i INP-WEALTHPK

Shams ul Nisa

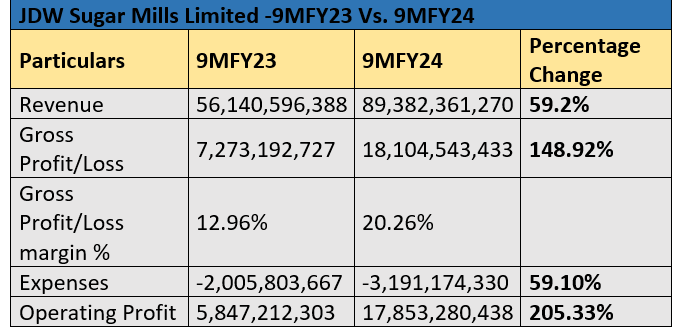

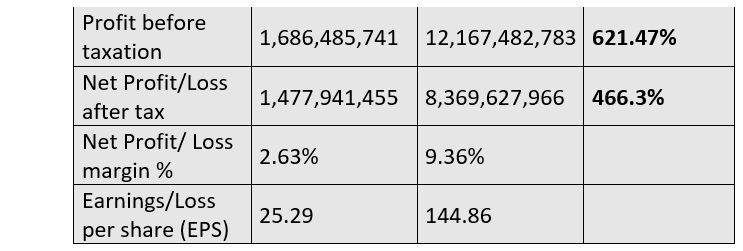

JDW Sugar Mills Limited’s revenue surged by 59.2% to Rs89.38 billion in the first nine months of the fiscal year 2023-24 (9MFY24) from Rs56.14 billion in 9MFY23, indicating strong product demand and improved pricing, reports WealthPK.

During the period, the gross profit surged 148.92%, pushing the gross profit margin from 12.96% in 9MFY23 to 20.26% in 9MFY24. The company attributed the increase in gross profit to the sale of carry-over sugar stocks at favourable prices. The company’s fiscal year ends in September.

Furthermore, the operating profit grew by a formidable 205.33%, highlighting the company's effective scaling and expense management. Additionally, the profit-before-taxation soared by 621.47% from Rs1.69 billion in 9MFY23 to Rs12.17 billion in 9MFY24, indicating outstanding operational performance and strategic management. The profit-after-tax jumped exponentially by 466.3% in 9MFY24. Thus, the company's net profit margin improved from 2.63% in 9MFY23 to 9.36% in 9MFY24. During the period, the rise in sugarcane support prices set by the provincial governments, and enhanced sugarcane yield per acre contributed to the profitability of sugarcane corporate farms. Similarly, the earnings per share also saw a remarkable increase from Rs25.29 in 9MFY23 to Rs144.86 in 9MFY24, demonstrating the company’s strong financial health and enhanced shareholder value.Top of FormBottom of Form

Historical trends

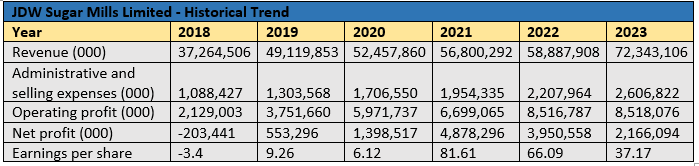

JDW Sugar Mills’ revenues grew from Rs37.26 billion in 2018 to Rs72.34 billion in 2023, reflecting its successful market share and sales expansion due to increased demand for sugar and higher prices leading to higher revenue generation each year. The rise in administrative and selling expenses from Rs1.08 billion in 2018 to Rs2.6 billion in 2023 suggests the company’s investment in operations and marketing efforts. However, the increase in administrative expenses is relatively slower than the revenue over the past six years, suggesting efficient cost management.

The company’s operating profit showed strong growth as it more than tripled from Rs2.13 billion in 2018 to Rs8.52 billion in 2023, indicating effective cost management and widening of the company’s core operations to improve its financial position. The company recovered from suffering a net loss of Rs203.44 million in 2018 and posted a net profit of Rs2.17 billion in 2023, with the peak net profit of Rs4.88 billion in 2021, highlighting the company's robust performance during that year. The earnings per share followed a similar trend, recovering from a loss of Rs3.40 in 2018 to a profit of Rs37.17 in 2023. It posted the highest EPS of Rs81.61 in 2021.

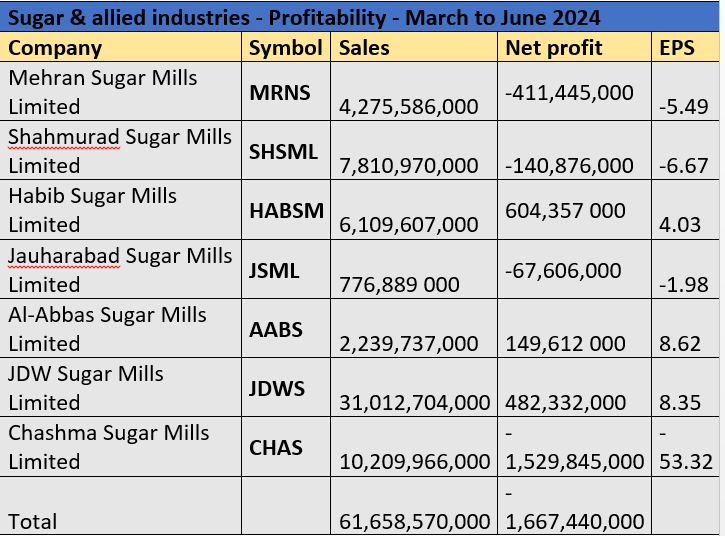

Sugar & allied industries

JDW Sugar Mills led the sugar and allied industries between March and June 2024, generating total sales of Rs31.01 billion and posting a net profit of Rs482.33 million. Habib Sugar Mills Limited and Al-Abbas Sugar Mills Limited reported net sales of Rs6.19 billion and Rs2.23 billion, and net profits of Rs604.3 million and Rs149.6 million, respectively.

In contrast, the rest of the companies struggled with significant losses, as Mehran Sugar Mills Limited suffered a net loss of Rs411.4 million, Shahmurad Sugar Mills Limited Rs140.8 million, Jauharabad Sugar Mills Limited Rs67.6 million and Chasma Sugar Mills Limited Rs1.52 billion. As a result, the sector faced a cumulative net loss of Rs1.66 billion despite total sales of Rs61.65 billion during the period under review. Among the industries, Al-Abbas Sugar Mills Limited had the highest EPS of Rs8.62, followed by JDW Sugar Mills Limited with an EPS of Rs8.35.

Company’s profile

JDW Sugar Mills was incorporated in 1990 as a private limited company, and in 1991 it was converted into a public limited company. The core activities include production and sale of sugar, power generation, and operation of corporate farms. The company works to enhance rural areas' social and economic development through social mobilisation, women's business development, support for technical and primary education, microcredit for the underprivileged, infrastructure and livestock development, etc.

Credit: INP-WealthPk