i INP-WEALTHPK

Shams ul Nisa

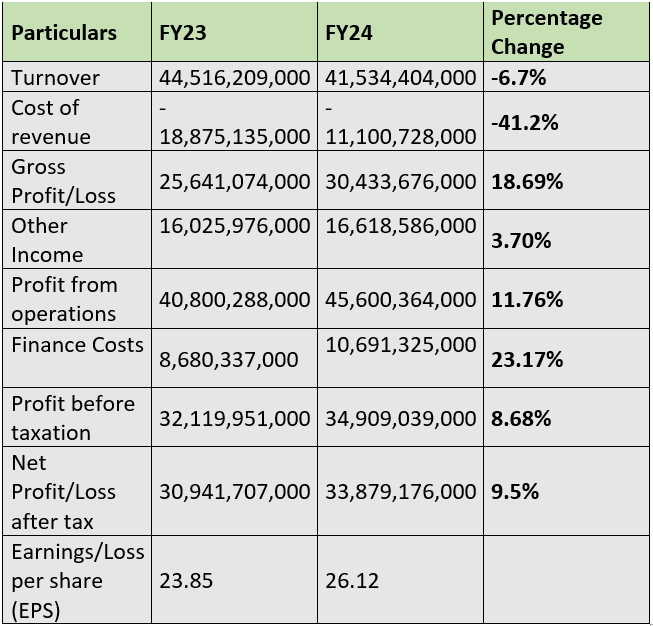

The turnover of Hub Power Company Limited (Hubco) dipped by 6.7% but net profit rose by 9.5% in the last fiscal year 2023-24 compared to the earlier fiscal, reports WealthPK.

The decrease in the net turnover was driven by lower net electrical output due to lower load demanded by Central Power Purchasing Agency. The increase in net profit pushed the earnings per share from Rs23.85 in FY23 to Rs26.12 in FY24. This growth was attributed to higher dividend income from subsidiaries and equity investments during the period under review. The company also managed to lower its cost of revenue by 41.2%, largely due to zero fuel expenses because of reduced generation. This success led to an 18.69% boost in gross profit, indicating strong cost management and operational efficiency.

![]()

During FY24, other income grew by 3.7%, driven by increased dividend income from subsidiaries, equity investments and higher interest income, which was partially offset by the absence of income from management services. Furthermore, the operating profit grew by 11.76%, reflecting solid operational performance despite reduced sales. However, the finance costs rose by 23.17%, attributed to additional loan utilisation. Additionally, the profit-before-tax increased by 8.68%, highlighting the company's effective expense control.

Quarterly performance analysis

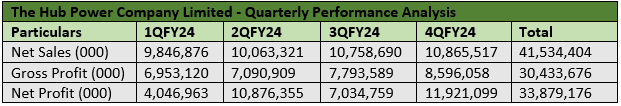

Hubco’s quarterly performance analysis in FY24 reveals substantial growth across key financial indicators, highlighting strong operational results. The company generated net sales of Rs41.53 billion during the fiscal, with consistent quarterly contributions, which increased from Rs9.85 billion in 1QFY24 to Rs10.87 billion in 4QFY24, suggesting steady demand for its services.

Similarly, the gross profit followed a notable upward trajectory, increasing from Rs6.95 billion in 1QFY24 to Rs8.60 billion in 4QFY24, culminating in a total gross profit of Rs30.43 billion for the year. During FY24, the net profit reached an impressive Rs33.88 billion, demonstrating solid profitability. The company posted the highest net profit of Rs11.9 billion in 4QFY24.

Power generation and distribution sector

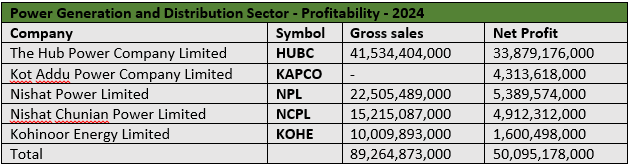

The profitability analysis of the power generation and distribution sector in FY24 shows varied results of major companies, with Hubco leading the sector, achieving gross sales of Rs41.53 billion and net profit of Rs33.88 billion. This highlights Hubco’s effective cost management and strong market demand, solidifying its position as a sector leader.

Kot Addu Power Company Limited reported a net profit of Rs4.31 billion during the period under review. Furthermore, Nishat Power Limited recorded gross sales of Rs22.51 billion and a net profit of Rs5.39 billion, indicating strong operational efficiency. Nishat Chunian Power Limited posted gross sales of Rs15.22 billion and a net profit of Rs4.91 billion. Kohinoor Energy Limited posted relatively smaller gross sales of Rs10.01 billion and a net profit of Rs1.60 billion. The sector reported total gross sales of Rs89.26 billion, with a combined net profit of Rs50.10 billion during FY24.

Future outlook

Hubco is focusing on renewable energy, electric vehicles and water management initiatives to strengthen Pakistan's energy security and support environmental sustainability. The company is set to participate in the bidding for KE renewable energy projects, including Pakistan's inaugural wind-solar hybrid project. Recognising the global shift in the automotive industry, Hubco is also venturing into the new energy vehicle sector. In water management, Hubco is exploring wastewater recycling through potential public-private partnerships with a pre-qualified project underway in Karachi. Hubco's strategic goals prioritise growth, innovation and sustainability, underpinned by a robust governance framework, financial resilience and strategic partnerships. The company is committed to pursuing new project opportunities, addressing sustainability issues, and refining its strategies to diversify its investment portfolio.

Company profile

Hubco, which was incorporated in Pakistan in 1991, primarily focuses on developing, owning, operating and maintaining power stations, including a 1,200MW power station in Balochistan.

Credit: INP-WealthPk