INP-WealthPk

Ayesha Mudassar

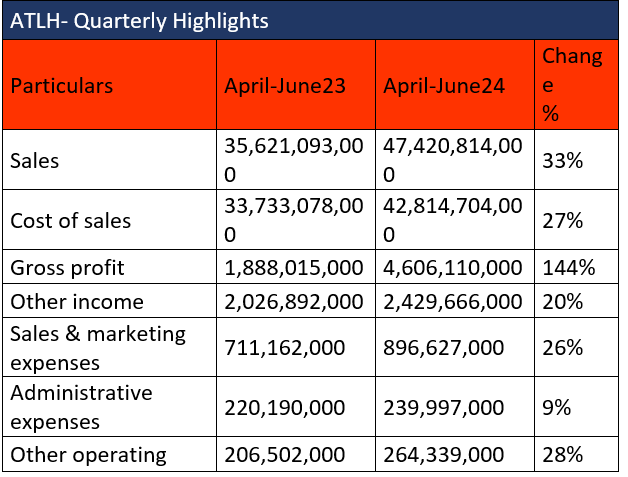

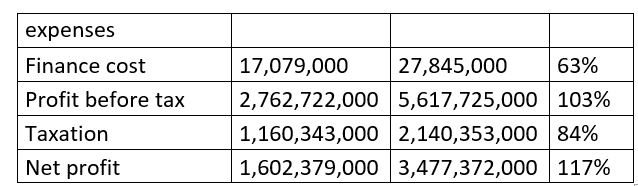

Atlas Honda Limited (ATLH), one of Pakistan’s leading motorcycle manufacturers, experienced a significant 117% increase in net profit for the quarter ended June 30, 2024, which reached Rs3.4 billion compared with Rs1.6 billion during the same period of 2023, according to WealthPK. The company observes its fiscal year from April to March. ATLH’s net sales increased by 33% year-on-year (YoY) to Rs47.4 billion from Rs35.6 billion in the quarter ended June 30, 2023. This growth can be attributed to the company's sound market position and reliable customer base.

Additionally, ATLH witnessed a 144% YoY increase in gross profit during the period under review. This improvement was driven by a favourable sales mix, a stable exchange rate, and various cost-reduction initiatives. Other income increased by 20%, driven by effective treasury operations that benefitted from higher liquidity and elevated interest rates. On the expense side, the company observed a rise in administrative costs by 9% YoY and sales and marketing expenses by 26% YoY during the period. Moreover, other operating expenses climbed by 28% YoY during the quarter. The company’s finance cost rose by 63% YoY to Rs27.8 million from Rs17.07 million in the same quarter of 2023, mainly due to higher interest rates. On the tax front, the company paid a higher tax worth Rs2.1 billion against the Rs1.1 billion paid in the same quarter of 2023, depicting an 84% YoY rise.

Yearly highlights: Operational performance

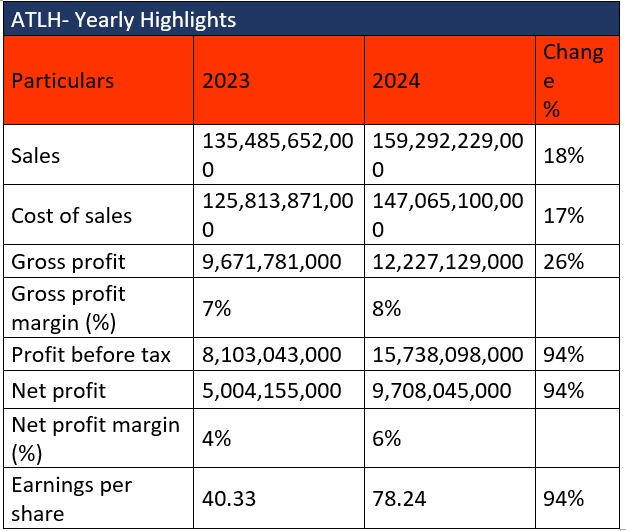

Atlas Honda Limited recorded an 18% YoY increase in sales, a 26% rise in gross profit and a 94% surge in net profit during its own fiscal year, which ended March 31, 2024. ATLH posted gross and net profit margins of 8% and 6%, respectively, during the year, compared to 7% and 4% previously.

The earnings per share (EPS) for the year were reported at Rs78.24, reflecting a substantial 94% increase compared to Rs40.33 previously. This notable growth underscores the company’s effective utilisation of profits to enhance shareholder value. In addition, the company contributed Rs38 billion to the government and its agencies through various taxes and levies. The company has consistently focused on productivity enhancement, process optimisation, and cost reduction. This included the localisation of completely knocked down (CKD) kits, tool modifications, and the establishment of production dashboards.

Pattern of shareholding

As of March 31, 2024, Atlas Honda Limited had 124.08 million shares outstanding, which were held by 1,694 shareholders. The largest shareholding (90.2%) was owned by associated companies, undertakings, and related parties. Individuals owned 9.24% of the shares, while banks, Development Finance Institutions (DFIs), non-banking financial institutions (NBFIs), insurance companies, modarabas, and mutual funds collectively held 0.3% of the shares.

About the company

Atlas Honda was incorporated as a public limited company on October 16, 1962, under the Companies Act, 1913 (now the Companies Act, 2017). The company is principally engaged in the progressive manufacturing and marketing of motorcycles and spare parts.

Future outlook

Pakistan’s economic and financial position continues to improve on the back of prudent policy management and the resumption of inflows from both multilateral and bilateral partners. The easing of import restrictions is anticipated to facilitate a recovery in the industrial sector. Additionally, maintaining fiscal discipline, implementing structural reforms, leveraging favourable external factors, and promoting domestically driven growth initiatives while focusing on high-potential export sectors will yield substantial benefits in the coming years.

Credit: INP-WealthPk