INP-WealthPk

Shams ul Nisa

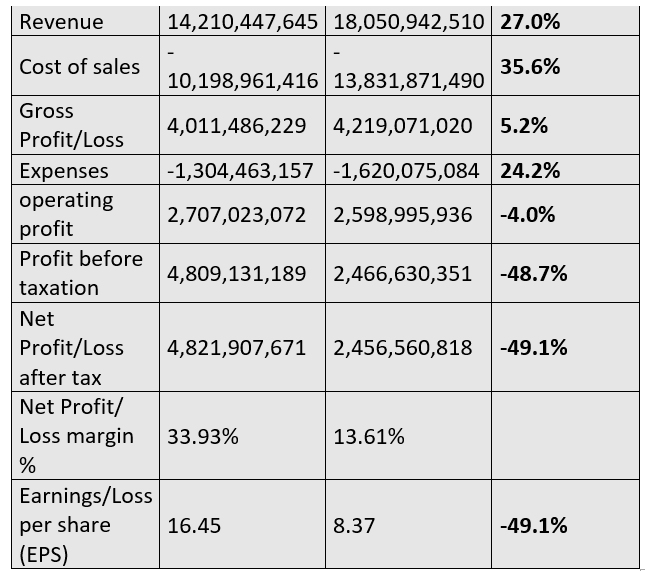

While Systems Limited experienced a 27.0% revenue increase, its net profit saw a significant 49.1% drop during the first half of the ongoing calendar year 2024 compared to the corresponding period of 2023, reports WealthPK.

The company reported revenue of Rs18.05 billion in 1HCY24, largely influenced by the rupee’s appreciation during this period. The cost of sales surged by 35.6% to Rs13.8 billion, outpacing revenue growth and signalling potential challenges in maintaining profitability. As a result, gross profit increased by only 5.2%, underscoring the need for the company to take more effective cost-control measures. Operating expenses rose by 24.2%, which further weakened operating profitability, leading to a 4.0% decline in operating profit, primarily due to rising inflationary pressures.

![]()

Profit-before-tax dropped sharply by 48.7%, falling from Rs4.81 billion in 1HCY23 to Rs2.47 billion in 1HCY24. Consequently, the net profit margin contracted from 33.93% in 1HCY23 to 13.61% in 1HCY24. Earnings per share decreased to Rs8.37 from Rs16.45 in 1HCY23, reflecting lower shareholder returns and potentially dampening investor confidence in the company.

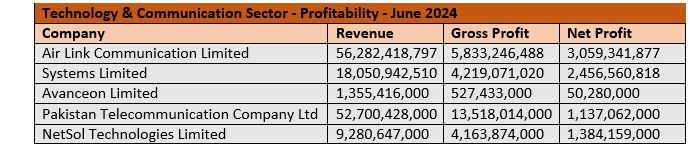

Profitability of technology & communication sector

The profitability analysis of the technology and communication sector for June 2024 shows diverse performance metrics among key players, including Air Link Communication Limited, Systems Limited, Avanceon Limited, Pakistan Telecommunication Company Limited and NetSol Technologies Limited. Air Link Communication posted revenue of Rs56.28 billion, gross profit of Rs5.83 billion and net profit of Rs3.06 billion in June 2024, reflecting strong cost management and solid profitability. Systems Limited recorded revenue of Rs18.05 billion, gross profit of Rs4.22 billion and net profit of Rs2.46 billion.

However, Avanceon Limited reported a relatively modest revenue of Rs1.36 billion, gross profit of Rs527 million and net profit of Rs50 million, suggesting potential challenges in scaling its operations and competing in the sector. Pakistan Telecommunication Company generated significant revenue of Rs52.70 billion, accompanied by a healthy gross profit of Rs13.52 billion, resulting in a net profit of Rs1.14 billion, indicating effective cost control relative to its revenue. NetSol Technologies achieved revenue of Rs9.28 billion, gross profit of Rs4.16 billion and net profit of Rs1.38 billion, demonstrating strong operational efficiency and a favouable position within the technology sector.

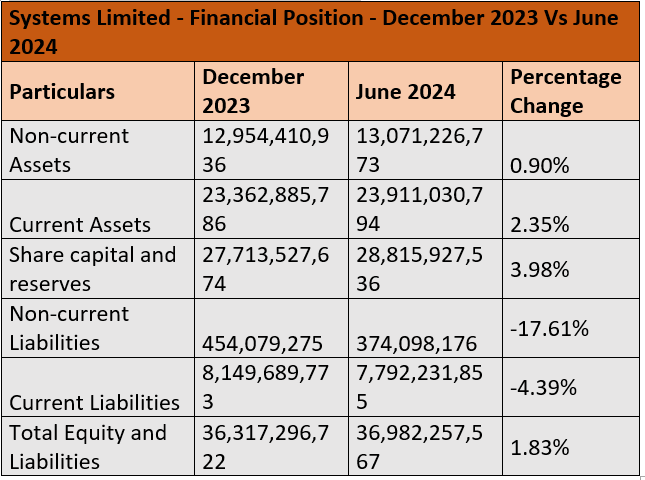

Systems Limited’s financial position

Systems Limited’s non-current assets grew by 0.90% from Rs12.95 billion in December 2023 to Rs13.07 billion in June 2024, reflecting a steady approach to capital investments. Current assets experienced a 2.35% increase, highlighting the company’s effective management of short-term resources such as cash, receivables and inventory.

Share capital and reserves grew by 3.98%, signalling the company’s ability to retain earnings and increase additional capital for future operations and investments. However, non-current liabilities dropped by 17.61%, indicating that Systems Limited likely reduced its long-term debt. Current liabilities also declined by 4.39%, reflecting the company’s focus on managing short-term obligations. Total equity and liabilities increased by 1.83% from Rs36.32 billion in December 2023 to Rs36.98 billion in June 2024, demonstrating a stable financial structure and effective management of capital.

Future outlook

The company’s revenue was influenced by seasonality, with fewer billable days in 2QCY24 due to public holidays. However, 3QCY24 had 5% more billable days, offering steady billing opportunities and increased revenue. The company is pursuing aggressive growth by investing in high-potential markets. Although rising inflation is pressuring profit margins, cost optimisation and efficiency improvements are expected to alleviate this. With a strong project backlog and a healthy pipeline, the company is well-positioned for future growth. The State Bank of Pakistan’s investment policy is attracting long-term investors and creating opportunities for growth through mergers and acquisitions. The company is also focusing on incorporating the use of artificial intelligence in its operations to tap into the increasing demand for AI-based solutions. As the Middle East remains a key growth area, the company focuses on expanding operations and increasing market share there. Additionally, the company’s recent contracts with banking and financial services clients are enhancing its returns on investment.

Company profile

Systems Limited is a public limited company established in Pakistan under the Companies Act, 2017. The company is principally engaged in the business of software development, trading of software and business process outsourcing services.

Credit: INP-WealthPk