INP-WealthPk

Hifsa Raja

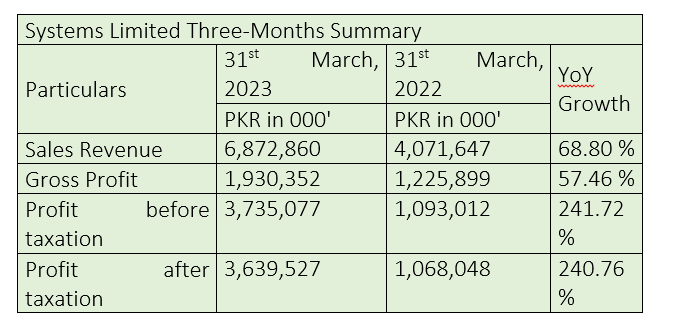

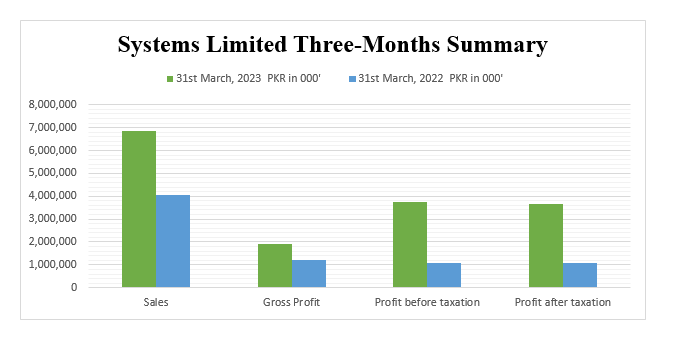

Systems Limited, the IT solutions provider, saw its net profit balloon 240% to Rs3.6 billion in the first three months of the ongoing calendar year 2023 from Rs1.06 billion over the corresponding period of the previous year. The company’s sales also increased by 68.80% to Rs6.8 billion in 3MCY23 from Rs4 billion in 3MCY22. Similarly, the company’s gross profit in 3MCY23 increased to Rs1.9 billion from Rs1.2 billion over the same period of CY22, showing a 57.46% yearly growth. The profit-before-taxation also rocketed to Rs3.7 billion in 3MCY23 from Rs1.09 billion in 3MCY22, posting a 241% growth, reports WealthPK.

Performance in 2022

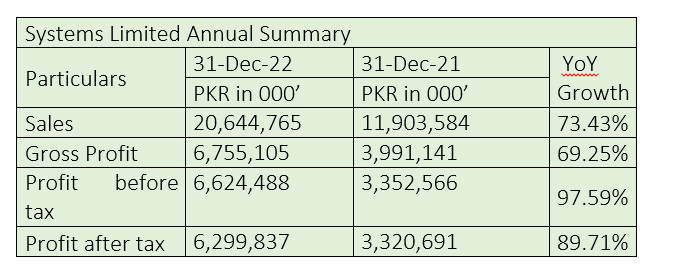

In 2022, the company’s sales jumped to Rs20 billion from Rs11 billion in 2021, posting a growth of 73.43%. The gross profit increased to Rs6.7 billion, up 69.25% from the previous year's Rs3.9 billion.

The company’s profit-before-tax jumped to Rs6.6 billion in 2022 from the previous year's profit of Rs3.3 billion, registering a growth of 97%. The company’s profit-after-tax also jumped to Rs6.2 billion in 2022 from Rs3.3 billion 2021, posting an increase of 89%.

Business profile

The company’s revenue comes primarily from digital, managed, consulting services, IT outsourcing and business process outsourcing. It generates over 80% of its revenue from export of services to various destinations such as North America, Europe, Middle East and Africa. The company is well diversified into various business verticals such as telco, retail, CPG, pharma, banking and public sector.

