INP-WealthPk

Ayesha Mudassar

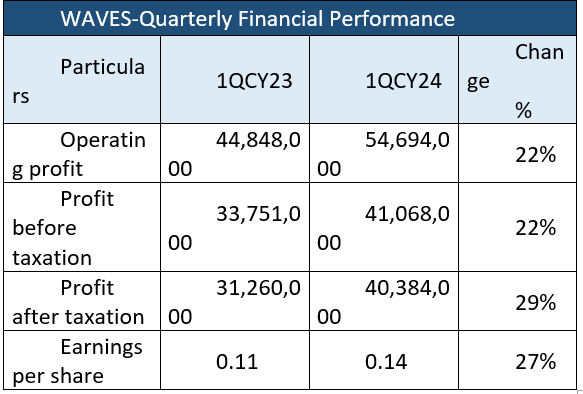

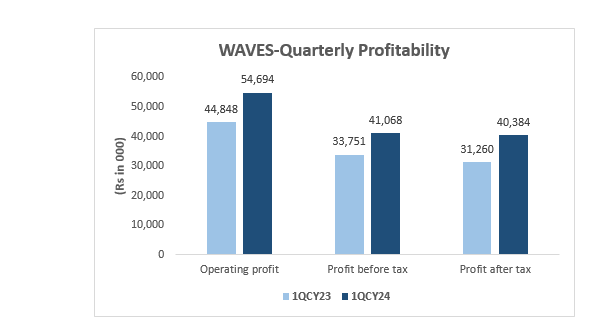

The operating profit of Waves Corporation Limited (WAVES) grew by 22%, the profit-before-tax (PBT) by 22% and the profit-after-tax (PAT) by 29%, respectively, in the first quarter of the ongoing calendar year (1QCY24) compared to the corresponding period of earlier year, reports WealthPK.

In 1QCY24, the company earned an operating profit of Rs54.6 million, PBT of Rs41.06 million and PAT of Rs40.3 million. As a result, the earnings per share increased to Rs0.14 from Rs0.11 in 1QCY23.

Pattern of shareholding

As of December 31, 2023, WAVES had a total of 281.4 million outstanding shares held by 6,980 shareholders. Directors, CEOs, their spouses, and minor children were the major shareholders of WAVES with a stake of 48.4% in the company. This category was followed by the general public, which held 46.9% shares. Joint stock companies accounted for 3.6% of the outstanding shares. The remaining shares were held by other categories of shareholders, each having less than 1% stake

Historical performance (2019-23)

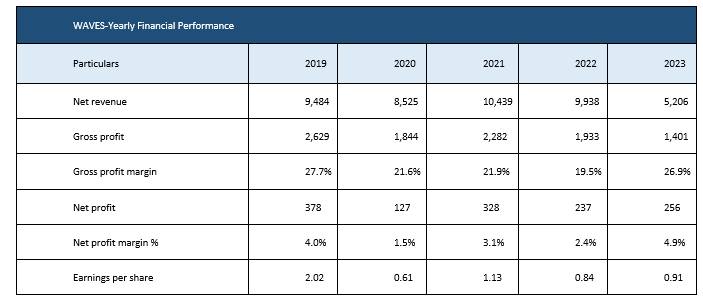

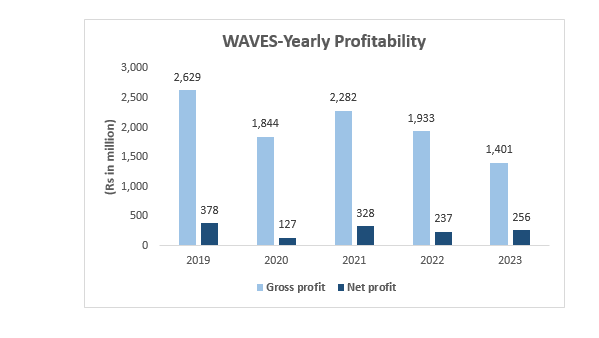

Since 2019, WAVES's top line tumbled thrice – in 2020, 2022, and 2023. Its bottom line posted a downtick in 2020 and 2022. The gross margin of the company followed a downward trajectory except in 2023 where the gross margin posted a considerable growth. Moreover, the net profit margin descended in 2020 and then rebounded in 2021 and 2023.

In 2020, WAVES's top line slid by 10% year-on-year (YoY) as the company's peak summer season was compromised due to a nationwide lockdown on account of Covid-19 pandemic. The high cost of sales resulted in a 30% decline in gross profit with the GP margin tapering down to 21.6% in 2020. Furthermore, the net profit narrowed down by 66% to clock in at Rs127 million with an NP margin of 1.5% and EPS of Rs0.61. The year 2021 appears to be a favorable year for WAVES as its sales grew by 22% to clock in at Rs10.4 billion. The robust sales volume and upward revision in prices resulted in a 24% rise in gross profit with a GP margin of 21.9% in 2021.

A drop in finance costs along with a hike in earned carrying charges culminated in a 157% growth in net profit during the year. In 2022, WAVES's top line declined by 5% YoY due to restrictions imposed on the import of basic raw materials. The gross profit slashed by 15% with the GP margin falling to 19.5% – the lowest of all the years being compared. In addition, the net profit for the year stood at Rs237 million with an NP margin of 2.4% versus 3.1% in 2021. In 2023, the company's net sales massively tumbled by 48% YoY due to lackluster demand. The lower sales volume translated into a 28% dip in the gross profit.

About the company

Waves Corporation was incorporated in Pakistan under the now repealed Companies Ordinance, 1984, as a public limited company. It was formerly known as Waves Singer Pakistan Limited. The firm is a manufacturer and assembler of domestic consumer appliances along with retailing and trading of the same and other light engineering products. The listed company is the fourth-largest firm registered in the cable and electrical goods sector with a market capitalization of Rs2.2 billion.

Credit: INP-WealthPk