i INP-WEALTHPK

Ayesha Mudassar

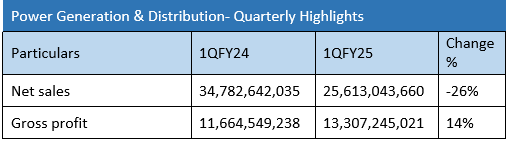

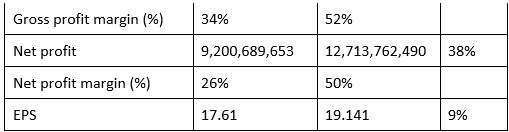

Pakistan’s power generation and distribution sector reported a gross profit of Rs13.3 billion and a net profit of Rs12.7 billion on net sales of Rs25.6 for the first quarter (July-September) of the ongoing fiscal year 2024-25, according to WealthPK.

The sector’s net profit grew by 38% and gross profit by 14% in 1QFY25 compared to the corresponding period of FY24. Key companies within the sector include Hub Power Company Limited (HUBC), Kot Addu Power Company Limited (KAPCO), K-Electric Limited (KEL), Nishat Power Limited (NPL), Engro Powergen Qadirpur Limited (EPQL), Kohinoor Energy Limited (KOHE), and Saif Power Limited (SPWL). Notably, KEL’s financials were excluded due to the absence of a Multi-Year Tariff (MYT) adjustment by the National Electric Power Regulatory Authority (Nepra).

According to the results available with WealthPK, sales revenue declined 26% year-on-year (YoY) to Rs25.6 billion compared to Rs34.7 billion in IQFY24. Despite lower sales, gross profit margins increased to 52% from 34%, reflecting enhanced operational efficiency and profitability.

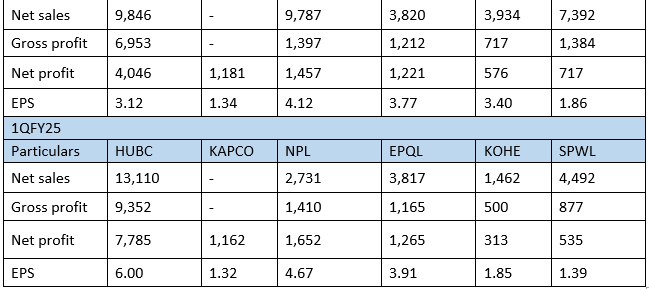

Intra-firm performance comparison- 1QFY25

HUBC, the country’s largest power company, with a market capitalisation of Rs143.5 billion, led the sector with the highest sales of Rs13.1 billion. HUBC's top line grew by 33% YoY, due to higher dispatches from Thar Energy Limited (TEL), rupee devaluation and improved operational efficiencies. SPWL reported the second-highest sales of Rs4.4 billion, followed by EPQL with Rs3.8 billion, NPL Rs2.7 billion and KOHE Rs1.4 billion. Note that the sector's second-largest player, KAPCO, made no sales during the period as its Power Purchase Agreement (PPA) expired on October 24, 2023. Since then, the plant has been out of operation. Regarding gross profit, HUBC earned the highest gross profit of Rs9.3 billion in 1QFY25, with NPL, EPQL, SPWL and KOHE contributing gross profits of Rs1.4 billion, Rs1.1 billion, Rs877 million and Rs500 million, respectively.

![]()

Concerning net profit, HUBC again posted the highest profit of Rs7.7 billion, followed by NPL and EPQL, which earned net profits of Rs1.6 billion and Rs1.2 billion, respectively. KAPCO earned a net profit of Rs1.1 billion, and KOHE posted the lowest profit of Rs313 million. HUBC posted the highest earnings per share of Rs6.0 in 1QFY25 followed by NPL’s Rs4.67. The lowest EPS was reported by KAPCO during the period.

Sectoral recommendations by CCP

The Competition Commission of Pakistan (CCP) recently released its report State of Competition in Key Markets in Pakistan: Power Sector, emphasising the need for a competitive energy market to spur economic growth and reduce costs for consumers. The report points out significant barriers, including high capital requirements, monopolistic structures, outdated infrastructure, and geographical constraints, which deter new market entrants. To address these issues, the CCP suggests structural reforms, such as implementing the Competitive Trading Bilateral Contracts Market (CTBCM) model, enhancing infrastructure investment, and revising tariff policies. These recommendations aim to create a more inclusive market by reducing barriers and encouraging private-sector participation.

Credit: INP-WealthPk