INP-WealthPk

Hifsa Raja

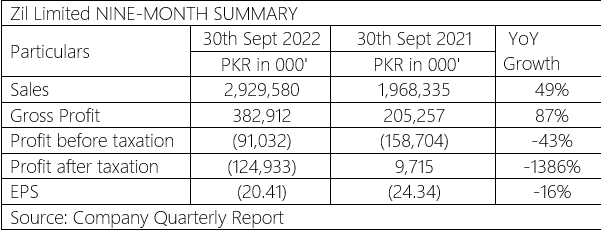

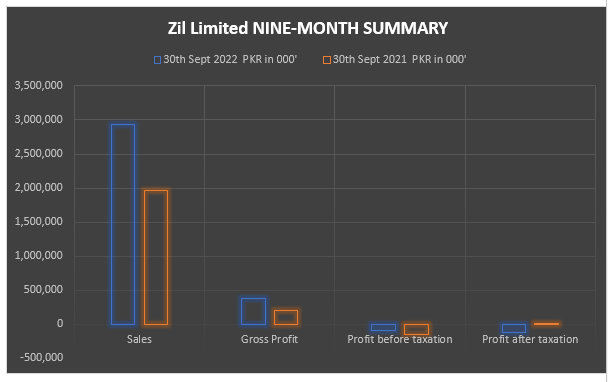

Zil Limited’s sales increased by 49% to Rs2.9 billion in the first nine months of the Calendar Year 2022 ending September 30 compared with Rs1.96 billion in the corresponding period of the previous year. The gross profit increased by 87% to Rs382 million in the first nine months of CY2022 compared with Rs205 million in the corresponding period of the previous year.

The loss before taxation during the nine-month period of CY22 reached Rs91 million from a loss of Rs158 million in the corresponding period of CY21. The loss after taxation was Rs124 million in the nine months of CY22 compared with Rs9 million loss over the corresponding period of CY21, reports WealthPK.

The company observed improved margins and profits in the third quarter, mainly due to increased retail prices and a decline in global commodity rates. The management anticipates achieving further improvements in creating shareholder value in the balance of the year amid recent efforts to improve profitability.

However, this depends on the rupee-dollar parity, which may seriously affect the raw material costs, the overall political ecosystem, and the effects of the near hyperinflation atmosphere in the country. The management continues to review consumer prices, remain vigilant about purchasing at favourable times, and improve the overall product mix to deliver higher profits while keeping in mind its market share and position.

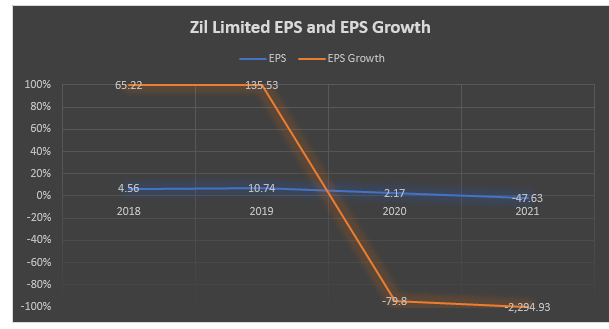

Earnings Growth Analysis:

Zil Limited’s stock price has shown significant volatility over the past few years. The earnings per share (EPS) was Rs10.74 in 2019. In 2020, it dropped to 2.17 and further to minus 47.63% in 2021. The earning growth has been on the decline since the year 2020.

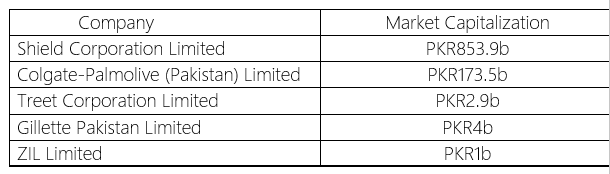

Industry comparison:

Shield Corporation Limited, Colgate-Palmolive (Pakistan) Limited, Treet Corporation Limited, and Gillette Pakistan Limited have all been regarded as rivals of ZIL Limited.

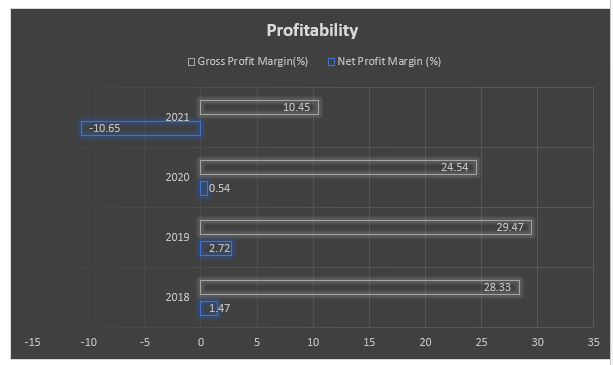

Profitability:

Zil Limited is generating a very low net profit margin compared to revenue. The company has a very high cost of sales along with other expenses. If the net profit margins are so low, it will be very difficult for the company to generate profits, and give dividends and earnings per share to the shareholders.

The company is in a state of insolvency and needs to focus on management inefficiencies. There are certain operational difficulties in the existing manufacturing facility due to the housing society built in its surrounding area leading to the closure of the factory.

Company profile:

ZIL Limited is a Pakistan-based company that manufactures and sells home and personal care products. The company offers Capri soap, Capri Handwash, HYPro anti-bacterial bar soap, Opal beauty soap, Lily beauty soap, and Beauty Drop soap. The Capri handwash range comes with an improved bottle shape. Re-fill pouches have also been introduced to meet consumer needs.

The company offers two variants of Lily beauty soap with herbal fragrance and exotic floral fragrance, providing a refreshing and purifying experience through the combination of nourishing floral extracts and milk protein for a soft and fragrant skin. The factory is situated on Link Hali Road, Hyderabad.

Credit: Independent News Pakistan-WealthPk