INP-WealthPk

Qudsia Bano

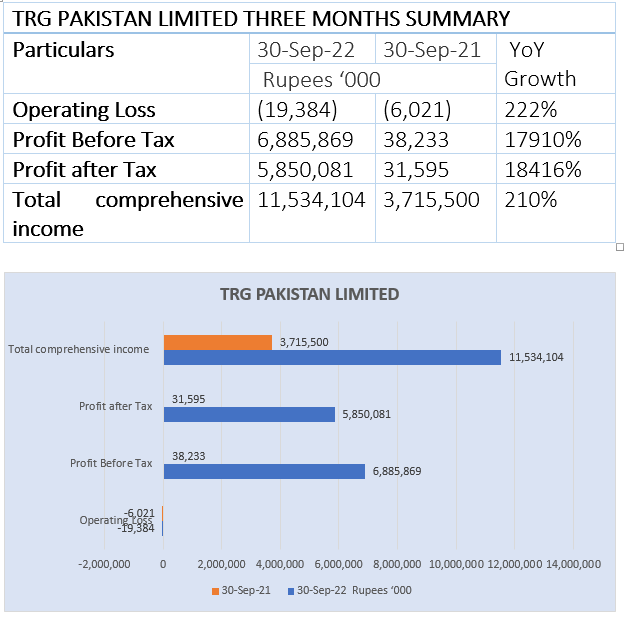

TRG Pakistan Limited’s operating loss increased 222% to Rs19.4 million in the first quarter of the ongoing financial year 2022-23 (1QFY23) from Rs6 million over the corresponding period of the previous fiscal. However, the company gained a massive increase in the profit-before-tax, which rocketed to Rs6.9 billion in 1QFY23 from Rs38 million in 1QFY22, registering mammoth growth of 17910%.

Similarly, the company posted a huge profit-after-tax of Rs5.9 billion in 1QFY23 compared to a profit of just Rs31.5 million over the corresponding period of FY22, posting another gigantic growth of 18416% year-over-year. Mark-to-market gains on shares on the IBEX stock exchange held by the company were the key cause of the massive increase in profits.

Performance in 2021-22

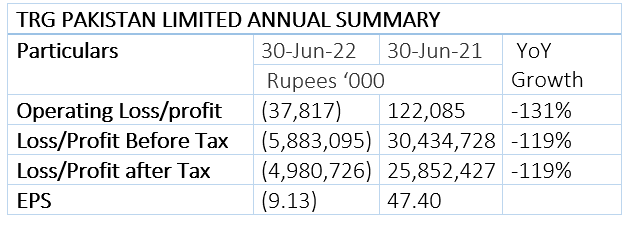

During the fiscal year 2021-22, the company posted an operating loss of Rs37.8 million compared to a profit of Rs122 million in FY21, showing a massive decrease of 131% year-on-year. The loss-before-tax for FY22 stood at Rs5.9 billion, 119% down from the pre-tax profit of Rs30.4 billion in FY21.

The primary cause of this loss was the redemption of some preference shares in December 2021. Additionally, a mark-to-market loss was recorded on IBEX shares held by the company. As a result, the company’s stock price on the NASDAQ stock exchange fell by nearly 14% over the course of FY22. The company recorded a net loss of Rs4.9 billion in FY22 compared to a profit of Rs25.8 billion in FY21, posting a decrease of 119%.

The company had earnings per share of Rs47.40 in FY21, but the company’s fortunes dwindled, resulting in a loss per share of Rs9.132 in FY22.

About Company

TRG Pakistan was incorporated as a public limited company on December 2, 2002. On May 14, 2003, the company obtained a licence from the Securities and Exchange Commission of Pakistan to undertake venture capital investment as a Non-Banking Finance Company in accordance with the Non-Banking Finance Companies (Establishment and Regulation) Rules, 2003. The principal activity of the company, through its associate, the Resource Group International Limited (TRGIL), is to invest in a portfolio of investments primarily in the technology, IT-enabled services, and Medicare insurance sector.

Credit: Independent News Pakistan-WealthPk