آئی این پی ویلتھ پی کے

Moaaz Manzoor

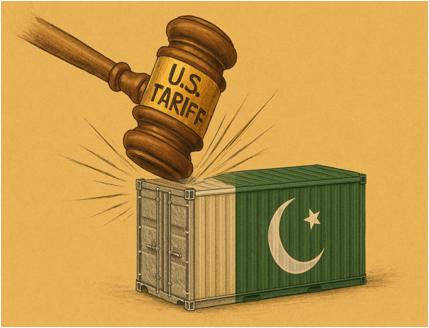

Amid a 90-day pause on higher US tariffs, experts warn that Pakistan’s textile and leather exports face a looming 29% duty that could hit hard if diplomatic efforts fail, threatening key sectors of the economy, reports WealthPK.

In light of the US government’s decision to impose sweeping “reciprocal” tariffs on imports from over 180 countries, including Pakistan, experts caution that the move could significantly challenge Pakistan’s textile, leather, and related sectors — the key pillars of the country's export economy. The newly introduced tariffs, which include a 10% baseline rate, have led to a cumulative 29% duty on Pakistani exports to the US.

Speaking with WealthPK, Dr. Nasir Iqbal, Registrar and Associate Professor at the Pakistan Institute of Development Economics (PIDE), emphasized that these tariffs could severely undermine Pakistan’s export competitiveness, particularly in its flagship textile sector. “A 29% tariff directly affects cost structures and price competitiveness. When costs increase due to such tariffs, you lose your edge.

The countries not facing the same trade barriers will naturally enjoy a price advantage, and our textile exports to the US, which are already under pressure, will likely be hit further,” he told WealthPK. Dr. Iqbal also highlighted the government’s awareness of the issue, noting that the prime minister had formed a dedicated committee to engage with the US administration. He continued: “At PIDE, we’ve stressed the need for Pakistan to pursue diplomatic avenues actively.

Tariffs of this nature are not sustainable for an export-led economy like ours. Without intervention, we risk marginalization in one of our largest markets.” Meanwhile, insights from the industry stakeholders reinforce this cautionary outlook. Muhammad Waqas, Global Account Manager for Leather Products at Nexus Safety Wears, noted that the US tariffs — informally dubbed the "Liberation Day" duties — have placed Pakistan in a precarious position.

“Our leather and safety wear exports are now subject to a 29% tariff, drastically reducing our cost competitiveness in the US market,” he said. Waqas explained that in FY2023-24, Pakistan's leather exports dropped by 5.46%, totaling $545.9 million. Within this, finished leather saw an even sharper decline of 17.92%. He warned that the newly imposed tariffs could accelerate this downward trend.

“Higher duties translate into higher prices for the buyers, and when those buyers have other options with lower tariffs — like India at 26% — they will naturally gravitate toward them.” However, Pakistan’s marginally better position offers little solace, as the 29% rate still places it at a disadvantage compared to more favorably treated competitors.

“Even a few percentage points can sway the importers' sourcing decisions,” Waqas added, underlining the importance of timely and targeted policy responses. The US tariff hike is more than a trade adjustment — it is a strategic shift that tests Pakistan’s economic agility. Pakistan must prioritize diplomatic engagement, diversify export markets, and enhance product innovation to protect and promote its key sectors. Resilience and reform are now prerequisites for staying relevant.

Credit: INP-WealthPk