i INP-WEALTHPK

Ayesha Mudassar

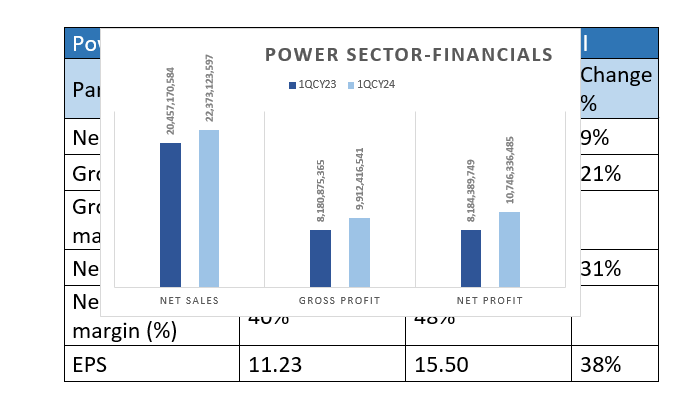

The power sector collectively declared a gross profit of Rs9.9 billion and a net profit of Rs10.7 billion on the net sales of Rs22.3 billion in the first quarter (January-March) of the ongoing calendar year 2024, according to WealthPK. The compiled power sector entities include Hub Power Company Limited (HUBC), K-Electric Limited (KEL), Nishat Power Limited (NPL), Engro Powergen Qadirpur Limited (EPQL), Kohinoor Energy Limited (KOHE), and Saif Power Limited (SPWL).

However, the compiled results do not include KEL’s financials due to the absence of the Multi-Year Tariff (MYT) adjustment by the National Electric Power Regulatory Authority (Nepra). As per the results available with WealthPK, sales revenue grew 9% year-on-year (YoY) to Rs22.3 billion compared to Rs20.4 billion in 1QCY23. Therefore, the gross margins inched up to 44% from 40% in the corresponding period of last year. During the quarter under review, the sector's gross profit rose 21% YoY to Rs9.9 billion in 1QCY24.

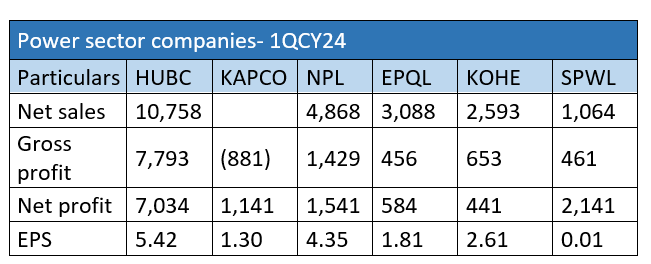

Power sector companies – intra-firm comparison-1QCY24

HUBC, the largest power firm with a market capitalisation of Rs182.2 billion, posted the highest sales of Rs10.7 billion. NPL contributed the second-highest sales of Rs4.8 billion. Likewise, EPQL posted net sales of Rs3.08 billion, KOHE Rs2.5 billion, and SPWL Rs1.06 billion. The sector’s second-largest player, KAPCO, made no sales during the period as its Power Purchase Agreement (PPA) expired on October 24, 2023. Since then, the plant has been out of operation. HUBC earned the highest gross profit of Rs7.7 billion in 1QCY24. NPL posted a gross profit of Rs1.4 billion and KOHE reported Rs653 million. EPQL and SPWL posted gross earnings of Rs456 million and Rs461 million, respectively, during the quarter under review. KAPCO continued to post a gross loss due to the top line situation as well as the higher cost of sales.

Concerning net profit, HUBC again posted the highest net profit of Rs7.03 billion followed by SPWL and NPL with net profits of Rs2.1 billion and Rs1.5 billion, respectively. KAPCO earned a net profit of Rs1.1 billion and KOHE posted the lowest profit of Rs441 million. HUBC's bottom line grew by 19% YoY due to controlled expenses and higher other incomes. The rise was also contributed by the currency depreciation during the period. The earnings per share comparison shows that HUBC posted the highest EPS of Rs5.42 in 1QCY24 followed by NPL’s Rs4.35. The lowest EPS was reported by SPWL at Rs0.01.

Credit: INP-WealthPk