INP-WealthPk

Ayesha Mudassar

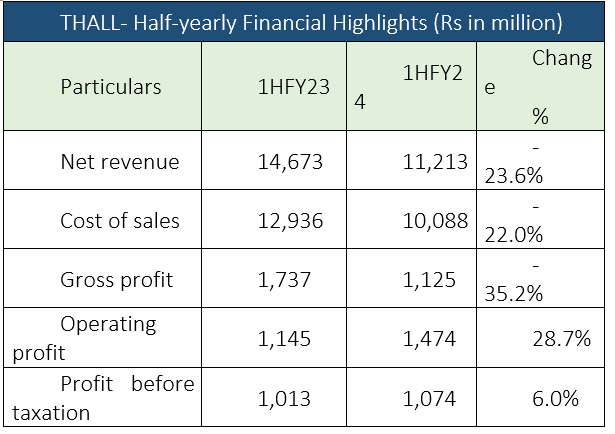

The net revenue of Thal Limited (THALL) – the engineer goods maker – declined by 23.6%, gross profit by 22.0%, and net profit by 5.1% during the first half of the ongoing fiscal year (1HFY24) compared to the corresponding period of the earlier fiscal, reports WealthPK. As per the unconsolidated interim statement, the company posted a net revenue of Rs11.21 billion and gross profit of Rs1.12 billion in 1HFY24. The net profit stood at Rs706 million compared to Rs744 million in the same period last year, resulting in an earnings per share (EPS) of Rs8.72 versus Rs9.18 in the corresponding period last year.

![]()

The sharp decline in sales was mainly due to a massive increase in input prices and tightened auto finance owing to the high-interest rate environment. In addition, the reduction in profits is primarily attributable to a 23.6% decline in net revenue during the reviewed period.

Financial performance (2018-2023)

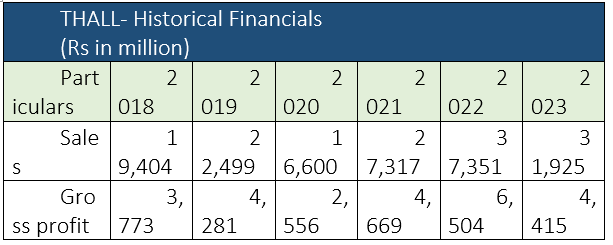

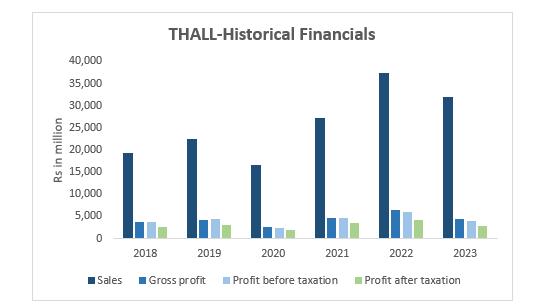

During the period under consideration, THALL's top-line and bottom-line plunged twice – in 2020 and 2023. This was mainly due to rupee depreciation and the imposition of additional duties and taxes, which inflated the auto prices. The historical analysis of THALL sales shows that in the last six years, the company earned the highest revenues in 2022 on account of a 42% increase in revenue from the engineering segment due to higher automobile sales. The other segment of THALL also posted a 29% rise in its revenue on the back of increased demand for Pakistani grain sacks in the export market.

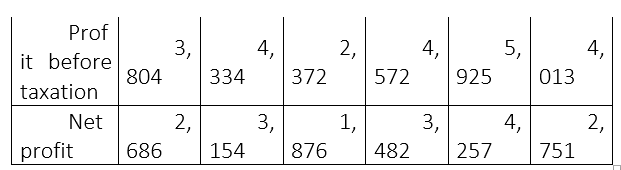

Concerning the gross profit, the company's performance fluctuated over the years. The company posted a gross profit of Rs3.7 billion in 2018, Rs4.2 billion in 2019, Rs2.5 billion in 2020, Rs4.6 billion in 2021, Rs6.5 billion in 2022 and Rs4.4 billion in 2023. The higher gross profit in FY22 is attributed to a significant increase in net sales. In the last six years (2018-2023), the auto parts maker posted the highest net profit of Rs4.2 billion in FY22. However, in 2023, the net profit nosedived by 35% to clock in at Rs2.7 million.

