i INP-WEALTHPK

Shams ul Nisa

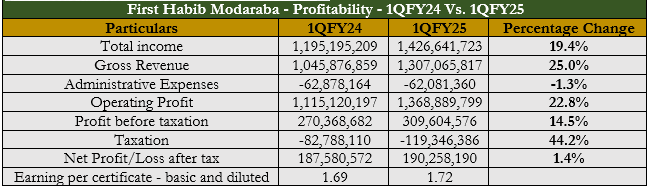

First Habib Modaraba reported a 19.4% increase in total income, reaching Rs1.43 billion, while gross revenue rose by 25.0% to Rs1.31 billion in the first quarter of FY25, reports WealthPk.However, the company’s administrative expenses slightly declined 1.3% to Rs62.0 million in 1QFY25, reflecting effective cost management.

Furthermore, the operating profit climbed by 22.8% to Rs1.37 billion, indicating enhanced operational efficiency. During the review period, the profit before tax grew by 14.5% to Rs309.60 million. However, tax expenses increased by 44.2%, from Rs82.7 million in 1QFY24 to Rs119.35 million in FY25, due to higher taxable income and changes in tax policies. Similarly, the company’s net profit saw a modest 1.4% increase to Rs190.26 million in 1QFY25, with earnings per certificate rising slightly from Rs1.69 in 1QFY24 to Rs1.72 in 1QFY25.

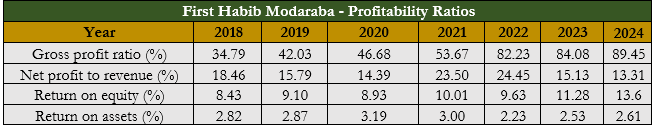

Profitability Ratios

First Habib Modaraba’s profitability ratios from 2018 to 2024 reflect notable improvements in financial performance. The gross profit ratio rose significantly from 34.79% in 2018 to 89.45% in 2024, highlighting effective pricing and cost management strategies. However, the net profit to revenue ratio has been more volatile, reaching a high of 24.45% in 2022 before dropping to 13.31% in 2024. This decline indicates challenges in converting gross profits into net profits, likely due to increasing operational costs. The fluctuating net profit margins indicate prioritizing expense control and operational efficiency to maintain profitability.

The return on equity (ROE) has demonstrated a positive trend, increasing from 8.43% in 2018 to 13.6% in 2024, highlighting that the company is effectively generating returns for its shareholders. Meanwhile, the return on assets (ROA) has remained relatively stable yet modest, fluctuating between 2.23% and 3.19% over the years.

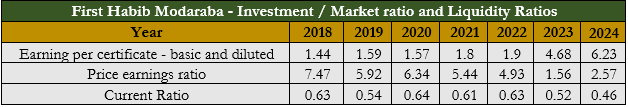

Investment / Market ratio and Liquidity Ratios

First Habib Modaraba’s investment and liquidity ratios from 2018 to 2024 reveal mixed financial stability, with strong profitability trends but some liquidity challenges. The earnings per certificate (EPS) rose substantially from 1.44 in 2018 to 6.23 in 2024, reflecting effective management strategies. However, the price-to-earnings (P/E) ratio declined sharply from a peak of 7.47 in 2018 to a low of 1.56 in 2023, indicating reduced investor confidence in future growth and potential stock undervaluation. In 2024, the P/E ratio grew to 2.57, suggesting ongoing investor concerns about earnings sustainability and market conditions.

The current ratio has declined from 0.63 in 2018 to 0.46 in 2024, signalling possible liquidity challenges. This downward trend indicates that, despite improved profitability, the company struggled with effective working capital management, leading to liquidity risks.

Company profile

First Habib Modaraba is a multipurpose modaraba working under the management of Habib Metropolitan Modaraba Management Company (Private) Limited. The Modaraba core operations are involved in the leasing, and financing of murabaha, and musharaka industries, among other related businesses.

Credit: INP-WealthPk