i INP-WEALTHPK

Shams ul Nisa

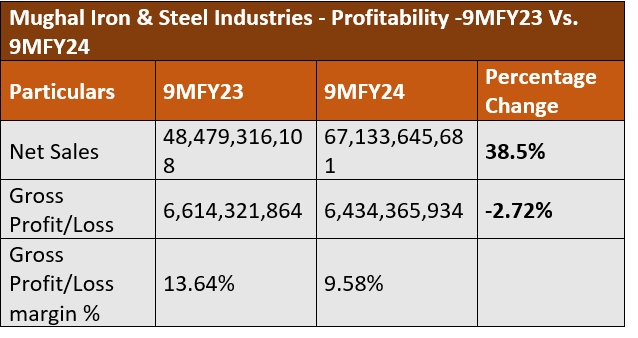

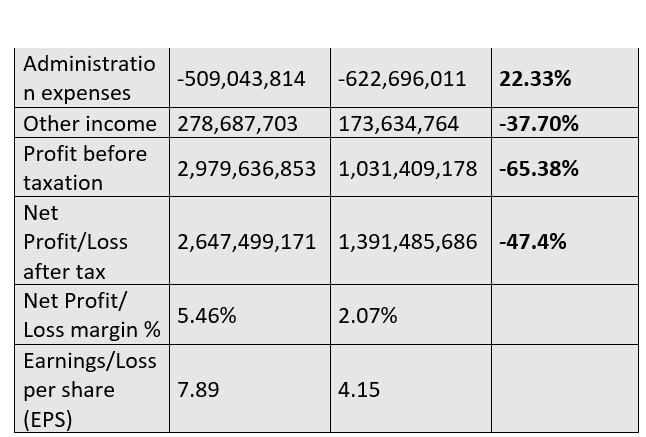

Mughal Iron and Steel Industries announced its highest-ever net revenues of Rs67.13 billion for the first nine months of the current fiscal year (9MFY24), showing a 38.5% increase from Rs48.47 billion in 9MFY23, according to WealthPK. This increase was caused by higher selling prices in both the ferrous and nonferrous categories and higher volumes in the ferrous division. However, the gross profit inched down by 2.72% to Rs6.43 billion from Rs6.61 billion in 9MFY23. The gross profit margin slipped to 9.58% in 9MFY24 from 13.64% in 9MFY23 due to a drop in ferrous margins.

The rise in salary costs pushed the administrative expenses to Rs622.69 million in 9MFY24, 22.33% up from Rs509.04 million in 9MFY23. Other incomes contracted by 37.70% and the profit-before-tax by 65.38% in 9MFY24. Similarly, the company earned a net profit of Rs1.39 billion, which was 47.4% down from the profit of Rs2.64 billion in 9MFY23. During this time, the net profit margin and earnings per share decreased to 2.07% and Rs4.15 from 5.46% and Rs7.89 in 9MFY23.

Engineering sector

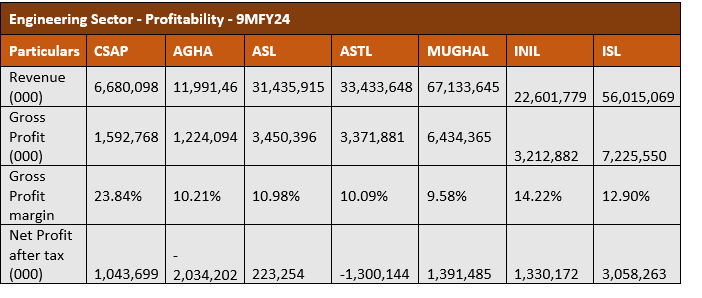

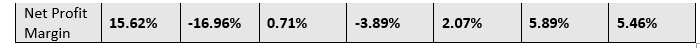

Crescent Steel & Allied Products Limited (CSAP) with a reported gross profit margin of 23.84% and a net profit margin of 15.62% stood out as the most profitable company in the engineering sector during 9MFY24. International Industries Limited (INIL) posted a revenue of Rs22.6 billion and a gross profit of Rs3.21 billion in 9MFY24, thus constituting a gross profit margin of 14.22%. During the period, the company posted a net profit of Rs1.33 billion, resulting in a net profit margin of 5.89%, and becoming the second most profitable company in the sector.

