INP-WealthPk

Shams ul Nisa

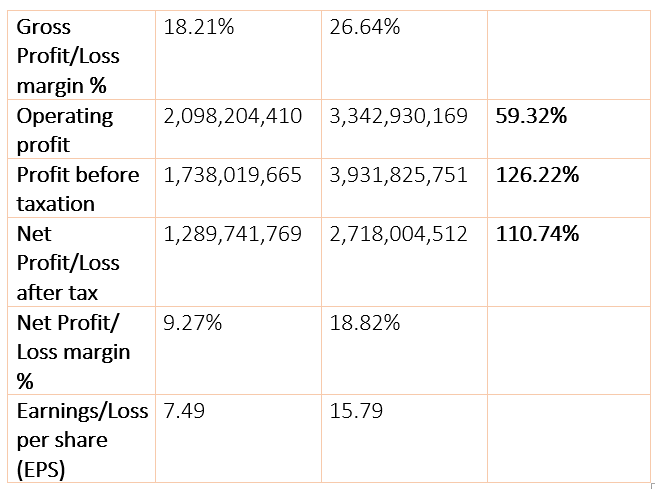

Tariq Glass Industries Limited posted an impressive 110.74% growth in net profit, which jumped to Rs2.7 billion in the first half of the ongoing fiscal year (1HFY24) compared to the corresponding period of FY23, reports WealthPK. During the period, the net sales increased by 3.80%, gross profit by 51.82% and operating profit by 59.32%. The contributing factors included the company’s promotion of float glass under the brand name ‘Toyo Nasic Float Glass’ by integrating its product branding strategically.

The bargain purchase gain on investments in associates pushed the gross profit margin to 26.64% in 1HFY24 from 18.21% in the same period last year. The company attributed gain in gross profit margin to the partial pass-through of higher costs to customers.

The company registered a profit-before-tax of Rs3.93 billion in 1HFY24, which was 126.22% higher than Rs1.7 billion in the same period last year. The net profit margin jumped to 18.82% in 1HFY24 from 9.27% in 1HFY23. At the end of 1HFY24, the company’s earnings per share clocked in at Rs15.79 compared to Rs7.49 in 1HFY23.

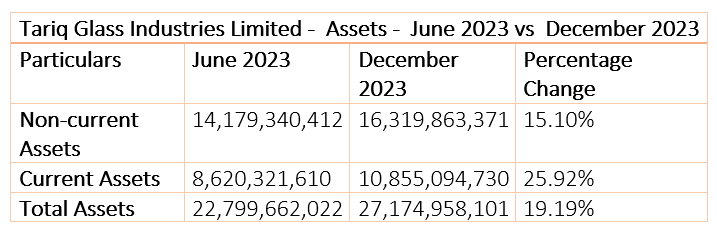

Assets analysis

The non-current assets of Tariq Glass Industries Limited expanded from Rs14.17 billion in June 2023 to Rs16.32 billion in December 2023, showcasing a significant surge of 15.10%. Regarding current assets, the company reported an expansion of 25.92%, from Rs8.62 billion in June 2023 to Rs10.85 billion in December 2023. Because of this increase in both current and non-current assets, the total assets grew by 19.19%.

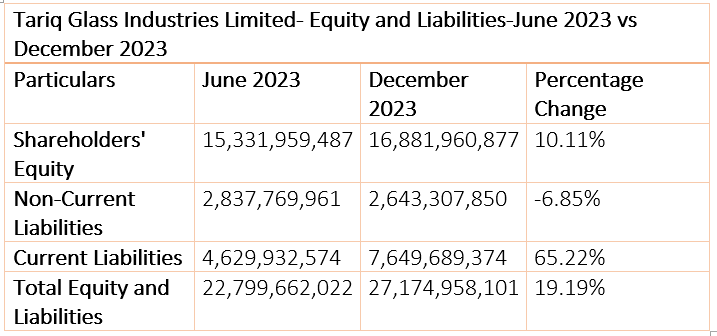

Equity and liabilities analysis

The company posted a 10.11% rise in shareholders’ equity to Rs16.88 billion in December 2023 from Rs15.33 billion in June 2023. However, its non-current liabilities contracted by 6.85%, indicating that the company financed its operations entirely through internal resources. On the other hand, the current liabilities ballooned by 65.22% to Rs7.6 billion at the end of December 2023, representing the company failed to oversee its core activities and keep an eye on its expenses. At the end of December 2023, the company's total equity and liabilities stood at Rs27.17 billion, representing a growth of 19.19% compared to June 2023.

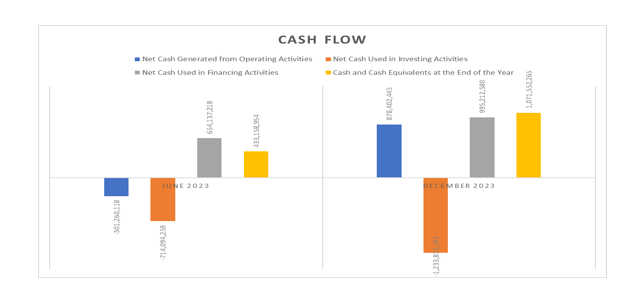

Cash flow analysis

In December 2023, Tariq Glass Industries Limited managed to earn a whopping Rs878.4 million net cash generated from operating activities compared to net cash of Rs301.26 million used in operating activities in June 2023, representing an exponential surge of 391.58%. However, the company witnessed an expansion of 72.78% in net cash used for investing activities. Regarding financing activities, the company managed to expand net cash generation by 52.14%. The amount of cash and cash equivalents at the end of the year jumped massively by 147.38% from Rs433.15 million in June 2023 to Rs1.07 billion in December 2023.

Glass and ceramics sector

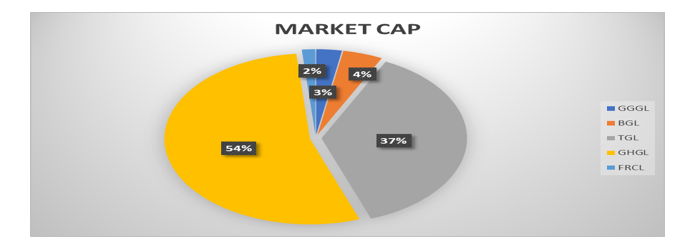

A thorough comparison of the companies in the glass and ceramics sector for 2023 is assessed by market capitalisation and earnings per share (EPS). Ghani Glass Limited managed to secure the highest 54% of the total outstanding shares followed by 37% market capitalisation of Tariq Glass Industries Limited, 4% by Balochistan Glass Limited, 3% by Ghani Global Glass Limited and the lowest 2% by Frontier Ceramics Limited.

However, in terms of EPS, Tariq Glass Industries Limited led the sector with an EPS of Rs14.63 in 2023. Ghani Glass Limited secured the second position with an EPS of Rs8.1. During 2023, Balochistan Glass Limited and Frontier Ceramics Limited recorded a loss per share of Rs0.52 and Rs4.05, respectively.

Company’s achievements

Tariq Glass Industries Limited was listed among the three Pakistani organisations on Forbes Asia's prestigious “200 Best Under A Billion”. In November 2023, Forbes Asia awarded a certificate of recognition to the company.

Company profile

Tariq Glass Industries Limited was incorporated in 1978. The company is principally engaged in the manufacturing and sale of glass containers, opal glass, tableware and float glass.

Credit: INP-WealthPk