INP-WealthPk

Shams ul Nisa

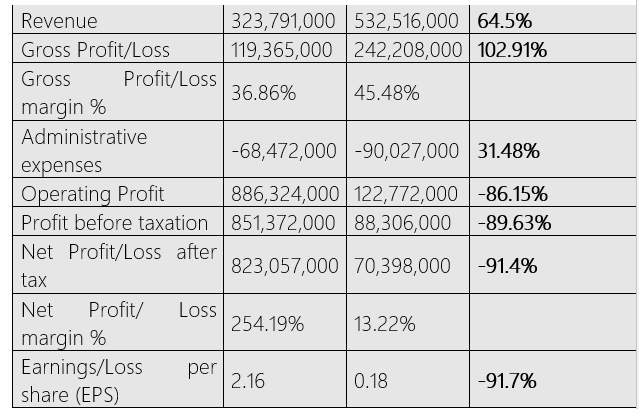

Avanceon Limited's financial results showed a strong revenue growth of 64.5% but a significant decline of 91.4% in profitability, reports WealthPK. The company reported a revenue of Rs532.5 million and a net profit of Rs70.3 million in 1QCY24. The decline in its net profit was mainly attributed to the stable US dollar exchange rate during the period. Consequently, the group did not record any unrealized exchange gains, which had earlier boosted profitability.

![]()

Furthermore, the gross profit surged 102.91% to Rs242.2 million in 1QCY24. Therefore, the gross profit margin improved from 36.86% to 45.48%. Additionally, the administrative expenses increased by 31.48%, causing a sharp drop of 86.15% in the operating profit to Rs122.7 million, suggesting difficulties in managing the operating costs relative to the revenue increase. Similarly, the profit before taxation plummeted by 89.63% to Rs88.3 million in 1QCY24 from Rs851.3 million in the same period last year. Despite the higher sales, the net profit margin dramatically decreased from 254.19% to 13.22%. Additionally, the earnings per share dropped to Rs0.18 in 1QCY24 from Rs2.16 in the same period last year.

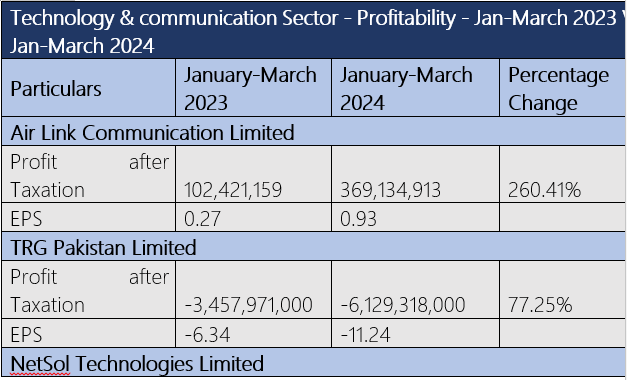

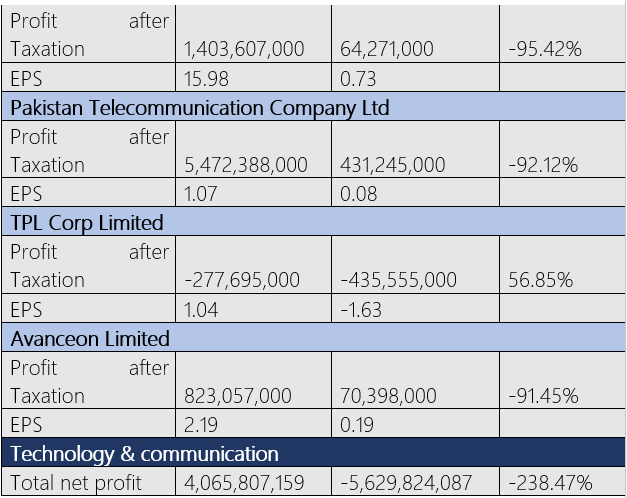

Technology and communication sector

From January to March 2024, Pakistan's technology and communication sector saw substantial declines in net profits compared to the previous year, leading to an overall sector loss. Among the companies, from January to March 2024, Air Link Communication Limited bucked the trend with a 260.41% increase in profit after tax to Rs369.1 million from Rs102.4 million, demonstrating a strong operational performance and effective cost management. The company posted a slight increase in earnings per share to Rs0.93.

However, TRG Pakistan Limited and TPL Corp Limited remained persistent in net loss. TRG Pakistan Limited registered growth in the net loss by 77.25%, with the loss per share widened to Rs11.24. TPL's losses increased to Rs435.5 million with a loss per share of Rs1.63 during the period. NetSol Technologies Limited's profitability plummeted by 95.42%, and EPS decreased drastically to Rs0.73. Pakistan Telecommunication Company Limited also faced a significant downturn, with a 92.12% reduction in profit after tax and a steep decline in EPS to Rs0.08. Avanceon Limited reported a decrease in net profit by 91.45%, registering an EPS of Rs0.19. At the end of the review period, the sector ended with a loss of Rs5.62 billion compared to a net profit of Rs4.06 billion in the same period last year.

Future outlook

According to the company’s growth outlook for Purchase Order (PO) generation, this year is extremely promising. The company started the year with a significant opening backlog valued at USD70 million. Moving forward in 2024, the company is very confident about the strategic corporate initiative, the "Road to 100 Plan," which targets PO generation of USD100 million. This plan is carefully designed, underscoring commitment to a robust and sustainable growth. The company expects successful execution of the "Road to 100 Plan" to be evident in the revenue conversion throughout the year. As POs are fulfilled and converted into completed projects, this will lead to substantial revenue growth, enhancing the financial performance for 2024.

Company profile

Avanceon Limited was incorporated in Pakistan on 26th March 2003. The principal activity is to trade in products of automation and controls equipment and provide related technical services.

Credit: INP-WealthPk