INP-WealthPk

Ayesha Mudassar

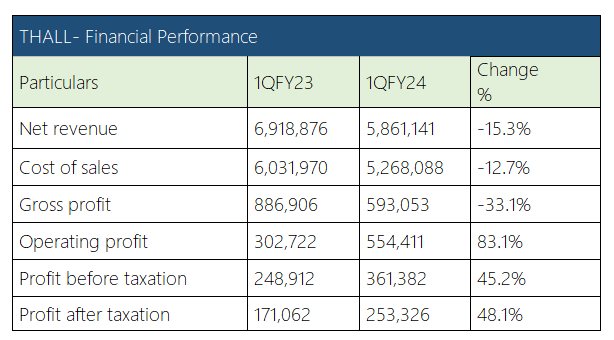

The before and after-tax profits of Thal Limited (THALL), an auto parts maker, increased by 45.2% and 48.1%, respectively, in the first quarter (July-September) of the ongoing Fiscal Year 2023-24 as compared to the corresponding period of the previous fiscal year, according to WealthPK. During this period, THALL posted a pre-tax profit of Rs361 million and a post-tax profit of Rs253 million. As per the company's quarterly report, the gross profit stood at Rs593 million, down 33.1% from the previous year's three-month period. This reduction is primarily attributable to a 15.3% decline in net revenue during the period under review.

Owing to the reduced demand for automobiles, the company's sales stood at Rs5.8 billion in 1QFY24 as compared to Rs6.9 billion in 1QFY23, representing a 15.3% decline. Moreover, the finance cost jumped by 259% to Rs193 million due to higher short-term borrowings.

Six years at a glance (2018-2023)

Financial Performance

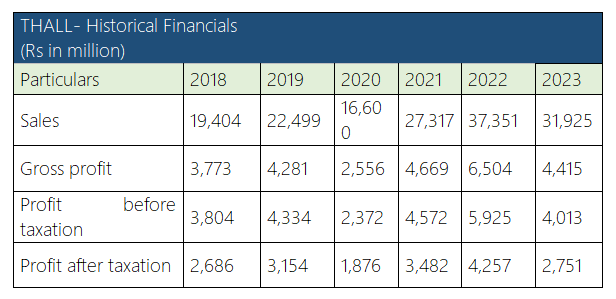

Historical analysis of THALL sales shows that in the last six years, the company earned the highest revenues in FY2022 on account of a 42% increase in revenue from the engineering segment due to higher automobile sales. However, the revenue plunged in both 2020 and 2023, mainly because of the rupee devaluation and the higher duties and taxes that raised the auto prices. Concerning gross profit, the company’s historical performance fluctuated over the years.

The company posted a gross profit of Rs3.7 billion in 2018, Rs4.2 billion in 2019, Rs2.5 billion in 2020, Rs4.6 billion in 2021, Rs6.5 billion in 2022, and Rs4.4 billion in 2023. In a span of six years (2018-2023), the automobile assembler posted the highest net profit of Rs4.2 billion in FY22. However, in 2023, the net profit nosedived by 35% to clock in at Rs2,750.76 million.

Six years’ ratio analysis

Profitability ratios

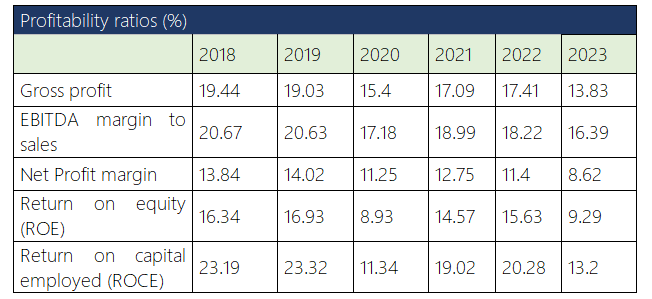

Profitability ratios provide insights into a company's ability to generate profits relative to its revenue, assets, equity, or other financial metrics. The company witnessed fluctuations in its gross profit margin over the six years. In FY23, the gross profit margin was 13.83% compared to the previous year’s margin of 17.41%, indicating a decreasing revenue.

Concerning the net profit ratio, the company posted the highest ratio of 12.75% in 2021. However, a declining trend has been observed in the subsequent years (2022 and 2023). The decrease may be attributed to various factors including an increased operating expense, changes in market conditions, or reduced profitability. During the years under consideration, both ROE and ROCE ratios show fluctuations but generally a decline from 2018 to 2023, suggesting potential challenges in generating returns for shareholders.

Liquidity ratios

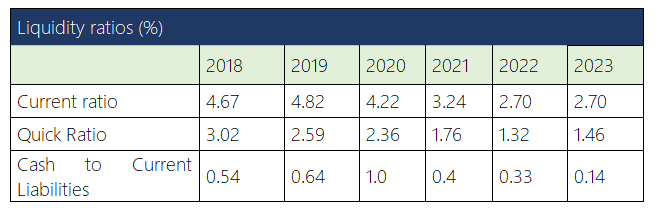

Liquidity ratios provide insights into a company's ability to meet its short-term obligations using its current assets. The current ratio has been declining over the years, from 4.67 in 2018 to 2.70 in 2023. A decrease in this ratio might indicate potential liquidity issues or inefficient use of assets to generate revenue.

Similar to the current ratio, the quick ratio has been declining over the years, illustrating a potential decrease in the company's ability to meet its short-term obligations with its most liquid assets. Furthermore, the cash-to-current liabilities ratio sheds light on the company's ability to pay off its short-term liabilities using only its cash reserves. The trend shows fluctuations, but there is a significant decrease from 2020 to 2023, which demonstrates challenges in maintaining sufficient cash reserves to cover short-term obligations.

Company Profile

Established in 1966 as a public limited company in Pakistan, Thal Limited mainly manufactured jute goods, engineering goods, laminate sheets, and paper sacks.

Credit: INP-WealthPk