INP-WealthPk

Shams ul Nisa

Archroma Pakistan Limited suffered a net loss of Rs307.8 million in the first nine months of the fiscal year 2023-24 (9MFY24) compared to a net profit of Rs903.1 million in 9MFY23, registering a massive decline of 134%, reports WealthPK.

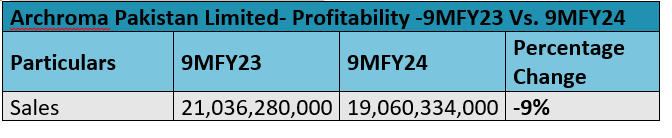

This decline was largely due to increased energy and commodity prices and rising business costs, all influenced by the ongoing Middle East and Ukraine crises. Additionally, the demand in Archroma's textile and construction markets remained weak for both local and export sales during the period under review. Likewise, the sales decreased by 9% from Rs21.04 billion in 9MFY23 to Rs19.06 billion in 9MFY24. This was due to less than 50% production capacity utilisation by the textile industry during the period. Furthermore, the gross profit dropped sharply by 37%, causing gross profit margin to decline to 18% in 9MFY24 from 26% in 9MFY23.

The expenses increased slightly by 4%, mainly driven by the rise in distribution and marketing costs, further worsening the company’s profitability. As a result, the company sustained a loss-before-tax of Rs374.5 million compared to a profit-before-tax of Rs1.56 billion in 9MFY23. The company incurred a net loss margin of 2% against a net profit margin of 4% in 9MFY23. Additionally, the earnings per share fell from Rs26.47 to a loss per share of Rs8.91 in 9MFY24.

Historical trend

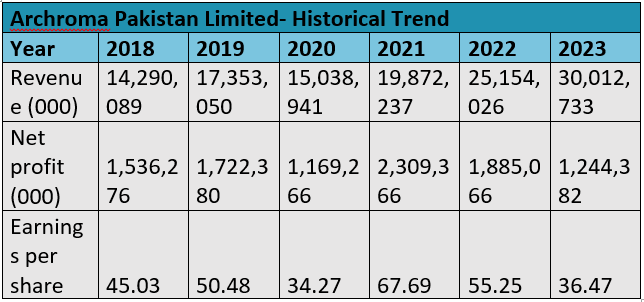

The chemical maker’s revenue has grown steadily over the years from 2018 to 2023 except a decline in 2020. Consequently, its net profit dropped significantly in 2020, but recovered in 2021. However, the profit declined again in 2022 and 2023, despite revenue increases. The earnings per share mirrored the trend in net profit throughout the reviewed period. In 2019, the revenue increased by 21.43% from the previous year. However, it dropped by 13.34% in 2020 due to the Covid-19-induced lockdowns and reduced demand. Despite this setback, the company’s revenue continued to grow in the following years, achieving a total growth of 110.02% from 2018 to 2023. The primary driver of this revenue growth was the increased sales volume, particularly in the textile and construction sectors.

However, the company’s net profit declined overall by 19% from Rs1.53 billion in 2018 to Rs1.24 billion in 2023. In 2023, rising energy costs, higher commodity prices, inflation and currency devaluation increased the cost of sales, squeezing profits. During the period, the company recorded its highest earnings per share of Rs67.69 in 2021, and the lowest of Rs34.27 in 2020.

Activity/turnover ratios analysis

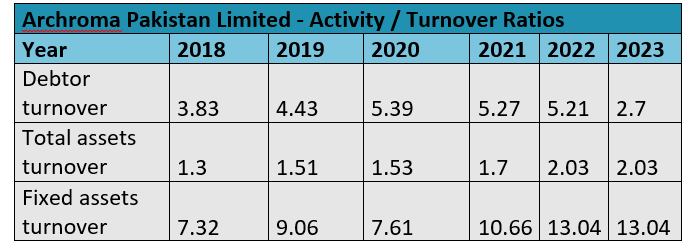

The company's debtor turnover ratio remained consistent over the years, reflecting the effective collection of outstanding accounts receivables. The highest debtor turnover ratio was 5.39 in 2020. Additionally, the total assets turnover ratio consistently stayed above 1, peaking at 2.03 in 2022 and 2023. This indicates that the company’s total assets were generating significant revenue. Over the past six years, the company has consistently had less cash than current liabilities. The highest cash to current liabilities ratio was 0.23 in 2021, while the lowest was 0.01 in 2022.

Future outlook

The ongoing situation in the Middle East continues to affect global energy and commodity prices and the supply chain for raw materials, thereby putting strain on Pakistan's balance of trade and foreign exchange reserves. These issues will impact the country’s business and economic outlook in the coming months. However, anticipated IMF financing and corrective fiscal measures are expected to improve Pakistan's macroeconomic conditions, potentially benefiting the textile and construction industries. The company's management is optimistic that through rigorous control of net working capital and a strong project pipeline, especially following the acquisition of Huntsman Textile Effects, it will achieve profitable growth in the short to medium term.

Company profile

Archroma Pakistan is a limited liability company focused on the manufacture, import and sale of chemicals, dyestuffs, coatings, adhesives and sealants. It also functions as an indenting agent. The company is a subsidiary of Archroma Textiles GmbH, which is registered and headquartered in Reinach, Switzerland.

Credit: INP-WealthPk