i INP-WEALTHPK

Ayesha Mudassar

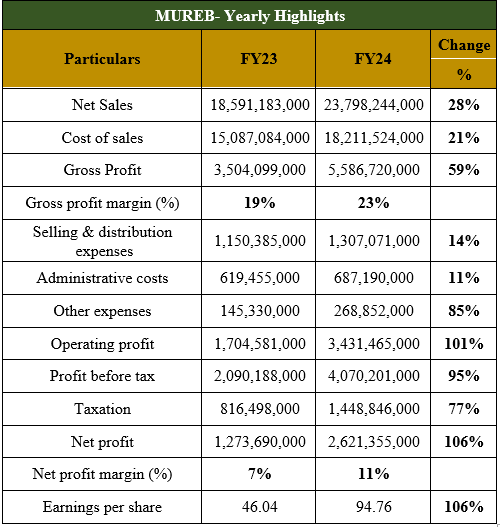

Murree Brewery Company Limited (MUREB) recorded a 106% growth in its annual earnings, with net profit rising to Rs 2.6 billion compared to a profit of Rs 1.2 billion in earlier fiscal, reports WealthPk.

According to the results, the company's top line expanded by 28% to Rs 23.7 billion, compared to Rs 18.5 billion in FY23. Although the cost of sales increased by 21%, it remained lower relative to the rise in revenue, driving a 59% upsurge in gross profit to Rs 5.5 billion in FY24. Consequently, the gross margins improved to 23%, up from 19% in the previous year.

On the expense side, the company's administrative expenses increased by 11% year-on-year (YoY) to Rs 687.1 million, while distribution and selling expenses rose by 14% YoY to Rs 1.3 billion. Additionally, other operating expenses surged by 85% YoY, reaching Rs 268.8 million. Regarding taxation, MUREB paid a higher tax worth Rs 1.4 billion, marking a 77% increase compared to Rs 816.4 million paid during FY23.

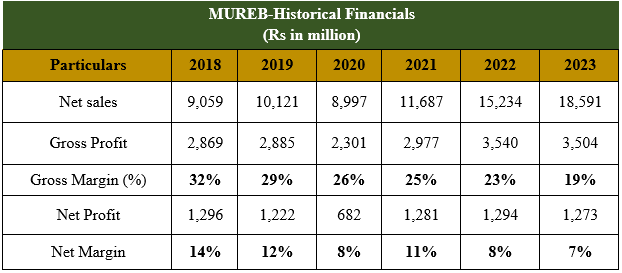

Performance over the last six years (2018-2023)

MUREB has demonstrated consistent topline growth over the years, except for 2020. In contrast, the bottom line showed growth only in 2021 and 2022. The company's gross margin has been declining over the past five years while net margins decreased until 2020, rebounded in 2021, and then fell again in the subsequent years. In 2019, MUREB's net sales posted a reasonable YoY growth of 12%, reaching Rs 10.1 billion. The company's sales mix is primarily driven by Pakistan-made foreign liquor (PMFL) and non-alcoholic beverages. However, the net profit slid by 6% YoY to Rs 1.2 billion, resulting in a net profit margin of 12%, down from 14% in 2018. In 2020, the company's top line experienced an 11% YoY decline. Sales revenue decreased in all categories except tetra-pack juices, bottled drinking water, and glass products. Due to curtailed production, gross profit fell by 20%, and the GP margin plummeted to 26%. Consequently, MUREB's net profit plunged by 44% to Rs 682 million, with an NP margin of 8% in 2020.

In 2021, MUREB's topline achieved its highest-ever sales growth of 30% on account of high exports. Strong sales and controlled expenses drove the net profit up by a stunning 88%, with the NP margin rising to 11%. The company's topline grew by an additional 30% in 2022, supported by both local and export sales. However, record high inflation, rupee depreciation, and energy charges led to a 34% increase in the cost of sales. Furthermore, the imposition of super tax nearly offset the bottom line growth, which grew by only 1% to Rs 1.29 billion. The year 2023 proved challenging for MUREB. The combination of rupee depreciation, a global commodity super cycle, and rising fuel and power costs resulted in a 1% YoY decline in gross profit. The gross profit margin also fell from 23% in 2022 to 19% in 2023. Moreover, the bottom line slumped by 2% YoY to Rs 1.27 billion with an NP margin of 7% against 8% during 2022.

About the company

Murree Brewery Company was incorporated as a public limited company in February 1861. The principal activity of the company is the manufacturing and sale of alcoholic beer, non-alcoholic beer, Pakistan-made foreign liquor (PMFL), aerated water, mineral water, food products as well as glass bottles and jars. The company presently operates three divisions, namely liquor, tops, and glass, to carry out its principal activities.

Credit: INP-WealthPk