INP-WealthPk

Shams ul Nisa

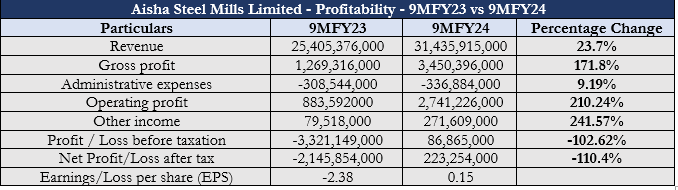

Aisha Steel Mills Limited’s net profit surged 110.4% to Rs223.2 million in the nine months of the current fiscal year, compared to a net loss of Rs2.14 billion in the corresponding period of the last year, reports WealthPk. The company’s revenue grew by 23.7% from Rs25.4 billion in 9MFY23 to Rs31.43 billion in 9MFY24, and its gross profit spiked massively by 171.8% to Rs3.4 billion. This rise was due to the increase in total quantity sold from July 2023 to March 2024, by 16% to 119,676 tons compared to 103,387 tons sold in the same period last year. Additionally, the company witnessed a growth in export quantity to 18,185 tons from 1,152 tons last year.

In terms of expenses, the company’s administrative expenses showed a moderate growth of 9.19% to Rs336.8 million in 9MFY24. Additionally, its operating profit increased drastically from Rs883.5 million in 9MFY23 to Rs2.7 billion during the review period. Likewise, other income surged 241.57% to Rs271.6 million in 9MFY24. Compared to a loss before tax of Rs3.32 billion in 9MFY23, the company reported a profit before tax of Rs86.8 million in 9MFY24. The review period recorded earnings per share of Rs0.15, up from a loss per share of Rs2.38 during the same period the previous year.

Engineering Sector

Sales

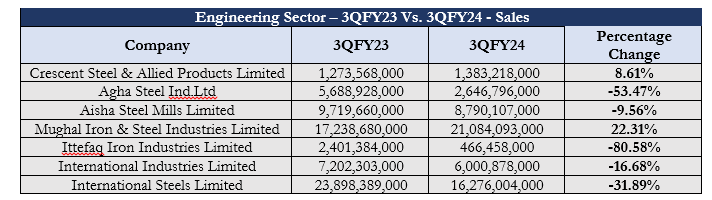

In the Engineering Sector, only two companies managed to enlarge their sales at the end of the third quarter of 2024. The highest sales of Rs21.08 billion was achieved by Mughal Iron & Steel Industries Limited, up by 22.31% from Rs17.23 billion in 3QFY23, mainly because of increased steel sales. The sales of Crescent Steel & Allied Products Limited, the second largest player in the sector, increased 8.61% to Rs1.38 billion in 3QFY24. The company achieved this impressive hike in sales due to higher selling prices in the ferrous and non-ferrous divisions and higher volumes in the ferrous segment. Generally, non-ferrous volumes decreased due to a decline in waste sales, while copper volumes rose.

However, a contraction in sales of 53.47% by Agha Steel Ind.Ltd, 9.56% by Aisha Steel Mills Limited, 80.58% by Ittefaq Iron Industries Limited, 16.68% by International Industries Limited, and 31.89% by International Steels Limited was reported in the Engineering Sector at the end of 3QFY24. This decline was triggered by lower HRC (hot rolled coil) prices and decreased demand in domestic and international markets.

Capital Structure Ratios Analysis

A financial leverage ratio gauges a company's reliance on debt or equity to fund operations and asset acquisitions. Over time, the firm has had financial leverage above 1, with a peak of 2.49, showing a larger reliance on debt to fund the company's activities and assets.

![]()

The interest cover ratio evaluates the company's capacity to meet interest-bearing commitments. The higher the ratio, the better the company's financial situation. The company's interest cover ratio was 2.78 in 2018. The ratio decreased to 0.6 in 2020, increased to 6.63 in 2021 but decreased to -0.33 in 2023.

Future Outlook

The positive outlook from China is keeping the price of raw materials of steel stable. The prices of coke and iron ore are both trending upward. However, there is still low local demand. On the other hand, the steadily declining inflation and stable currency rate have raised investor confidence generally. This will help the struggling manufacturing sector to improve in the future.

Company Profile

Aisha Steel Mills Limited was established in Pakistan on May 30, 2005, as a public limited company. The company's primary activity is producing and marketing cold rolled coils and hot dipped galvanized coils. It has established a cold rolling mill complex and a galvanization factory at Pakistan Steel, Bin Qasim, Karachi.

Credit: INP-WealthPk