INP-WealthPk

Fozia Azam

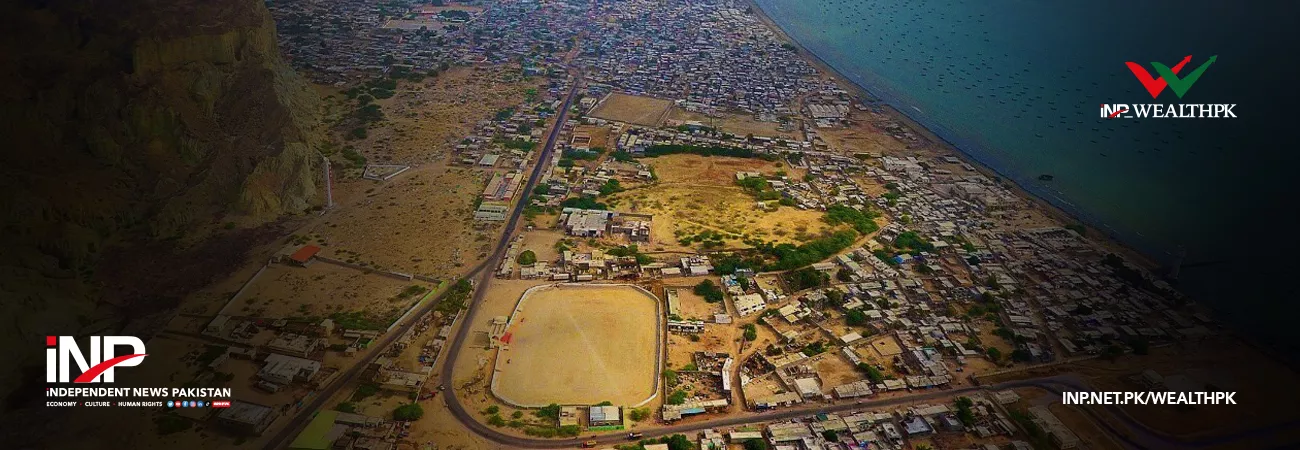

The declaration of Gwadar as a tax-free zone is a promising initiative that has the potential to transform the economic situation of the area significantly as tax incentives are expected to make it more attractive for foreign investment and local businesses. Mehmood Khalid, Senior Research Economist at the Pakistan Institute of Development Economics (PIDE), said while talking to WealthPK that the initiative will prove to be a game-changer for investors, local businesses, and entrepreneurs, spurring investment and growth across the region. He said that the tax-free zone status for Gwadar means that businesses operating in the area will be exempted from taxes such as sales tax, income tax, and customs duties, which subsequently reduce the cost of doing business in the area, making it more attractive for foreign investment, and local businesses.

Mehmood said the tax-free zone is expected to open up new markets for local sectors such as fisheries, agriculture, and tourism, potentially generating millions of dollars in earning while improving the livelihoods of the residents. “The area is well-positioned to become a major hub for trade and commerce in the region, and the declaration of a tax-free zone is expected to attract significant investment, boost economic activities and generate employment opportunities,” he continued. “The decision will have a profound impact on the local economy, attracting investment and creating new opportunities across the region,” he added. Furthermore, the tax-free zone will help spur economic growth by serving as a magnet for industrial and manufacturing activities. The establishment of industries in the area will create new jobs for residents of Gwadar and the surrounding areas.

The development of the infrastructure required for industrial and logistic operations is expected to boost infrastructure growth, attract additional investment, and speed up the overall development of the area.One of the critical areas expected to benefit from the declaration of Gwadar as a tax-free zone is the real estate sector. Investors are expected to flock to the area to take advantage of tax incentives, which will improve demand for residential and commercial properties. The demand for real estate is expected to increase rapidly in response to the expansion of the port, and the construction of industrial zones, which will attract businesses seeking to establish a base in Pakistan to take advantage of its strategic location. The change is expected to produce positive knock-on effects, benefiting both local residents and the broader Pakistani economy.

Credit : Independent News Pakistan-WealthPk