Industry comparison

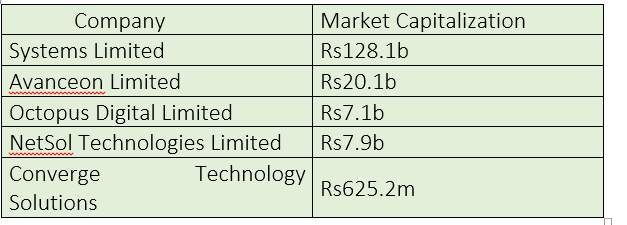

Rivals of Systems Limited include Avanceon Limited, Octopus Digital Limited, NetSol Technologies Limited and Converge Technology Solutions. Systems Limited has the highest market capitalisation of Rs128.1 billion, while Converge Technology Solutions has the lowest market value of Rs625.2 million.

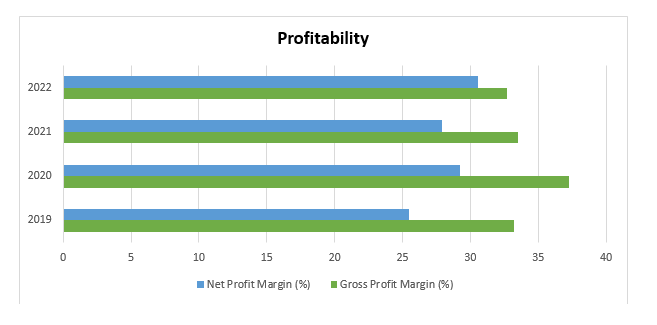

Profitability

Systems Limited has exhibited a positive trend in both net and gross profit margins over the past four years. The data reveals that the company has maintained a robust and consistent gross profit margin over the years. Starting at 33.21% in 2019, the gross profit margin steadily increased to 37.24% in 2020, showcasing the company's efficiency in managing its cost of goods sold and generating revenue from its core operations. Although there was a slight dip to 33.53% in 2021, the company demonstrated resilience by maintaining a competitive gross profit margin at 32.72% in 2022.

Equally impressive is Systems Limited's net profit margin, which measures the company's ability to convert its revenue into profits after accounting for all expenses and taxes. Beginning at 25.5% in 2019, the net profit margin grew to 29.2% in 2020, indicating effective cost management and operational efficiency. Despite the challenges brought on by the Covid-19 pandemic in 2021, Systems Limited sustained a favourable net profit margin of 27.9%. Notably, the most recent data for 2022 showcases an impressive increase to 30.52%, highlighting the company's successful growth strategies and adaptability to changing market conditions.

Subsidiaries

TechVista Systems, a limited liability company incorporated by Dubai Technology and Media Free Zone Authority, is a 100% owned subsidiary of Systems Limited. TVS is engaged in the business of developing software and providing ancillary services. Systems Arabia for Information Technology, a limited liability company incorporated in the Kingdom of Saudia Arabia, is a 100% owned subsidiary of Systems Limited. Systems Arabia is engaged in the business of developing software and providing ancillary services. Systems Venture (Private) Limited (SV), a private limited company registered under Companies Act, 2017, is a 100% owned subsidiary of Systems Limited. Systems Venture is established in Pakistan to invest in new ventures, startups and incubate new ideas. SV has invested in Retailistan (Private) Limited acquiring a 20% stake.

Future plans

The company plans to consolidate its offerings under three core verticals. With the acquisition of NDC, the company’s existing banking and finance sector (BFS) vertical is strengthened by merging all core and non-core banking services under one roof. This vertical is led by a seasoned professional team responsible for overall growth of the vertical by expanding its offerings and services through innovation and global expansion. The company has further strengthened its telco vertical around digital BSS (business solution services) side. The company has focused over the past few years on the digital BSS and has developed solutions and frameworks for the telco, which serves as a door opener to access new telco clients. The company has combined all other services under a third vertical, a growth vertical where it is offering technology solutions to clients in public sector, pharma, healthcare, and retail sectors across different regions..

Credit: INP-WealthPk