the current fiscal year (9MFY24) compared to the same period of FY23, reports WealthPK. Increased volume and favourable price strategies pushed the company's sales to Rs84.02 billion from Rs66.14 billion in 9MFY23. Similarly, gross profit increased to Rs26.27 billion in 9MFY24 from Rs18.15 billion in 9MFY23, pushing the gross margin to 31.28% from 27.45% in 9MFY23. This was made possible because of consistent commodity pricing policies and cost-cutting initiatives. As a result, the company earned a hefty amount of Rs12.09 billion in net profit in 9MFY24 compared to Rs7.19 billion in 9MFY23.

Other income increased to Rs3.7 billion in 9MFY24, up by 197.41%. The company showcased impressive growth in profit from operations, which grew by 80.58% to Rs19.47 billion in 9MFY24 from Rs10.78 billion in 9MFY23. During this period, the company invested in advertising and brand building. At the end of the period, the company earned Rs19.35 billion profit-before-taxation, which was 81.30% higher than Rs10.67 billion in 9MFY23. Thus, net profit margin and earnings per share jumped to 14.40% and Rs49.83 in 9MFY24 from 10.88% and Rs29.63 in 9MFY23.

Investment measures per ordinary share analysis

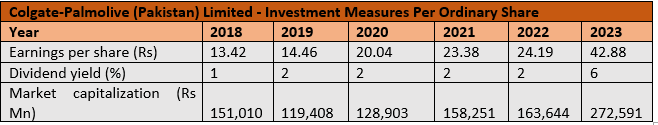

Over the last six years, starting 2018, the company witnessed a steady growth in its earnings per share, which rose from Rs13.42 in 2018 to Rs42.88 in 2023, indicating a magnificent growth of 219.52%. The EPS made the highest jump of 77.26% in 2023 compared to 2022, when EPS stood at Rs24.19.

Starting from a 1% dividend yield received by the shareholders of the company in 2018, it then remained stagnant from 2019 till 2022 at 2%. However, the dividend yield surged 200% to 6% in 2023, reaching the highest-ever dividend yield during the period. The company's market capitalisation slipped once in 2019 to Rs119.4 billion from Rs151 billion in 2018, down by 20.93%. It then continued to grow, reaching Rs272.59 billion in 2023. Overall, the company reported an increase of 80.51% in market capitalisation.

Profitability ratios analysis

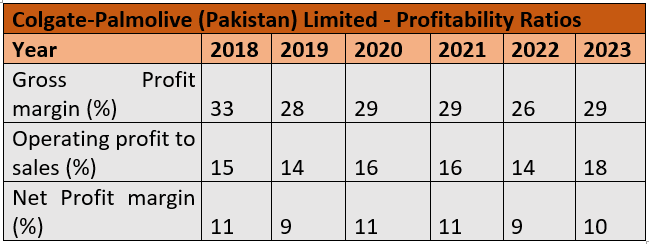

The study of the profitability ratios of a company offers a thorough understanding of how profits are generated relative to operating expenses. A company's ability to control its manufacturing costs is evaluated by its gross profit margin. Colgate Palmolive's gross margin generally fluctuated from 33% in 2018 to 29% in 2023, with 2022 recording the lowest margin of 26%. Whereas, operating profit, which is the income earned from the core operations of a company, increased from 15% in 2018 to 18% in 2023.

On the other hand, the net profit margin, which evaluates net income as a proportion of revenue, fluctuated between 9% and 11% over the years. Overall, the net profit margin dropped from 11% in 2018 to 10% in 2023.

Liquidity ratios analysis

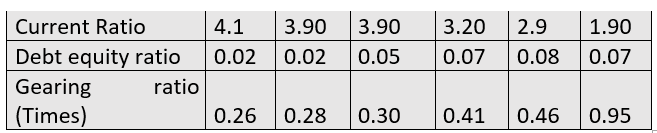

With a current ratio of 4.1, the company was in a solid position in 2018. However, this ratio continued to fall in the following years, from 3.90 in 2019 to 1.90 in 2023, showing a decrease in current assets relative to an increase in short-term liabilities. Nonetheless, the ratio continued to show the company's secure position.

![]()

The debt-to-equity ratio remained below 1, indicating a reduced risk of covering liabilities. The gearing ratio climbed from 0.26 in 2018 to 0.95 in 2023. However, it stayed below 1, suggesting lower debt and lower investment risk.

Future outlook

Political unpredictability, geopolitical instability, and heavy debt payments are projected to continue to bog down the economic growth in Pakistan. Amid increased taxation and stricter reforms, which are dubbed necessary for the economy to stabilise, the company is focusing on cost-cutting strategies to achieve sustainable growth as consumers' spending power gets eroded due to inflationary pressures.

Company profile

Colgate-Palmolive (Pakistan) was established as a public limited company in Pakistan on December 5, 1977. It is principally engaged in the manufacture and sale of personal care, detergents and related products.

Credit: INP-WealthPk