INP-WealthPk

Ayesha Mudassar

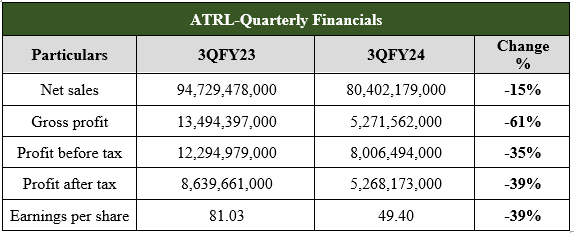

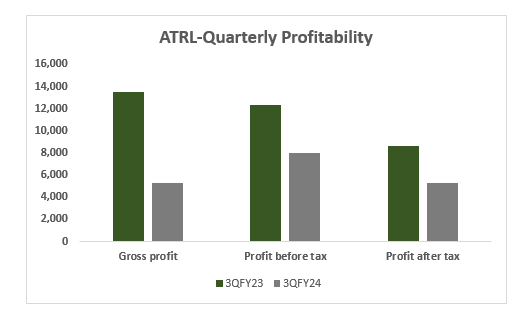

Attock Refinery Limited (ATRL), a subsidiary of the Attock Oil Company Limited, experienced a decline of 35% and 39% in before and after-tax profits, respectively, during the third quarter (December-March) of the ongoing fiscal year, compared to the corresponding period of FY23, reports WealthPK. The ATRL posted a pre-tax profit of Rs 8 billion and a post-tax profit of Rs 5.2 billion in the third quarter of FY24. The lower profit was mainly due to challenging and adverse economic conditions, including higher raw materials costs, depreciation of local currency, a rapid increase in the interest rate and high inflation.

In addition, the company’s net sales contracted to Rs 80.4 billion in 3QFY24 compared to Rs 94.7 billion in 3QFY23, thus posting a 15% decline. Its earnings per share (EPS) were recorded at Rs 49.40 in 3QFY24 as compared to Rs 81.03 in the same period last year.

Performance over the last four years (2020-2023)

Financial Highlights

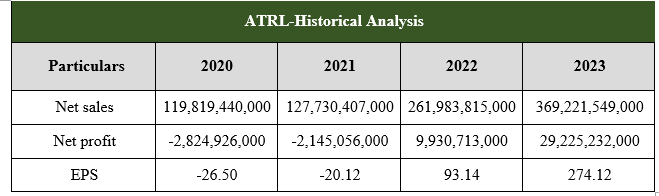

The company seems to have undergone a turnaround from losses to profits, with substantial growth in net sales and profitability over the years 2020 to 2023. This suggests positive financial performance and potentially improved operational efficiency and market positioning during the period. During 2020, the company suffered loss after tax of Rs 2,825 million, which resulted in a loss per share of Rs 26.50. The eruption of the COVID-19 pandemic resulted in a drastic reduction in demand for petroleum products and hence massive inventory losses.

The year 2021 was a recovery year. The gradual increase in oil prices and petroleum products helped the ATRL to reduce losses. The ATRL posted a net loss of Rs 2.1 billion compared to a net loss of Rs 2.8 billion in 2020. In 2022, the company earned a net profit of Rs 9.9 billion as compared to a net loss of Rs 2.8 billion last year. The improved margins were mainly due to higher demand for petroleum products after the easing of COVID-19 restrictions. Furthermore, the Ukraine crisis resulted in higher product prices, leading to better refinery margins, especially in the last quarter of the year. In 2023, the company posted a profit after tax of Rs 29.2 billion. The year witnessed record profit owing to high gross refining margins (GRMs), better inventory management, and operating refinery at optimal throughput. Taking benefit of improved financial performance, the company made a premature settlement of an outstanding long-term loan.

Ratio Analysis

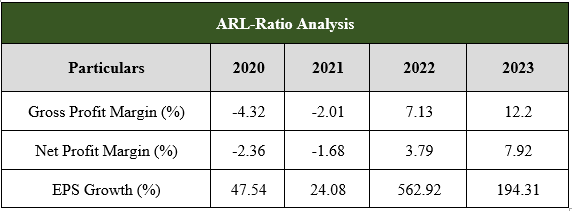

The company showed significant improvements in its gross profit margin, net profit margin, and EPS growth over the four years, indicating better cost management, increased profitability, and strong earnings growth.

In 2020 and 2021, the company had negative gross profit and net profit margins. However, the margins improved significantly in 2022 and 2023, suggesting an improvement in the company’s cost management. Moreover, the company experienced significant EPS growth from 2020 to 2023. In 2020, the EPS growth was 47.54%, followed by 24.08% in 2021. The growth skyrocketed in 2022 to 562.92% and remained high at 194.31% in 2023. Such substantial growth indicates strong performance and potentially effective management of resources and investments.

Company Profile

ATRL, the country’s pioneer in refining crude oil, was incorporated as a Private Limited Company in 1978 before becoming a public company the following year. Backed by a rich experience of successful operations, ATRL has now developed into a cutting-edge refinery with a nameplate capacity of 53,400 barrels per day.

Future Outlook

The economy and overall business climate in the country are expected to remain difficult with rising costs of doing business, high inflation, and unstable refining margins. Therefore, the management will continue to focus on proactively improving operational efficiencies to increase revenue and reduce costs.

Credit: INP-WealthPk