INP-WealthPk

Qudsia Bano

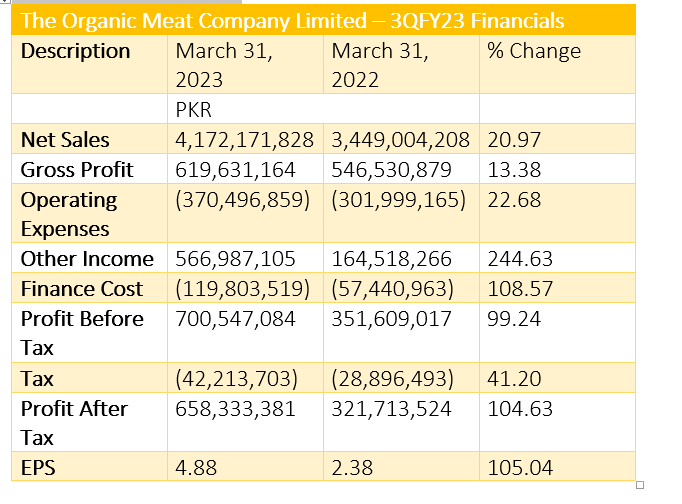

The Organic Meat Company Limited (TOMCL) managed to enhance its overall performance in export sales, including offal shipments, despite inflationary pressures and continuous volatility in currency markets during the third quarter of the ongoing fiscal year 2022-23. Additionally, TOMCL's new business line – Pet Chews – demonstrated strong performance in the US and Colombia. By implementing strategies to penetrate new markets like Canada and Europe, the company expects this business to provide valuable additions to its overall operations. Though TOMCL sustained a 1% decrease in gross profit margin in 9MFY23, it posted a 13.38% increase in the third quarter of FY23 to reach Rs619.6 million compared to Rs546.5 million over the corresponding period of the previous year.

However, the company achieved bottom-line growth and improved net profitability due to effective cost management and the beneficial impact of foreign exchange fluctuations in the market. In 3QFY23, TOMCL's sales grew by 21% to Rs4.17 billion. The cost of sales was higher due to unprecedented inflationary effects, particularly increased fuel and power consumption charges resulting from higher fuel prices, as well as increased costs of raw and packaging materials during the period. Selling prices were reduced by 7% in US dollar terms due to a significant devaluation of the Pakistani rupee against the dollar (31%) as competitors lowered prices to pass on the devaluation benefits to customers.

Operating expenses increased by 22.68%, primarily driven by a 46.87% rise in freight costs. However, TOMCL managed to mitigate the impact of high inflationary pressure through stringent cost management practices, keeping the remaining operating costs lower than market inflation. The company also faced higher costs due to an increase in the State Bank’s policy rate four times during the last nine months, leading to a 109% rise in finance costs. On the other hand, the company experienced a significant increase in other incomes, resulting from exchange gains on the interbank realisation of export proceeds and the remeasurement of foreign exchange base receivables.

Due to increased inward remittances from export sales, the tax expense also increased by 41% compared to the corresponding period last year. Overall, TOMCL achieved a profit-before-tax of Rs700 million in 3QFY23, representing a substantial increase of 99.24% compared to the same period of the previous year. TOMCL's profit-after-tax amounted to Rs658 million, reflecting an impressive growth of 104.63% year-on-year. Consequently, the earnings per share (EPS) for TOMCL stood at Rs4.88, exhibiting a remarkable increase of 105.04% compared to the previous year.

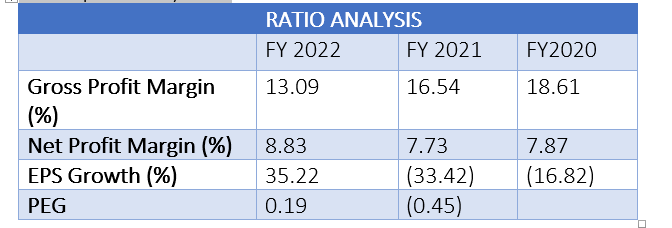

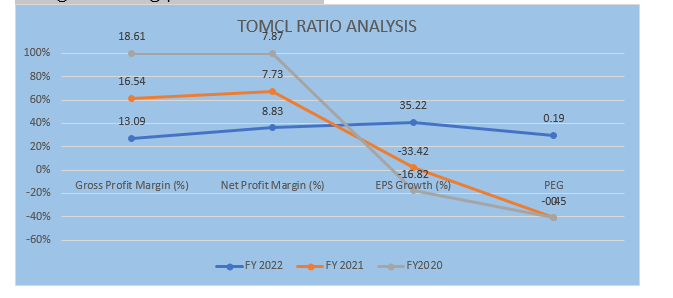

The gross profit margin indicates the percentage of revenue that remains after deducting the cost of goods sold. The company's gross profit margin declined from 18.61% in FY20 to 16.54% in FY21 and further to 13.09% in FY22. This declining trend suggests the company's profitability on its products has decreased overtime. It is essential to investigate the reasons behind this decline, such as rising production costs or pricing pressures.

The net profit margin measures the percentage of revenue that remains as profit after deducting all expenses, including taxes and interest. The company's net profit margin showed a slight decrease from 7.87% in FY20 to 7.73% in FY21, but rebounded to 8.83% in FY22. This rebound in net profit indicates the company was able to improve its efficiency in controlling costs and generating profits in FY22.

EPS growth (%)

EPS growth represents the percentage increase or decrease in earnings per share from one period to another. The company experienced significant negative growth of 16.82% in FY20, followed by a further decline of 33.42% in FY21. However, there was a notable improvement with a positive EPS growth of 35.22% in FY22. This suggests the company's earnings per share fluctuated, but improved last fiscal year.

PEG Ratio

The PEG ratio (price/earnings to growth ratio) provides a valuation perspective by comparing the price-to-earnings ratio with the expected earnings growth rate. A PEG ratio below 1 is generally considered favourable, indicating an undervalued stock relative to its growth prospects. In this case, the company's PEG ratio was 0.19 in FY22, indicating a potentially attractive investment opportunity. In contrast, the PEG ratio was negative (-0.45) in FY21, which might suggest an overvaluation.

About company

The company was incorporated on July 14, 2010 as a private limited firm under the repealed Companies Ordinance, 1984 (now Companies Act, 2017). The company's principal activities are the processing and sale of halal meat and allied products.

Credit : Independent News Pakistan-WealthPk