INP-WealthPk

Hifsa Raja

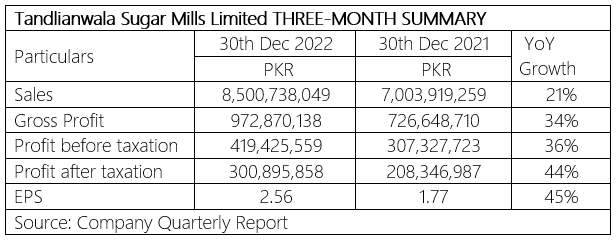

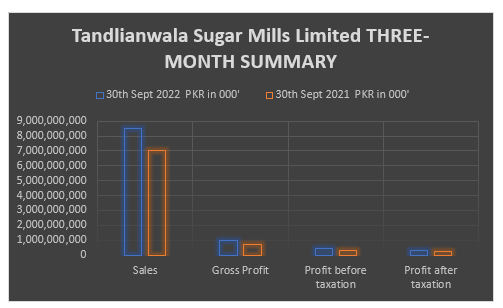

Tandlianwala Sugar Mills Limited’s sales increased by 21% to Rs8 billion in the first three months (Oct-Dec) of FY23 ending Dec 31, 2022 compared with Rs7 billion in the corresponding period of the previous year, reports WealthPK. The gross profit shows an increase of 34% from Rs726 million in the first quarter of FY21 compared with Rs972 million in the corresponding period of FY23.

The profit before taxation during the first three-month period of FY23 reached Rs419 million from a profit of Rs307 million in the corresponding period of FY22. The profit after taxation shows an increase of 44%, standing at Rs300.9 million in the three months of FY23 compared with Rs208 million profit over the corresponding period of FY22.

The sugarcane crushing season commenced on 25th November 2022. The mills crushed more sugarcane producing more sugar till 8th January 2023 in comparison with the same number of days last year with better recoveries too. The company management expects an increase in production and revenue targets and better performance in the current year in both sugar and ethanol divisions. The distillery division is expected to perform much better both in terms of production levels as well as revenue generation of ethanol exports due to better prices of ethanol in the international market as well as the depreciation of PKR currency.

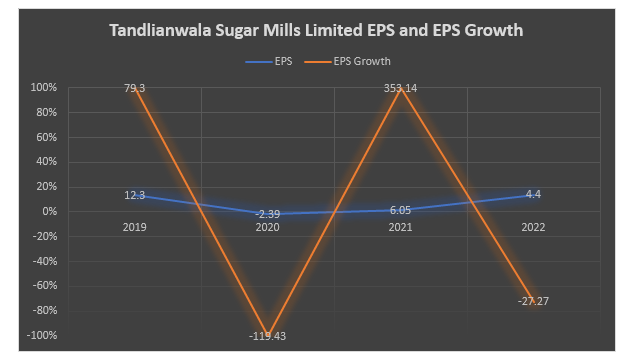

Earnings Growth Analysis:

In 2019, the EPS growth was rather good, but it slowed down considerably in 2020. The EPS increased to Rs353.14 in 2021. There was a significant decrease in 2022.

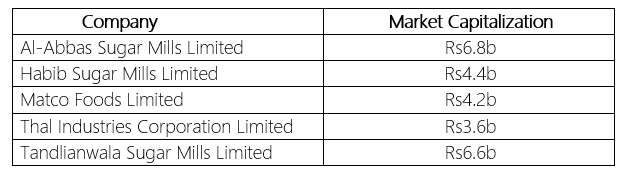

Industry comparison:

Tandlianwala Sugar Mills Limited has competitors, including Al-Abbas Sugar Mills Limited, Habib Sugar Mills Limited, Matco Foods Limited, and Thal Industries Corporation Limited. The investors can use market capitalization to contrast the sizes of several companies because it shows the price investors are willing to pay for a company’s stock. Al-Abbas Sugar Mills Limited has the greatest market capitalization of Rs6.8 billion in contrast to Tandlianwala Sugar Mills Limited, which is valued at Rs6.6 billion.

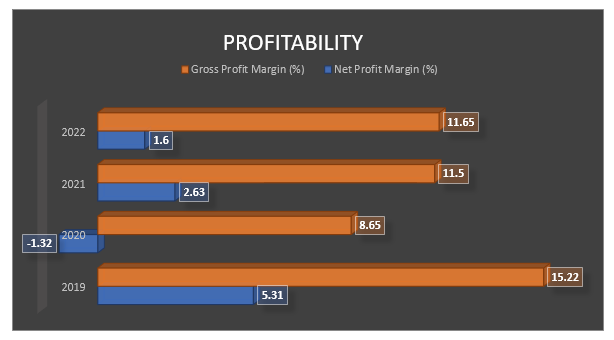

Profitability:

The profitability of the company is indicated by net profit margin and gross profit margin. In 2019, the net profit margin and gross profit margin were high, but there was a significant drop in 2020.

Company profile:

Tandlianwala Sugar Mills Limited was incorporated in Pakistan on 1st November 1988 as a public limited company. The company shares are quoted on Pakistan Stock Exchange Limited. The principal activities of the company are the production and sale of white crystalline sugar, ethanol and other related allied by-products. The manufacturing facilities of the company are located at Kanwani (Unit-I) Dera Ismail Khan (Unit II) and Muzaffargarh (Unit-III). The registered office of the company is situated at 66-L, Gulberg II, Lahore.

Credit: Independent News Pakistan-WealthPk