INP-WealthPk

Ayesha Mudassar

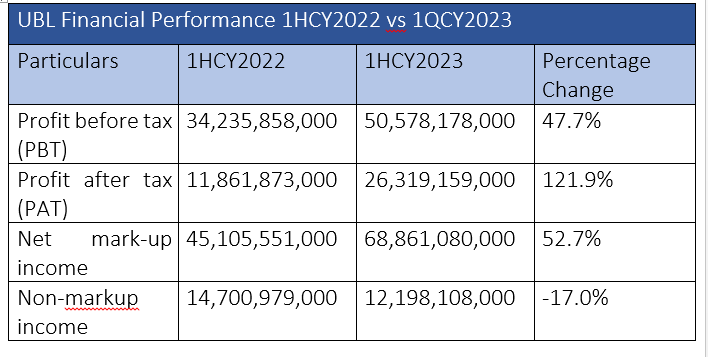

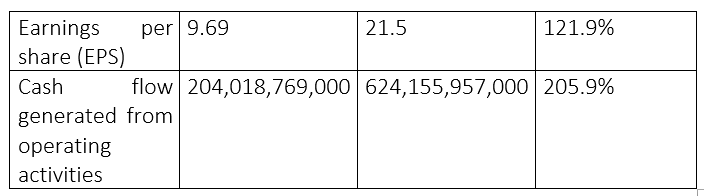

United Bank Limited (UBL), one of Pakistan's largest banks, has declared an unconsolidated profit-before-tax (PBT) of Rs50.6 billion for the first half of 2023, with an impressive growth of 48% over last year, reports WealthPK. According to the financial results submitted to the Pakistan Stock Exchange (PSX), the bank recorded a profit-after-tax (PAT) of Rs26.3 billion for 1HCY23 versus a PAT of Rs11.9 billion in the corresponding period of the last year, registering a staggering growth of 122%. UBL announced an impressive earnings per share (EPS) of Rs21.5 for the six months.

The bank’s net markup income rose sharply to Rs68.9 billion in the first six months of 2023, up from Rs45.1 billion in the same period last year. This was due to higher interest rates and timely adjustments in the bank’s assets, which improved its profit margins. However, non-markup interest income for six months reached Rs12.19 billion, representing a 17% year-on-year decrease. Furthermore, the bank’s asset base reached Rs3.4 trillion and deposits Rs2.4 trillion as of June 2023. The bank's gross revenues stood at Rs85.5 billion, growing by 36%, driven by the build-up in the deposit base and well-positioned investment portfolio.

UBL reversed Rs0.5 billion in net provisions for the first half of 2023, thanks to strong recoveries from both domestic and international loans and investments.The bank also kept a prudent level of coverage for its portfolios. Domestic Current Account Saving Accounts (CASA) deposits averaged Rs1.5 trillion for 1HCY23, with a growth of 13% year-on-year, with a portfolio increase of Rs167 billion. The average CASA to total deposits ratio continued to rise and was measured at 90.3% in 1HCY23. Moreover, the bank added 474,000 new current account relationships in 1HCY23 as against 303,000 in the corresponding period of last year. This has resulted in average current deposits recording a growth of 16% year-on-year to Rs802 billion in 1HCY23.

Quarterly profitability review

UBL has witnessed an astounding profit growth of 430% for the quarter ending June 30, 2023, as it declared a profit-after-tax of Rs12.42 billion for 2QCY23, compared to Rs2.33 billion in the same quarter of the previous year. The main factor that contributed to this massive jump in profit is the reversal of provisions, amounting to Rs3.08 billion during the quarter under review. Moreover, UBL announced an impressive EPS of Rs10.14 for the quarter, compared to Rs1.91 in the corresponding quarter last year.

UBL-historical financials

Historical analysis of UBL performance shows that in the last four years, the bank earned the highest markup in 2022. This indicates that the bank had a strong performance in terms of interest income, which is a significant revenue source. However, the bank has witnessed two dips regarding earned markup in 2020 and 2021. UBL earned a total income of Rs83.4 billion in 2019, Rs92.1 billion in 2020, Rs95.1 billion in 2021 and Rs137.7 billion in 2022. The bank achieved its highest PAT in four years in 2022, reaching Rs32.1 billion. A higher PAT was likely driven by increased revenues in the period considered. The bank posted a net profit of Rs19.1 billion in 2020, Rs20.9 billion in 2021, and Rs30.8 billion in 2021.

The trend of increasing EPS over the years, with the highest EPS in CY22, indicates that UBL's financial performance was generally improving primarily due to income growth.

Future outlook

UBL aims to boost the economy by expanding financial access and offering banking services throughout the country. Furthermore, the bank will target low-cost deposits to its earnings and invest heavily in technology to become more agile and efficient. Strengthening compliance and control standards in line with international best practices remains an ongoing strategic priority.

Credit: INP-WealthPk