INP-WealthPk

Hifsa Raja

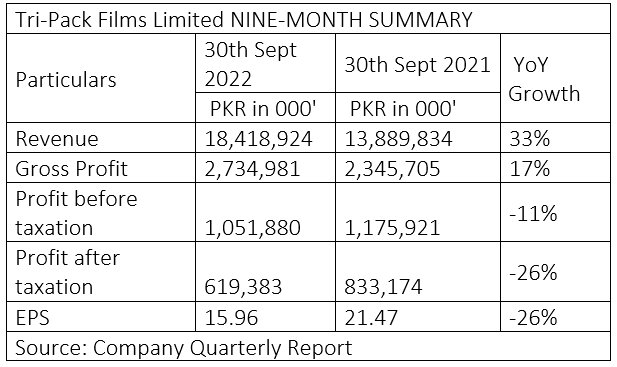

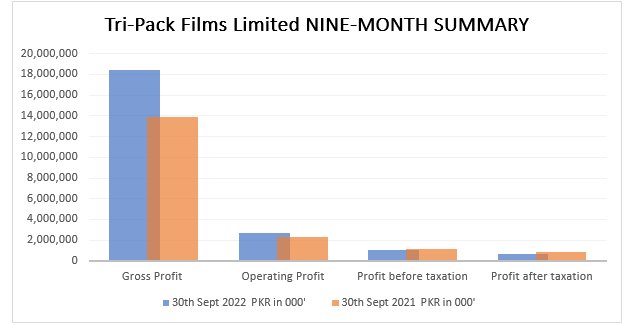

Tri-Pack Films Limited’s revenue increased 33% to Rs18.4 billion in the first nine months of the calendar year 2022 from Rs13.8 billion in the corresponding period of the previous year. The company’s gross profit also increased 17% to Rs2.7 billion in 9MCY22 from Rs2.3 billion in 9MCY21. However, the profit-before taxation inched lower to Rs1 billion in 9MCY22 from Rs1.1 billion over the corresponding period of CY21. The profit-after-taxation also showed a decrease of 26%, and fell to Rs619 million in 9MCY22 from Rs833 million in the same period of CY21, reports WealthPK.

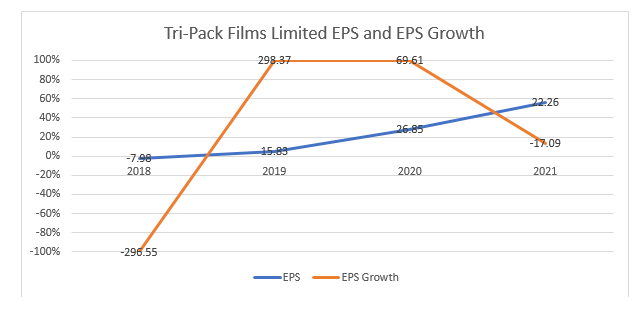

Earnings Growth Analysis

The earnings per share and the growth remained positive during recent years. However, increased interest rates, foreign exchange fluctuations, political and economic unrest, and the flood-aftermath all have the potential to have an impact on performance of the company. Also, modifications to import laws necessitated by the current economic conditions are posing significant difficulties for development initiatives.

Industry Comparison

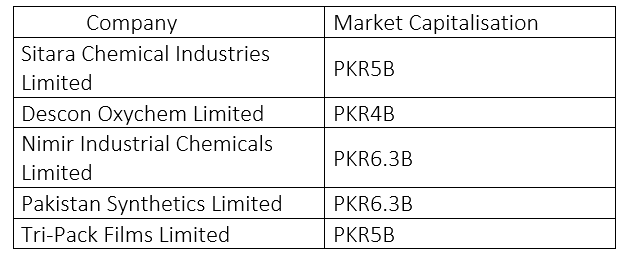

Sitara Chemical Industries Limited, Descon Oxychem Limited, Nimir Industrial Chemicals Limited, and Pakistan Synthetics Limited are regarded as rivals of Tri-Pack Films Limited.

Tri-Pack Films Ltd and Sitara Chemical Industries Limited have market capitalisation of Rs5 billion each. Pakistan Synthetics Limited and Nimir Industrial Chemicals Limited have the largest market cap of Rs6.3 billion each.

Profitability

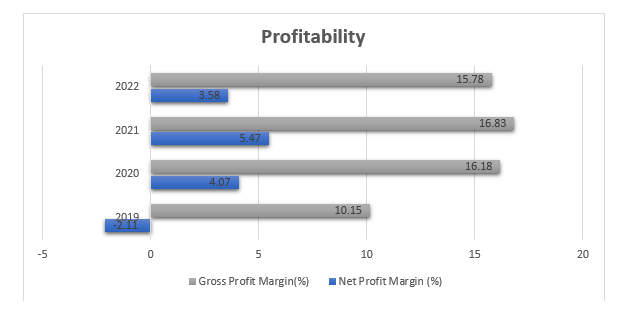

The gross profit margin of Tri-Pack Films Limited was 15.78% in 2022 compared to 16.18% in 2020 and 16.83% in 2021. This indicates that the cost of goods sold increased as a percentage of revenue due to factors such as high raw material costs, inflation, and supply chain disruptions.

Tri-Pack Films Limited had a net profit margin of 3.58% in 2022, which was lower than 5.47% in 2021. This indicates that the company generated lower profits relative to its revenue. The decrease in net profit margin was due to factors such as higher operating expenses, higher finance costs, or lower sales prices.

Tri-Pack Films Ltd and Sitara Chemical Industries Limited have market capitalisation of Rs5 billion each. Pakistan Synthetics Limited and Nimir Industrial Chemicals Limited have the largest market cap of Rs6.3 billion each.

Profitability

The gross profit margin of Tri-Pack Films Limited was 15.78% in 2022 compared to 16.18% in 2020 and 16.83% in 2021. This indicates that the cost of goods sold increased as a percentage of revenue due to factors such as high raw material costs, inflation, and supply chain disruptions.

Tri-Pack Films Limited had a net profit margin of 3.58% in 2022, which was lower than 5.47% in 2021. This indicates that the company generated lower profits relative to its revenue. The decrease in net profit margin was due to factors such as higher operating expenses, higher finance costs, or lower sales prices.

Company Profile

Tri-Pack Films Limited is engaged in the manufacture and sale of BOPP and cast polypropylene (CPP) films. The BOPP products include plain film, which is used in laminating cardboard, general packaging, wrap for fresh flowers and adhesive tape; composite film, which is used in packing of confectionery/biscuits, soap and processed food items; cigarette grade film, which is manufactured for cigarette wrapping, and pearlised, which is used as a packaging material for processed food, ice bars, candies and gift wrappers.

Credit: Independent News Pakistan-WealthPk