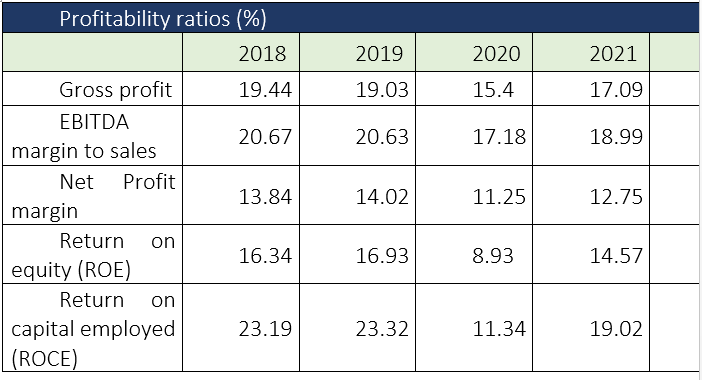

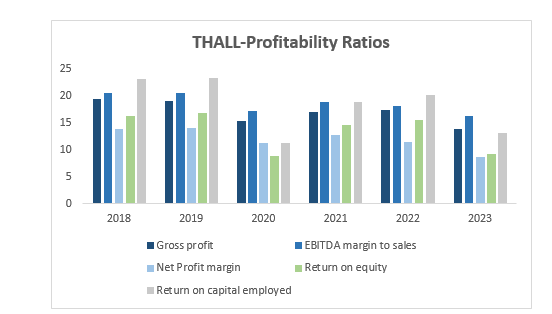

Ratio analysis (profitability ratios)

Profitability ratios provide insights regarding a company's ability to generate profits relative to its revenue, assets, equity or other financial metrics. The company experienced fluctuations in its gross profit margin over the six years. In FY23, the gross profit margin was 13.83% compared to the previous year's margin of 17.41%, which indicates a decreasing revenue.

Regarding the net profit ratio, the company posted the highest ratio of 12.75% in 2021. However, a declining trend has been observed in the subsequent years (2022 and 2023). The decrease may be attributed to various factors, including an increased operating expense, changes in market conditions or reduced profitability. During the years under consideration, both return on equity and return on capital employed ratios showed fluctuations, but generally declined from 2018 to 2023, suggesting potential challenges in generating returns for shareholders.

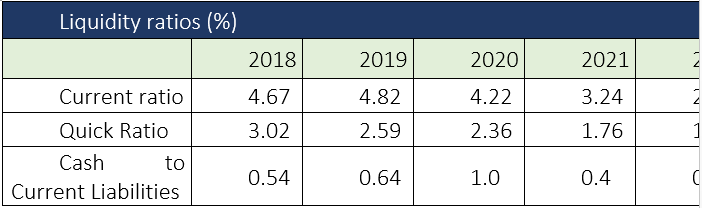

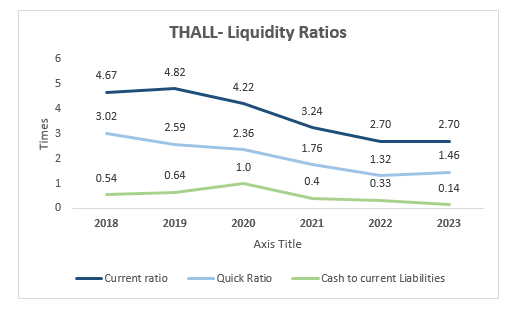

Liquidity ratios

Liquidity ratios provide insights into a company's ability to meet its short-term obligations using its current assets. The current ratio has declined over the years, from 4.67 in 2018 to 2.70 in 2023. A decrease in this ratio might indicate potential liquidity issues or inefficient use of assets to generate revenue.

Similar to the current ratio, the quick ratio has been declining over the years, illustrating a potential decrease in the company's ability to meet its short-term obligations with its most liquid assets. Furthermore, the cash-to-current liabilities ratio provides a specific insight into the company's ability to pay off its short-term liabilities using only its cash reserves. The trend shows fluctuations, but a significant decrease from 2020 to 2023 demonstrates challenges in maintaining sufficient cash reserves to cover short-term obligations.

Company profile

Thal Limited was incorporated in Pakistan as a public limited company in 1966. The principal activity of the company is the manufacturing of jute goods, engineering goods, laminate sheets and paper sacks.

Future outlook

Upcoming quarters are expected to remain challenging due to expected increases in energy costs. However, the management remains focused on cost-effective initiatives, and product mix strategies to boost profitability and gain market share.

Credit: INP-WealthPk