i INP-WEALTHPK

Ayesha Mudassar

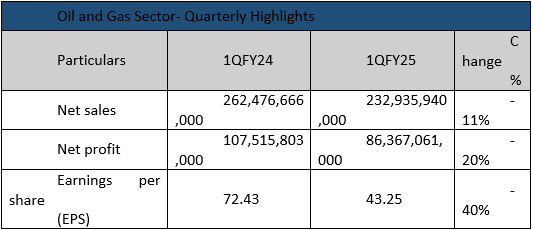

Pakistan's oil and gas exploration sector experienced significant declines in financial performance during the first quarter of the current fiscal year 2024-25. The sector reported an 11% decrease in net sales and a 20% reduction in net profits compared to the corresponding period of the earlier fiscal (FY24), reports WealthPK.

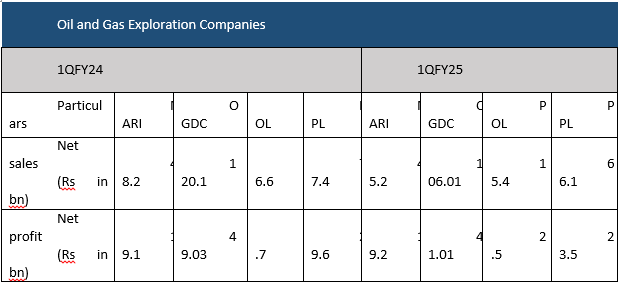

In 1QFY25, listed oil and gas firms collectively posted net sales of Rs232.9 billion compared to Rs262.4 billion in 1QFY24. The sector's sales decline was mainly due to a decrease in the average crude oil basket price, driven by a combination of weakened demand from China, strategic geopolitical manoeuvres and sluggish economic activity in major economies. Additionally, sales were affected by a drop in the average realised gas price accompanied by an appreciation of the rupee against the dollar. Oil and Gas Development Company Limited (OGDC) made the highest contribution of 46% in the total revenue posted by the sector followed by Pakistan Petroleum Limited (PPL) with a 28% contribution in 1QFY25. Mari Petroleum Company Limited (MARI) ranked third with a 19% share, while Pakistan Oilfields Limited (POL) stood fourth, contributing 7% to the sector's total sales. In terms of net profit, OGDC led the sector with a 47% share. PPL and MARI contributed 27% and 22%, respectively, to the sector’s aggregate earnings, while POL recorded the smallest contribution, accounting for 3% of the total net profit.

Intra-firms comparison 1QFY24 vs 1QFY25

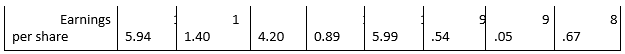

OGDC, the country’s leading state-owned oil and gas exploration company, posted a 12% decline in revenue, a 16% drop in net profit, and a 16% decrease in earnings per share during 1QFY25 compared to the same period of previous fiscal year. This decline in earnings was primarily due to higher transportation charges and increased exploration and prospecting expenditures. PPL, the country’s key gas supplier, reported a 20% decline in net profit for 1QFY25, primarily due to reduced sales, increased operating and administrative expenses, and higher finance costs. Net sales for the period declined to Rs66.1 billion compared to Rs77.4 billion in the same period of the previous year. In the first quarter of FY25, MARI recorded a slight net profit increase of 0.3%, reaching Rs19.2 billion compared to Rs19.1 billion in 1QFY24. Despite a 6% reduction in revenue to Rs45.2 billion, the company maintained its profitability bolstered by substantial growth in net finance income.

During 1QFY25, POL achieved a profit-after-tax of Rs2.5 billion, significantly lower than the Rs9.7 billion during the same period last year. This profit translates into earnings per share of Rs9.05 compared to Rs34.2 per share in the corresponding period of FY24. The lower profit was attributed to numerous factors, including lower sales, higher operating costs, and increased exploration charges.

Challenges confronting exploration sector

The sector has lost its shine over the years as it grapples with challenges, including depleting reserves, declining production flows, and small discoveries. Furthermore, policy inconsistency and the accumulation of circular debt have contributed to the sector's sluggishness. As a result of these ongoing issues, several international players like British Petroleum, ExxonMobil, and Eni have exited the Pakistan oil and gas market.

Strategies for sustainable future

Restoring investor confidence necessitates the enhancement of regulatory frameworks and the establishment of consistency in decision-making. Additionally, drawing insights from global leaders such as ARAMCO, ADNOC, and Petronas, which have set exemplary benchmarks in increasing production volumes, and adopting innovative technologies, can provide valuable guidance.

Credit: INP-WealthPk