i INP-WEALTHPK

Ayesha Mudassar

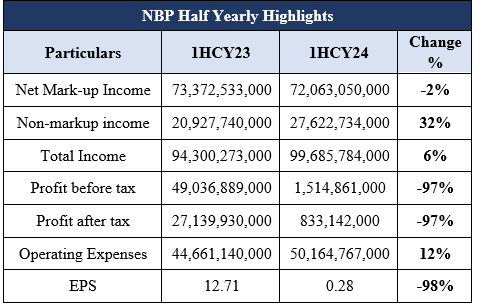

The National Bank of Pakistan (NBP) recorded a net profit of Rs 833.1 million for the first half of the ongoing calendar year, representing a 97% decline compared to the corresponding period the last year, according to WealthPk. The bank registered a profit-before-tax (PBT) of Rs 1.5 billion for 1HCY24, compared to Rs 49 billion in the same period of the previous year. Consequently, earnings per share dropped to Rs 0.28 from Rs 12.71 in 1HCY23.

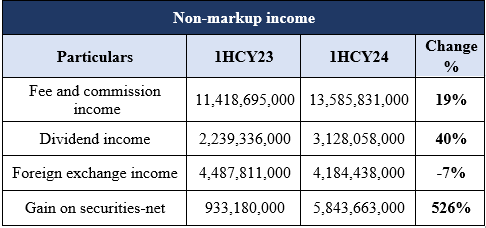

NBP earned a net markup income of Rs 72.06 billion compared to Rs 73.3 billion in the corresponding period of 2023. The decline is mainly due to higher interest expenses resulting from volumetric growth. However, non-markup income increased by 32% YoY to Rs 27.6 billion, driven by a significant rise in gains on securities. Amid the high inflationary pressures and Rupee depreciation, the bank’s operating expenses rose to Rs 50.1 billion, a 12% YoY increase compared to Rs 44.6 billion in 1HCY23. NBP’s strategic focus on digital transformation and customer service enhancement contributed to a 19% growth in fee and commission income, which reached Rs 13.5 billion during 1HCY24, compared to Rs 11.4 billion in the same period last year.

Furthermore, the dividend income increased by 40% to reach Rs 1.7 billion for the period ended June 30, 2024, compared to Rs 2.2 billion for the half year ended June 30, 2023. However, the bank’s foreign exchange income declined by nearly 7%, down from Rs 4.4 billion in 1HCY23 to Rs 4.1 billion in 1HCY24. Notably, the bank reported a substantial 526% gain on securities, which amounted to Rs 5.8 billion in 1HCY24, compared to Rs 933.1 million in the first half of 2023.

Performance over the last four years (2020-2023)

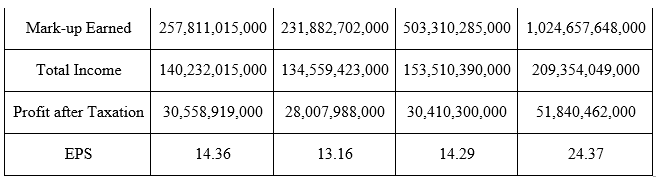

The historical analysis of NBP reveals a positive trend in key financial indicators, including markup earned, total income, profit after taxation, and EPS. These metrics highlight consistent growth and improved financial performance across the years under review. In 2023, the bank recorded its highest markup income, reflecting robust performance in interest earnings. However, a slight decline in markup income was observed in 2021, marking the only dip during the analyzed period.

![]()

Concerning total income, NBP earned a total income of Rs 140.2 billion in 2020, Rs 134.5 billion in 2021, Rs 153.5 billion in 2022, and Rs 209.3 billion in 2023. The substantial increase in 2023 was mainly due to an enormous rise in foreign exchange income, interest earnings, and other income. In terms of profitability, the bank achieved its highest PAT in 2023, amounting to Rs 51.8 billion, supported by increased revenues. The bank posted a net profit of Rs 30.5 billion in 2020, Rs 28 billion in 2021, and Rs 30.4 billion in 2022. The trend of increasing EPS over the years, with the highest EPS in 2023, indicates that NBP’s financial performance generally improved, primarily due to income growth.

About the bank

The bank operates one of the largest branch networks, with over 1,500 branches in Pakistan. It is aggressively pursuing a significant organizational transformation program through digitalization and expanding its range of products and services.

Future Outlook

The bank will continue to play a pivotal role in delivering sustainable value for stakeholders and supporting a robust economic momentum in the country. In the foreseeable future, the bank’s business strategy will remain focused on accelerating digital transformation and expanding financial services across all market segments, with a particular emphasis on promoting financial inclusion for underserved sectors.

Credit: INP-WealthPk