i INP-WEALTHPK

Moaaz Manzoor

The digital revolution in Pakistan, as outlined by the State Bank of Pakistan (SBP) Governor’s Annual Report 2023-2024, is on track to reshape the nation’s business sector, with Raast — a digital payment system — leading the charge as a transformative force, reports WealthPK. Raast’s impact is evident through its Person-to-Merchant (P2M) service, which facilitates quick and secure payments using QR codes, Raast IDs, and IBANs. This digital payment solution promotes cashless transactions, improving both transparency and efficiency. As Pakistan’s payment landscape continues to evolve, Raast plays a crucial role in encouraging widespread adoption of digital payments nationwide. The SBP highlights Raast’s impressive achievement.

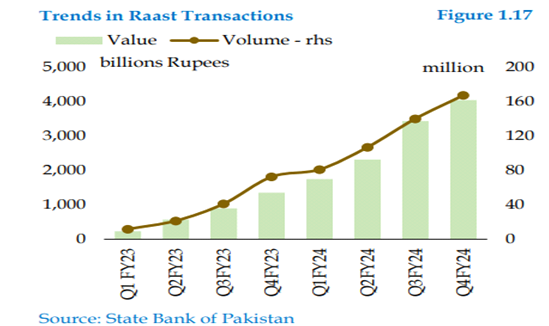

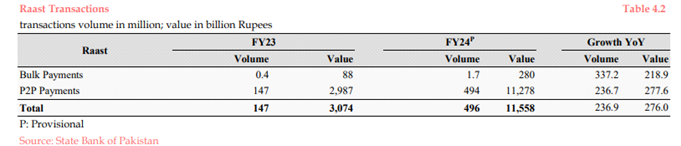

Raast has facilitated 892 million transactions totalling Rs20 trillion, with an average transaction size of Rs22,421.52. The remarkable transaction growth can be credited to the successful launch of Person-to-Person (P2P) module in February 2022, marking a significant advancement in the accessibility and convenience of digital payments in Pakistan. This initiative is paving the way for further expansion of digital financial services in the country. During FY24, Raast processed an impressive 496 million transactions, amounting to Rs11,558 billion. This marks a significant increase from FY23, where the transactions totaled 147 million, valued at Rs3,074 billion, indicating substantial year-on-year growth.

Source: https://www.sbp.org.pk/reports/annual/Gov-AR/pdf/2024/Gov-AR.pdf

In just two years since its inception, Raast has achieved remarkable success by onboarding all banks, Payment System Operators (PSOs), and Electronic Money Institutions (EMIs), translating to a 237% increase in the transaction volume and a fourfold rise in transaction value. This accelerated growth underscores the rising acceptance of digital payments and highlights Raast’s growing role in modernizing Pakistan’s financial sector. The annual report reveals further signs of progress.

By the close of FY24, the financial account ownership had surged by 18%, reaching a record 215 million, fueled by an expanding network of financial institutions and alternative delivery channels. Additionally, deposits across banks, development finance institutions (DFIs), and microfinance banks rose by 21.6%, totaling Rs33.2 trillion, mainly due to the high-interest rates. The SBP suggests this trend could reduce cash dependence in the economy, helping to strengthen national savings and reinforce Pakistan’s formal financial sector.

Source: https://www.sbp.org.pk/reports/annual/Gov-AR/pdf/2024/Gov-AR.pdf

However, the report also cautions against some ongoing challenges. While the banking sector experienced a 30.4% rise in after-tax profits, the increase in bank taxation may impact financial stability and limit the sector’s resilience against future economic shocks. The report also notes a decline in the private sector credit growth, even as investments in government securities rose by 35.2%. This could indicate a cautious approach among investors due to the economic uncertainties. Additionally, microfinance banks (MFBs) face a more challenging operating environment, with slower growth in their asset base, underscoring the need for continued support to ensure a balanced sector-wide development.

As Pakistan moves towards broader financial inclusion, the role of Raast and similar digital initiatives is set to grow. The SBP’s emphasis on digital transformation, as illustrated in the Governor’s Annual Report, strengthens financial inclusion and lays a robust foundation for economic growth. Raast propels Pakistan towards a more competitive and digitally advanced financial landscape by facilitating easy, efficient, and inclusive financial transactions. This commitment to expanding digital payments reflects a broader vision for economic development, where secure, convenient digital transactions can support individual empowerment and business growth, positioning Pakistan for a dynamic digital future.

Credit: INP-WealthPk