INP-WealthPk

Muhammad Asad Tahir Bhawana

The telecom sector experienced a significant increase in its contribution to the national exchequer, with a year-on-year growth of 42% during FY22. The sector's contribution amounted to PKR325 billion, compared to PKR228 billion in FY21, reports WealthPK. A detailed breakdown shows that the major components of this contribution include the PTA Deposits and other levies, as well as duties imposed by the FBR.

The PTA Deposits accounted for PKR103 billion in FY22, representing 32% of the total contribution (20% in FY21), while the other levies and duties constituted 45% (51% in the previous year) at PKR146 billion (PKR116 billion in FY21).

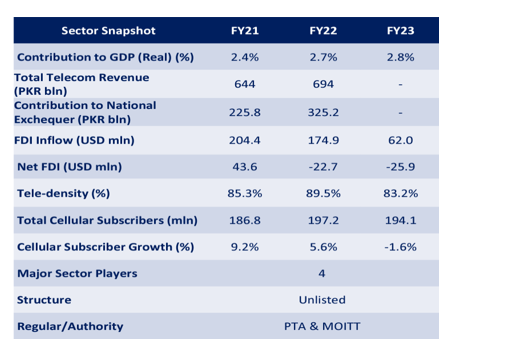

Further analysis shows that the PKR103 billion PTA deposits comprised PKR30 billion from the Next Generation Mobile Services (NGMS) auction and PKR72 billion from license renewals. The telecom sector encompasses approximately 197 million subscribers, covering approximately 89% of the population in FY22. The sector achieved a total revenue of PKR694 billion, representing a growth of 7.8%.

Its contribution to the country's GDP stood at 2.7% in FY22, which increased to 2.8% in FY23. As a part of the services industry, the telecommunication sector is one of the largest segments of economy, accounting for approximately 13% of the industry and nearly 55% of the total GDP in FY22 (compared to approximately 58% in FY21).

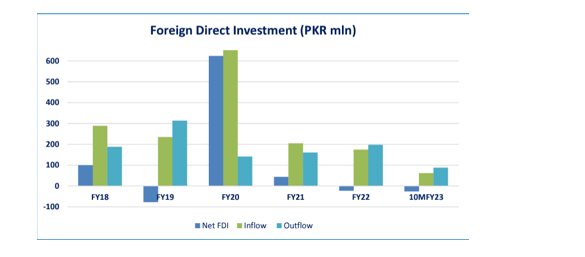

Regarding foreign investment, the sector attracted USD204 million in foreign direct investment (FDI) during FY21, with a Net FDI of USD43.6 million. However, in FY22, the situation reversed, with the FDI inflows declining by approximately 14% YoY to approximately USD174.9 million. Net FDI turned negative, indicating greater outflows.

During FY22, the local manufacturing of mobile phones witnessed the establishment of 30 manufacturing plants and companies, producing 7.24 million 4G smartphones. This increased the total number of locally manufactured mobile phones to 16.7 million and created 26,000 jobs. On the other hand, telephone imports during FY22 amounted to approximately USD1,979 million, declining by approximately 4.2% YoY. In 10 months of FY23, mobile phone imports experienced a substantial decline of 74% YoY, reaching USD473 million compared to USD1,809 million in the previous year.

This decline was attributed to import restrictions implemented since May 22. In terms of market share, Jazz leads the telecommunication sector with approximately 38%, followed by Telenor with 26%, Zong with 22%, and Ufone with 12%. SCO, which operates solely in Gilgit-Baltistan, holds a 1% market share. The telecom sector has witnessed increased internet usage and a rise in subscribers since FY19, driven by the Covid-19 pandemic. Efforts by the regulatory body to promote inclusivity and sustain growth have contributed to this trend.

However, the sector still faces certain weaknesses, including limited accessibility in remote regions, inadequate investment in research and development, privacy concerns, cybercrime, and interconnection issues for smaller players. To enhance the sector's contribution, it is necessary to adopt advanced customer engagement approaches, introduce new service offerings and entertainment bundles to converge and diversify entertainment experiences and implement strategies that promote business agility. Additionally, the introduction of 5G technology in Pakistan is crucial to bolster the sector's growth.

Credit: INP-WealthPk