i INP-WEALTHPK

Shams ul Nisa

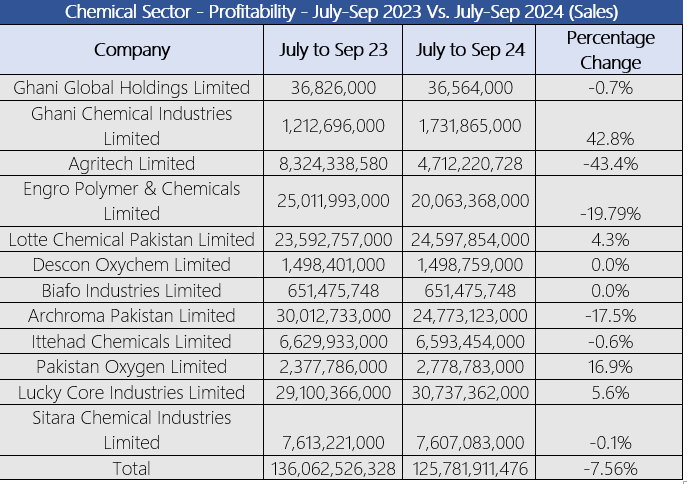

The chemical sector’s total sales decreased by 7.56% from Rs136.06 billion in July-Sep 2023 to Rs125.78 billion in July-Sep 2024, reports WealthPK.

Ghani Chemical Industries Limited led the chemical sector with a notable 42.8% increase in sales, reflecting strong cost management and rising product demand. In contrast, Agritech Limited saw a 43.4% drop in sales, driven by high input costs and a surge in imports. Additionally, companies such as Engro Polymer & Chemicals Limited and Archroma Pakistan Limited reported substantial declines of 19.8% and 17.5%, respectively, underscoring challenges in sustaining profitability due to rising operational costs and intensified competition.

Lotte Chemical Pakistan Limited recorded a modest 4.3% increase in sales, while Lucky Core Industries Limited achieved a slight growth of 5.6%. Meanwhile, Descon Oxychem Limited and Biafo Industries Limited maintained stable sales, reflecting consistency but lack of growth momentum, which could impact their long-term competitiveness. The overall sector faced sales declines due to the increased imports and elevated energy costs driven by global inflation, which posed challenges for pricing strategies. Additionally, the demand in China and India remained subdued during the monsoon season, and global PVC prices remained weak throughout the review period.

Net Profit

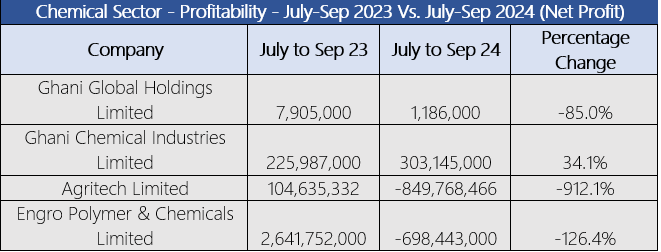

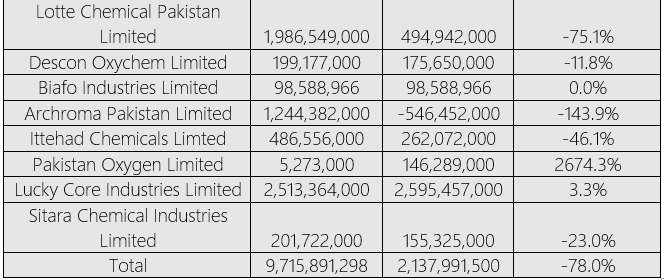

The chemical sector in Pakistan saw a sharp drop in net profits, which decreased by 78% from Rs9.72 billion in July-September 2023 to Rs2.14 billion in the same period of 2024. This downturn is linked to the rising operational costs and market instability. Companies such as Ghani Global Holdings Limited and Agritech Limited reported substantial declines in net profits of 85% and 912.1%, respectively, likely due to the high input costs and reduced demand for agricultural chemicals, highlighting potential issues in their cost management and operational efficiency. Similarly, Engro Polymer & Chemicals Limited faced 126.4% drop in profitability, attributed to the increased production costs and heightened competition.

Lotte Chemical Pakistan Limited and Archroma Pakistan

Limited also reported declines of 75.1% and 143.9%,

respectively, reflecting challenges in sustaining profitability as the costs rise. However, Ghani Chemical Industries Limited achieved a rise of 34.1% in net profit, reflecting a robust product demand and efficient cost control. Pakistan Oxygen Limited reported an impressive 2674.3% profit surge, suggesting successful strategies that leveraged the market opportunities. Meanwhile, Lucky Core Industries Limited posted a modest 3.3% profit increase, while Sitara Chemical Industries Limited and Ittehad Chemicals Limited saw profit declines of 23% and 46.1%, respectively. To strengthen competitiveness and boost profit margins, the companies in the sector will need to focus on innovation and invest in more efficient production technologies.

Future Outlook

In the chemical sector, the companies are pursuing growth and resilience by expanding production capacity and diversifying markets despite facing rising costs, inflationary pressures, and economic uncertainties. Strategic investments include the construction of a 275 TPD ASU plant in KPK to produce essential gases like oxygen, nitrogen, and argon, with the emphasis on serving healthcare demands and exploring export opportunities in GCC, Latin America, and South Africa. Efforts are underway to lower the production costs and enhance manufacturing efficiency through a targeted manufacturing excellence program, with goals of becoming the region’s lowest-cost producer. The sector is also actively optimizing capital allocation and identifying new revenue streams to ensure a sustainable and resilient future amid fluctuating raw material prices, evolving energy costs, and potential geopolitical and currency risks.

Credit: INP-WealthPk