i INP-WEALTHPK

Shams ul Nisa

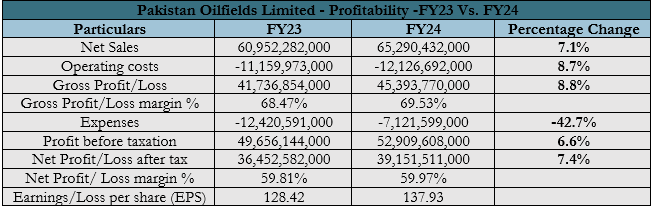

Pakistan Oilfields Limited’s net sales surged by 7.1%, from Rs60.95 billion in FY23 to Rs65.29 billion in FY24, reports WealthPk.

In FY24, the company’s operating costs rose 8.7% to Rs12.13 billion. Despite this increase, gross profit grew by 8.8% to Rs45.39 billion, leading to a slight improvement in the gross profit margin, which reflects the company’s strong pricing power and cost control. Additionally, expenses were significantly reduced by 42.7%, contributing to a 6.6% rise in profit before tax.

Furthermore, net profit increased by 7.4% to Rs39.15 billion, maintaining a stable net profit margin of 59.97% during the period. This profitability was driven by factors including increased sales value due to a higher rupee-dollar exchange rate, elevated oil and gas prices, higher interest income from increased deposits and interest rates, as well as reduced exploration and finance costs. Earnings per share also rose from Rs128.42 in FY23 to Rs137.93 in FY24, underscoring the company’s capacity to deliver shareholder value amid rising costs.

Statement of balance sheet

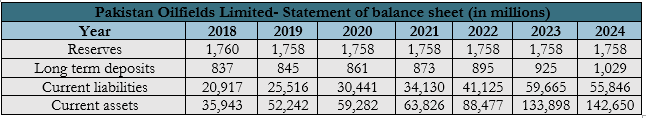

The balance sheet analysis of Pakistan Oilfields Limited from 2018 to 2024 provides valuable insights into the company’s financial health, liquidity, capital structure, and stability. Reserves have remained steady at Rs1.758 billion, indicating a stable equity foundation. Additionally, long-term deposits increased to Rs1.02 billion in 2024, reflecting a positive trend in securing long-term funding for growth.

Current assets have grown substantially, rising from Rs35.94 billion in 2018 to Rs142.65 billion in 2024, demonstrating effective resource management. However, current liabilities have more than doubled, reaching Rs55.8 billion in 2024 compared to Rs20.9 billion in 2018, which could pose liquidity risks if liabilities continue to outpace asset growth.

Summary of cash flows

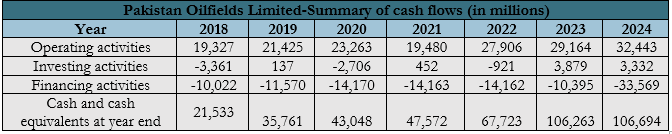

The cash flow analysis for Pakistan Oilfields Limited from 2018 to 2024 shows a steady increase in operating cash flows, reaching Rs32.4 billion in 2024, highlighting improved efficiency and profitability in oil and gas production. Investment cash flows have varied, with negative flows of Rs3.3 billion in 2018, Rs2.7 billion in 2020, and Rs921 million in 2022, but positive cash flows of Rs3.8 billion in 2023 and Rs3.3 billion in 2024, reflecting strategic divestments and enhanced investment management.

However, financing cash flows show a concerning rise in negative flows, from Rs10.02 billion in 2018 to Rs33.57 billion in 2024, suggesting increased debt and interest obligations and raising questions about sustainability. Despite these challenges, cash and cash equivalents at year-end have grown consistently from Rs21.53 billion in 2018 to Rs106.69 billion in 2024, demonstrating strong liquidity and financial resilience.

Future Outlook

In the past year, the company has prioritized exploration and development, drilling three development wells, two exploratory wells, and one water well. The Jhandial-3 well delivered promising outcomes and has been linked to the production line. Additionally, the Razgir-1 well, part of a joint venture, successfully tested two exploratory formations, marking an important discovery for the area. Despite various challenges, these accomplishments underscore the company’s dedication to innovation and progress. Investments in seismic data acquisition, processing, and interpretation have driven notable advancements. Looking ahead, the company plans to drill additional development and exploratory wells, committing significant resources to expand its reserves.

Company Profile

Pakistan Oilfields Limited is a publicly listed Pakistani company focused on the exploration, drilling, and production of crude oil and natural gas. It also markets POLGAS liquefied petroleum gas and facilitates petroleum transportation.

Credit: INP-WealthPk