INP-WealthPk

Hifsa Raja

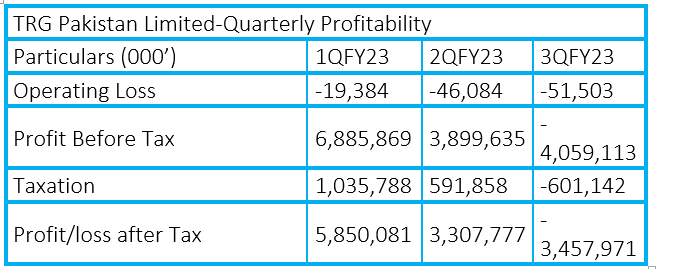

TRG Pakistan Limited’s operating losses continued to surge in the first three quarters of the previous fiscal year 2022-23, though the non-banking finance company posted a post-tax profit in the first two quarters. In the first quarter (July-Sept) of FY23, TRG Pakistan posted an operating loss of Rs19 million, but a profit-before-tax of Rs6.8 billion and a net profit of Rs5.8 billion.

In the second quarter (Oct-Dec), the company’s operating loss jumped to Rs46 million. The pre-tax profit in this quarter decreased to Rs3.8 billion, and the net profit to Rs3.3 billion. In the third quarter (Jan-March), the company’s operating loss further increased to Rs51 million. During this quarter, the company suffered a loss-before-tax of Rs4 billion and a post-tax loss of Rs3.4 billion.

Performance in 2021-22

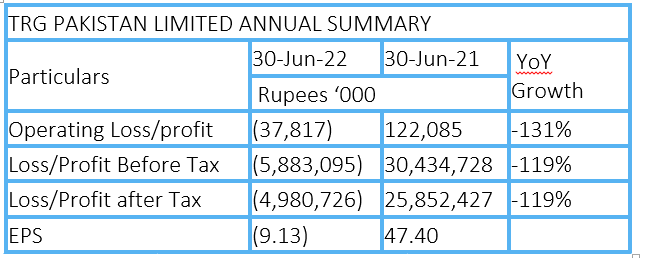

During the fiscal year 2021-22, the company posted an operating loss of Rs37.8 million compared to a profit of Rs122 million in FY21, showing a massive decrease of 131% year-on-year. The loss-before-tax for FY22 stood at Rs5.9 billion, 119% down from the pre-tax profit of Rs30.4 billion in FY21. The primary cause of this loss was the redemption of some preference shares in December 2021. Additionally, a mark-to-market loss was recorded on IBEX shares held by the company. As a result, the company’s stock price on the NASDAQ stock exchange fell by nearly 14% over the course of FY22. The company recorded a net loss of Rs4.9 billion in FY22 compared to a profit of Rs25.8 billion in FY21, posting a decrease of 119%.

The company had earnings per share of Rs47.40 in FY21, but the company’s fortunes dwindled, resulting in a loss per share of Rs9.13 in FY22.

Earnings Per Share

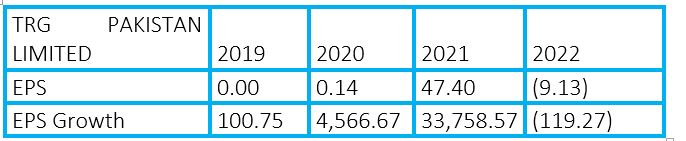

In 2019, TRG Pakistan's EPS stood at 0.00, reflecting a neutral position in terms of earnings. However, the following year witnessed a significant surge, with EPS reaching 0.14. This notable growth of 100.75% indicated the company's ability to generate higher earnings compared to the previous year, marking a positive turning point for TRG. The year 2021 proved to be a game-changer for TRG Pakistan, with EPS soaring to an astonishing 47.40. This tremendous leap of 33,758.57% signifies an exponential increase in earnings, demonstrating the company's exceptional performance and market leadership. The remarkable growth in EPS during this period showcased TRG's successful implementation of growth strategies and its ability to capitalise on the booming IT sector.

However, the year 2022 saw a dip in TRG Pakistan's EPS, as it dropped to -9.13. While this decline of 119.27% raises concerns, it's essential to contextualise the challenges faced by businesses worldwide due to the global economic downturn and unprecedented market conditions.

Industry comparison

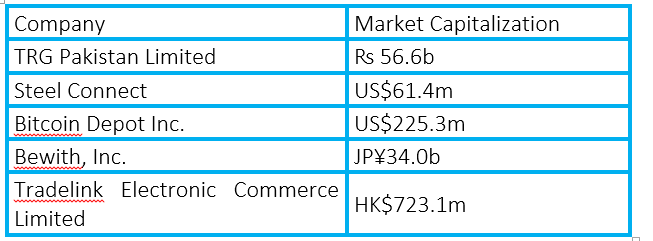

TRG Pakistan Limited’s competitors include Steel Connect, Bitcoin Depot Inc., Bewith, Inc., and Tradelink Electronic Commerce Limited.

About company

TRG Pakistan was incorporated as a public limited company on December 2, 2002. On May 14, 2003, the company obtained a licence from the Securities and Exchange Commission of Pakistan to undertake venture capital investment as a Non-Banking Finance Company in accordance with the Non-Banking Finance Companies (Establishment and Regulation) Rules, 2003. The principal activity of the company, through its associate, the Resource Group International Limited (TRGIL), is to invest in a range of businesses, primarily in the technology, IT-enabled services, and Medicare insurance sectors.

Credit: INP-WealthPk