INP-WealthPk

Ayesha Mudassar

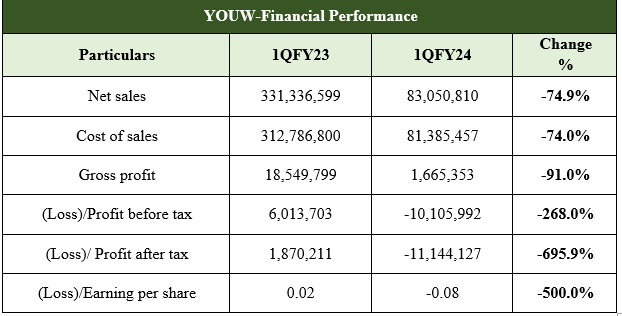

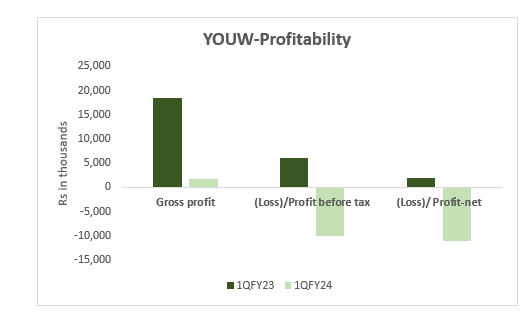

The Yousaf Weaving Mills Limited (YOUW), a textile company, has posted a loss-after-tax (LAT) of Rs 11.1 million during the first quarter that ended September 30, 2023, compared with a profit of Rs 1.8 million in the corresponding period of last year, reports WealthPk. As per a quarterly report, the YOUW reported a loss-before-tax (LBT) of Rs 10.1 million during 1QFY24, compared to profit-before-tax of Rs 6.01 million in 1QFY23. Likewise, the gross profit plunged by 91% during the period under review.

A notable decline in net sales is observed, representing a 75% reduction from the preceding year. Furthermore, the cost of sales also declined by 74% during the 1QFY24. The company posted a loss per share of Rs 0.08 for the quarter ended June 30, 2023. Certain factors, including extortionate prices of inputs, massive rupee devaluation, and uncertain political and economic situation, predominantly played a role in worsening the company's performance.

Performance over last four years (2020-2023)

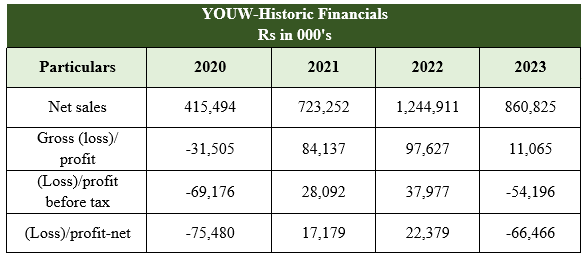

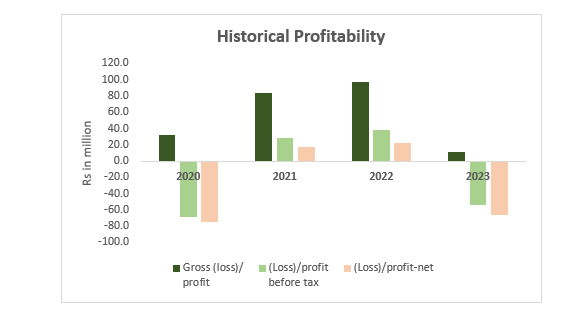

During the last four years, the YOUW's top and bottom lines plunged only once, in 2023. Likewise, the gross and before-tax margins of the company grew in 2020 and 2021, and then tumbled in 2023. Historical analysis of YOUW's sales demonstrates an increasing trend till 2022. The company posted its highest four-year sales in FY22, at Rs 1.2 billion. However, higher interest rates and unprecedented inflation caused a drastic hike in production costs, resulting in a 31% decline in net sales during 2023.

On net profit, the company's historical performance fluctuated over the years. In the last four years (2020-2023), the firm posted the highest profit of Rs 22.3 million in FY22. Due to uncertain political and economic conditions, the company incurred a loss of Rs 66.4 million in fiscal year 2023. Besides, the gross loss and loss-before-tax (LBT) have been fluctuating over four years.

The combination of strict monetary measures, discriminatory tax policies, and the prevailing economic challenges, including high inflation and currency devaluation, collectively dented the company's profitability in FY23.

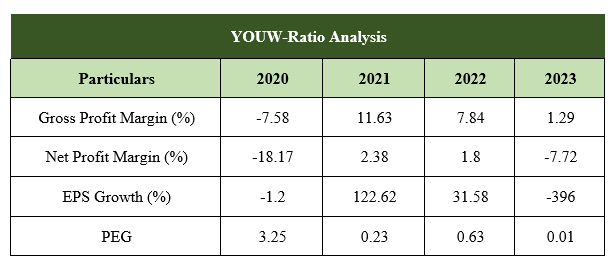

Ratio Analysis

The historical ratios of Yousaf Weaving Mills provide valuable insights regarding the company's financial performance and growth patterns over the years. The YOUW showcased fluctuations in its gross profit margin, reaching 1.29% in FY23, down from 7.8% in FY22, and 11.63% in 2021. This steady downward trend reflects the company's inability to implement effective cost management and pricing strategies, contributing to a lower bottom line.

The net profit margin for the Yousaf Weaving Mills also experienced negative growth, declining to negative 7.72% in FY23, compared to 1.8% in FY22, and 2.38% in FY21. The downward trajectory in net profit margin demonstrates YOUW's inability to manage expenses and maximize profits. On earnings per share (EPS), the company reported a significant decline of 396% in FY23.

The company witnessed a 31.58% growth and an outstanding 122.62% surge in FY21. During the years under review, the price/earnings to growth (PEG) ratio for the company was notably low at 0.01 in FY23. The PEG ratio assesses the relationship between a company's price/earnings (P/E) ratio and its earnings growth rate. A PEG ratio below 1 suggests that the stock may be undervalued relative to its earnings growth potential.

Company Description

The Yousaf Weaving Mills Limited was incorporated on January 17, 1988, as a public limited company in Pakistan under the Companies Ordinance, of 1984 (now the Companies Act, 2017). The company is engaged in the textile weaving, spinning, and sale of processed fabric.

General Market Review and Future Prospects

Global economic uncertainty and rising production costs have eroded the global competitiveness of Pakistan's textile industry. Additionally, frequent energy shortages and power outages in the country have hindered the textile industry's ability to maintain consistent production schedules, affecting delivery timelines and eroding customer trust. Amidst a continuously changing economic landscape, the textile composite is determined to work closely with the relevant departments to overcome these challenges, strengthen its presence, and explore new growth opportunities.

INP: Credit: INP-WealthPk