INP-WealthPk

Hifsa Raja

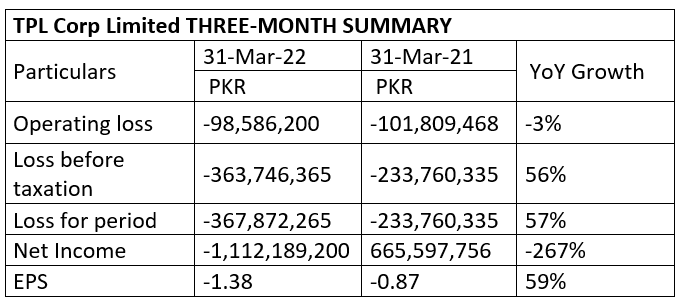

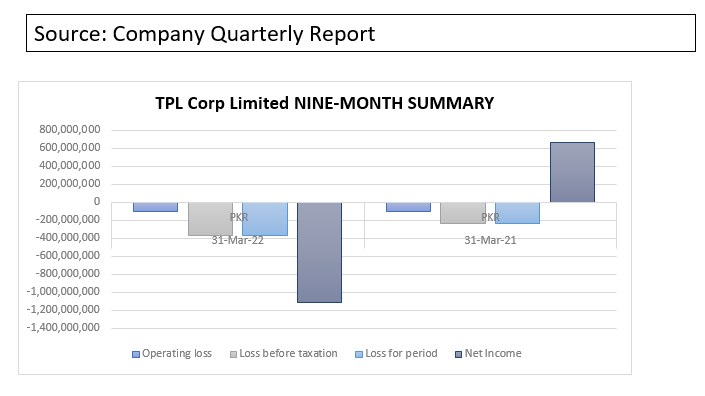

TPL Corp Limited’s operating loss decreased to Rs98 million in the first nine months of the previous financial year 2021-22 (9MFY22) from Rs101 million over the corresponding period of the earlier fiscal, posting a decrease in the loss by 3% year-on-year. However, the firm’s loss before taxation climbed 56% to Rs363 million in 9MFY22 from Rs233 million over the corresponding period of FY21.

The loss-for-period also increased 57% to Rs367 million in 9MFY22 from Rs233 million over the corresponding period of FY21. The company suffered a net income loss of 267% year-on-year, or Rs1.11 billion in 9MFY22, compared to Rs665 million profit in 9MFY21, reports WealthPK.

Performance in 2020-21

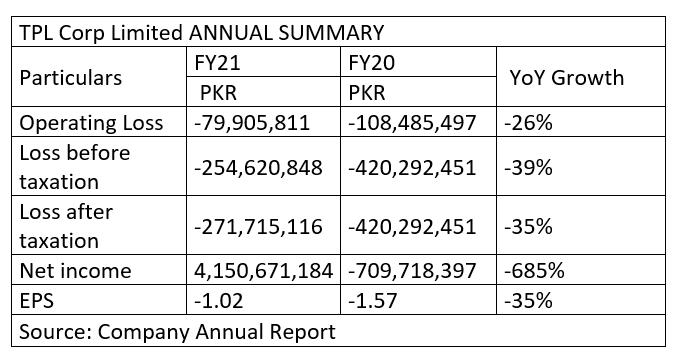

During the fiscal year 2020-21, the company’s operating loss decreased to Rs79.90 million from Rs108.48 million in 2019-20.

The company’s loss before taxation also decreased to Rs254 million in FY21 from Rs420 million in FY20.

The loss after taxation for FY22 also dropped to Rs271 million from Rs420 million in FY21.

Net income jumped to Rs4.15 billion from Rs709 million loss, posting a decrease in the loss by 685% year-on-year. This increase in net income was because of a reduction in the loss after taxation.

Earnings Per Share

The company’s earnings per share have witnessed a negative trend during recent years. The company has to focus on operating profit and profit before taxation to improve performance and efficiency.

