i INP-WEALTHPK

Ayesha Mudassar

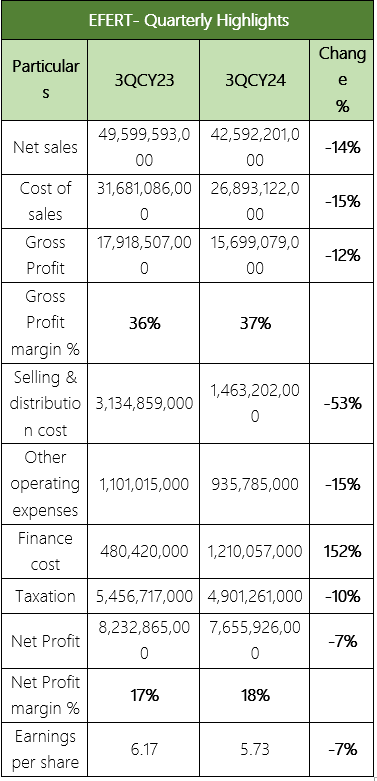

Engro Fertilizers Limited (EFERT) experienced a 14% decrease in net sales, a 12% decline in gross profit, and a 7% drop in net profit in the third quarter of the calendar year 2024 compared to the corresponding period last year, reports WealthPK.

For the third quarter of CY24, the company recorded net sales of Rs42.5 billion and a gross profit of Rs15.6 billion. The net profit fell to Rs7.6 billion compared to Rs8.2 billion in 3QCY23, resulting in the earnings per share (EPS) of Rs5.73 against Rs6.17 in the corresponding quarter of the previous year.

![]()

As per the results available with the Pakistan Stock Exchange (PSX), Engro Fertilizers Limited’s cost of sales declined by 15% year-on-year (YoY) to Rs26.8 billion compared to Rs31.6 billion in 3QCY23. On the expense side, the company experienced a significant reduction in the selling and distribution costs, which fell by 53% YoY to Rs1.4 billion. Additionally, the other operating expenses decreased by 15% YoY, reaching Rs935.7 million during the review period. However, the finance costs surged by 152% YoY and stood at Rs1.2 billion, compared to Rs480.4 million in 3QCY23. In terms of taxation, the company paid a lower tax of Rs4.9 billion, representing a 10% YoY decline compared to Rs5.4 billion tax paid in the same quarter of the previous year.

Sectoral Financials- 3QCY24

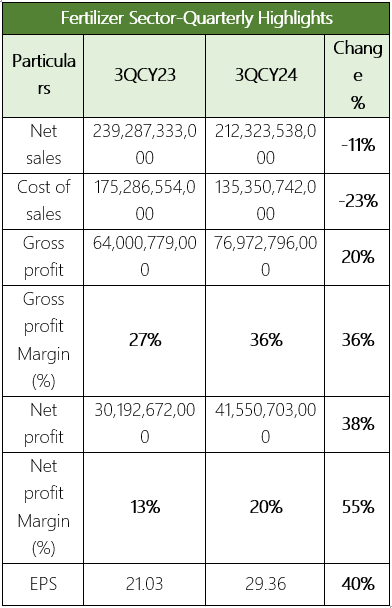

Pakistan's fertilizer sector reported a 20% increase in gross profit and a 38% growth in net profit during the third quarter of CY24, compared to the same period in the previous year. For 3QCY24, the listed fertilizers companies collectively earned a gross profit of Rs76.9 billion and a net profit of Rs41.5 billion, resulting in the gross profit and net profit margins of 36% and 20%, respectively.

According to the data compiled by WealthPK, the fertilizer sector’s net sales declined to Rs212.3 billion in 3QCY24 from Rs239.2 billion in the same period of CY23, representing a decrease of 11%. The fertilizer sector includes major companies such as Engro Fertilizers Limited (EFERT), Fauji Fertilizers Company Limited (FFC), Fatima Fertilizer Company Limited (FATIMA), and Fauji Fertilizer Bin Qasim Limited (FFBL).

Among these companies, FFC leads the sector with a market capitalization of Rs406.8 billion, followed by EFERT with a market cap of Rs269.7 billion. FATIMA and FFBL rank third and fourth with market capitalizations of Rs143.0 billion and Rs95.5 billion, respectively. In 3QCY24, FATIMA topped its peers in sales, while FFC recorded the highest net profit, followed by FATIMA, FFBL, and EFERT. Regarding earnings per share (EPS), the sequence changed from FFC to EFERT and FFBL. FATIMA stood at fourth position.

Company Profile

Engro Fertilizers Limited is a public company incorporated in Pakistan on June 29, 2009, as a wholly owned subsidiary of Engro Corporation Limited. The company specializes in the manufacturing, purchasing, and marketing of fertilizers, seeds, and pesticides, as well as logistics services.

Future Outlook

The company is dedicated to working closely with both the industry and the government to ensure uninterrupted production of urea. In light of the declining gas pressures, Fauji Fertilizer Company, along with other fertilizer producers, has reached an agreement with Mari Petroleum Company Limited (MPCL) to invest in Pressure Enhancement Facilities (PEF) at MPCL’s delivery node. This project, which is expected to involve significant capital investment, aims to ensure a reliable and continuous supply of gas for the fertilizer manufacturers.

Credit: INP-WealthPk