During the period, Agha Steel Ind.Ltd (AGHA) and Amreli Steels Limited (ASTL) had moderate gross margins of 10.21% and 10.09%, respectively. However, the companies reported a net loss of Rs2.03 billion and Rs1.30 billion, respectively, in 9MFY24, resulting in a net loss margin of 16.96% and 3.89%, respectively. The hike in energy costs, high inflation and unstable economic conditions hindered their growth during this period. In absolute terms, Mughal Iron & Steel Industries Limited posted the highest revenue of Rs67.13 billion and Agha Steel Ind.Ltd posted the lowest revenue of Rs11.99 billion in 9MFY24.

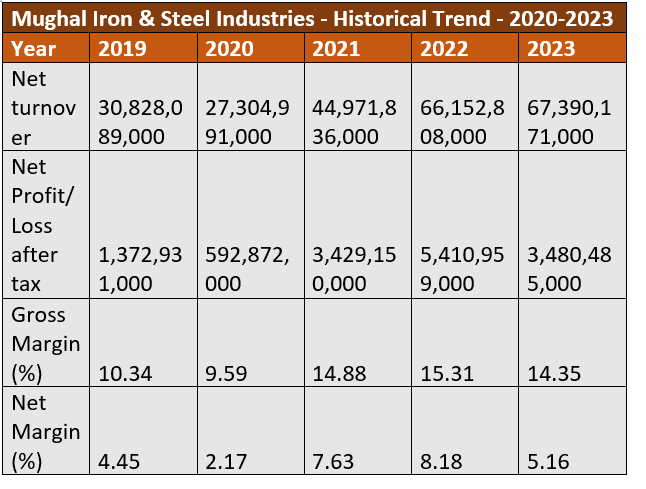

Historical trend

In 2019, better selling prices and higher sales volume resulted in Mughal Iron and Steel Industries posting a net turnover of Rs30.8 billion. However, it decreased by 11.43% in 2020, mainly because of the Covid-19-induced lockdowns, causing lower sales volume. In the subsequent years, the revenue peaked at Rs67.39 billion in 2023 because of higher sales prices and increased sales volumes in ferrous and non-ferrous segments.

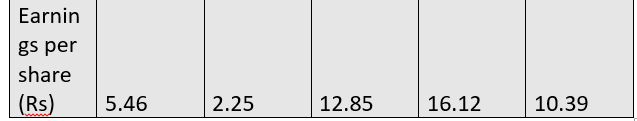

The company posted a net profit of Rs1.37 billion in 2019, which declined by 56.82% to Rs592.8 million in 2020. Lower sales volume, higher finance costs, and currency depreciation caused this. But the net profit climbed to Rs5.4 billion in 2022, which was the highest-ever over the five years, before declining to Rs3.48 billion in 2023. Lower operating profit, higher finance costs, and an overall reduction in sales contributed to the fall in 2023. The gross profit margin for the firm peaked in 2022 at 15.31% and plunged in 2020 to 9.59%. The company's net margin and earnings per share followed a similar pattern. Between 2020 and 2022, the net margin varied from 2.17% to 8.18%. Over the four years, the company had the highest earnings per share in 2022 at Rs16.12.

Future outlook

The company is optimistic about continuing to manage its top and bottom lines despite the political and economic uncertainties and the high discount rate.

Company profile

Mughal Iron & Steel Industries was established in Pakistan as a public limited company on February 16, 2010. The company’s operations comprise ferrous and nonferrous business segments. However, the principal activity of the company is the manufacturing and sale of mild steel products relating to the ferrous segment.

Credit: INP-WealthPk