i INP-WEALTHPK

Shams ul Nisa

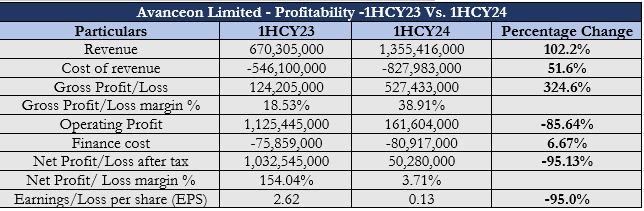

Avanceon Limited's revenue surged by 102.2%, but the net profit dropped by 95.13% during the first half of the calendar year 2024, reports WealthPk.

The company achieved a revenue of Rs1.35 billion in the first half of 2024, driven by stringent monitoring of target achievements. Additionally, the net profit after tax decreased significantly to Rs50.28 million, bringing the net profit margin down to just 3.71% in 1HFY24, compared to 154.04% in the same period last year. Despite a 51.6% increase in the cost of revenue, reaching Rs827.98 million, the company saw a substantial 324.6% surge in gross profit in the first half of fiscal year 2024. Consequently, the gross profit margin rose notably to 38.91% during this period, up from 18.53% in 1HFY23, highlighting improved operational efficiency and more effective pricing strategies.

However, the operating profit dropped sharply by 85.64% to Rs161.60 million, reflecting difficulties in controlling operating costs. Finance costs increased modestly by 6.67% in the first half of fiscal year 2024, mainly due to higher salary expenses. Additionally, the company reported an exchange loss of Rs74 million in the first half of 2024, a notable shift from the Rs2.04 billion exchange gain in the same period of the prior year, attributed to the PKR’s relative stability against the USD. Thus, earnings per share also declined from Rs2.62 to Rs0.13, indicating a substantial decrease in profitability.

Technology & Communication Sector

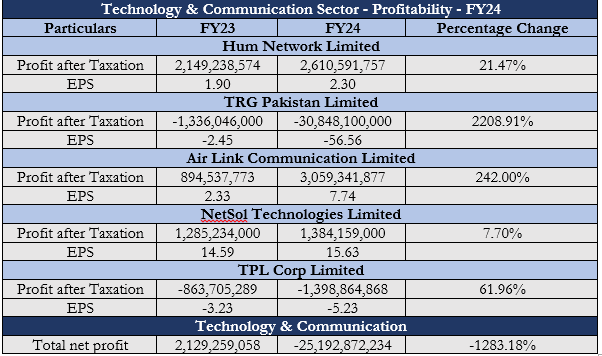

The Technology & Communication sector's profitability analysis for FY24 shows a stark contrast in performance among companies. Hum Network Limited recorded a profit after tax of Rs2.61 billion, marking a solid 21.47% increase from the previous year. However, TRG Pakistan Limited faced a substantial loss of Rs30.85 billion, reflecting a staggering 2208.91% increase in year-over-year losses, raising concerns over operational efficiency and market conditions and hinting at major issues within its business model or external challenges impacting profitability.

Air Link Communication Limited demonstrated impressive growth, with profit after tax soaring by 242% and EPS rising to Rs7.74. NetSol Technologies Limited maintained stability, achieving a profit after tax of Rs1.38 billion, a moderate 7.70% growth, with EPS slightly increasing to Rs15.63 in FY24 from Rs14.59 in FY23. Meanwhile, TPL Corp Limited reported a further increase in losses to Rs1.40 billion, highlighting ongoing financial challenges. Overall, the sector’s net profit plunged to Rs25.19 billion, representing a 1,283.18% decline from FY23.

Profitability Ratios

From 2020 to 2023, First Habib Modaraba's profitability ratios reveal a mixed trend. The gross profit ratio steadily declined from 39.57% to 29.97%, with a modest rebound to 32.45% in 2023. The net profit ratio stood at 93.15% in 2022, reflecting a high portion of revenue converted into profit. However, it decreased to 63.85% in 2023, indicating rising expenses..

![]()

![]()

Earnings per share showed impressive growth of 47.13% in 2022 but dropped to 5.19% in 2023, mainly due to challenges in maintaining profitability. The price-to-earnings growth (PEG) ratio fluctuated significantly over the years, with a low value in 2022 suggesting undervaluation. However, it increased to Rs2.27 in 2023, suggesting higher expectations for future growth.

Company profile

Avanceon Limited was incorporated in Pakistan on 26 March 2003. The principal activity is to trade in products of automation and control equipment and provide related technical services.

Credit: INP-WealthPk