INP-WealthPk

Ayesha Mudassar

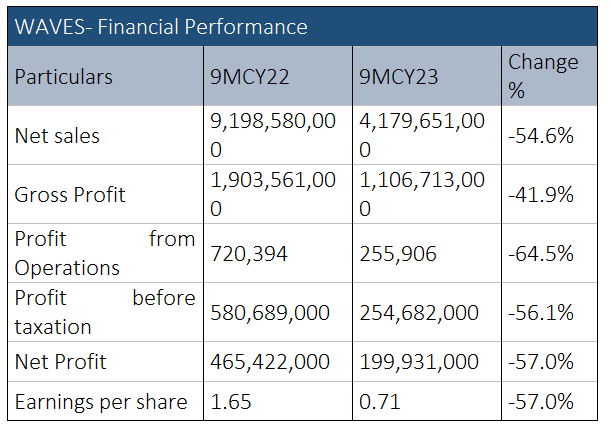

The net sales of Waves Corporation Limited (WAVES) plunged by 55%, the gross profit by 42% and the net profit by 57% in the first nine months of the last calendar year (9MCY23) compared to the corresponding period of the year earlier, according to WealthPK.

In 9MCY23, the company posted a revenue of Rs4.17 billion and a gross profit of Rs1.10 billion. The net profit stood at Rs199.9 million compared to Rs465.4 million in the corresponding period of CY22. As a result, the earnings per share decreased to Rs0.71 from Rs1.65 in 9MCY22. The subdued performance was mainly due to challenging and adverse economic conditions caused by the draining of the country’s foreign exchange reserves, depreciation of local currency, a steep increase in the interest rate and the highest-ever inflation.

Quarterly analysis

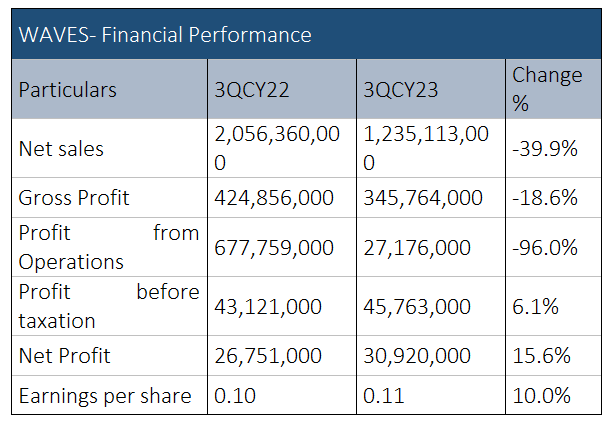

In comparison to the third quarter of 2022, WAVES experienced a reduction in net sales from Rs2.05 billion to Rs1.23 billion in 3QCY23, a fall of 40%. The gross profit of Rs424.8 million in 3QCY22 decreased by 18.6% in 3QCY23. The company, however, reported a 15.6% increase in net profit, which improved from Rs26.7 million in 3QCY22 to Rs30.9 million in 3QCY23, demonstrating a significant improvement in profitability. EPS inched up to Rs0.11 from Rs0.10 previously.

Historical performance

Historical analysis of WAVES shows that in the last four years, the company posted the highest net profit in 2019. It experienced a loss in 2020. From a net profit of Rs260 million in CY19, the company’s profit declined to Rs173 million in CY21 before recovering and posting a net profit of Rs253 million in CY22. As for EPS, the company’s performance fluctuated over the years. The firm posted the highest EPS of Rs1.39 in CY19. However, it had a loss per share in CY20 and CY21. It nonetheless posted EPS of Rs0.63 in CY22.

EPS growth (%) analysis

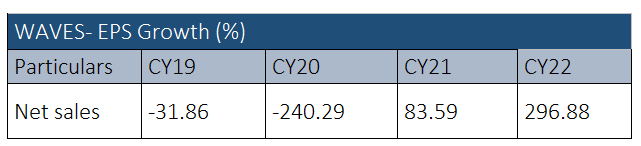

The trend in percentage growth of earnings per share of Waves Corporation Limited shows significant fluctuations over the period from 2019 to 2022. The company's profitability changed substantially during this time, resulting in notable changes in EPS growth. The EPS growth percentage stood at negative 31.86% in CY19 and then steeply fell to negative 240.2% in CY20. This can be attributed to Covid-induced lockdowns.

However, in the subsequent year (2021), the EPS growth rebounded and stood at 83.59%, reflecting the outstanding economic management of core activities to earn notable revenues. The company maintained the momentum as EPS growth had a massive jump to 296.88% in CY22.

Company’s profile

Waves Corporation was incorporated in Pakistan under the now repealed Companies Ordinance, 1984, as a public limited company. It was formerly known as Waves Singer Pakistan Limited. The firm makes and assembles home appliances and sells and trades them and other small engineering products. The company is the fourth-largest firm registered in the cable and electrical goods sector with a market capitalisation of Rs1.9 billion.

Credit: INP-WealthPk