Ratio Analysis

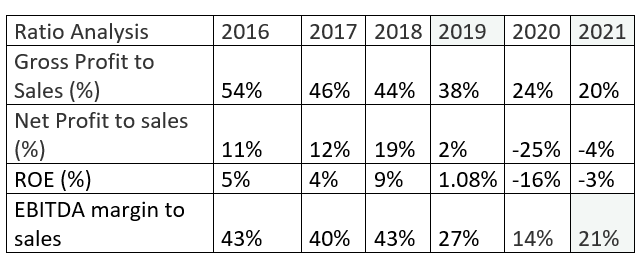

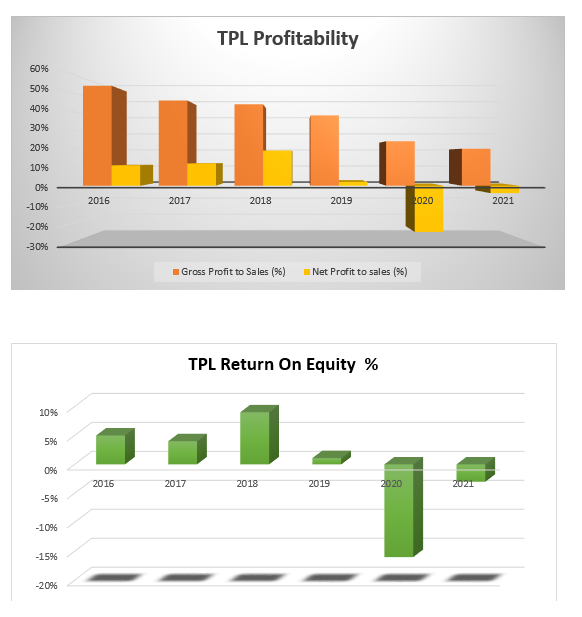

In 2016, the gross profit to sales reached a record high of 54%, indicating that management was doing an excellent job of generating profit while considering the cost of providing the company's products and services. The net profit to sales demonstrated net profitability of 11% after accounting for all other taxes. Return on equity was 5% for 2016, which demonstrated successful management in delivering a return on investments.

For 2017, the gross profit to sales decreased to 46%. Net profit to sales increased by 1% to 12%, and return on equity decreased by 1%, indicating a decline in the financial performance of the company.

In 2018, the gross profit to sales fell to 44%, whereas the net profit to sales increased to 19%, indicating the efficiency of the company.

The profitability kept decreasing from 2019 to 2021.

The earnings before interest, taxes, and amortization (EBITA) showed the operational efficiency of the company. The higher EBITA margin from 2016 to 2018 showed low operational expenses.

The next three years, 2019 to 2021, showed that the operational expenses increased, which ultimately reduced the profitability.

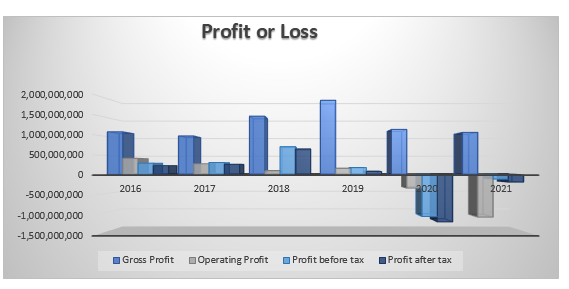

Profit or loss over the years

The gross profit has shown consistency for the last six years, which is a very good sign for the company. However, operating profit, profit before and after tax showed a mixed trend. It remained positive from 2016 to 2019 and showed a negative trend in 2020 and 2021.

TPL Trakker Limited, now TPL Corp Limited, was incorporated in Pakistan on December 4, 2008, as a private limited company under the Companies Ordinance, 1984 (now replaced with Companies Act, 2017).

Principal activity of the firm is to invest in groups and other companies.

Credit : Independent News Pakistan-WealthPk