INP-WealthPk

Shams ul Nisa

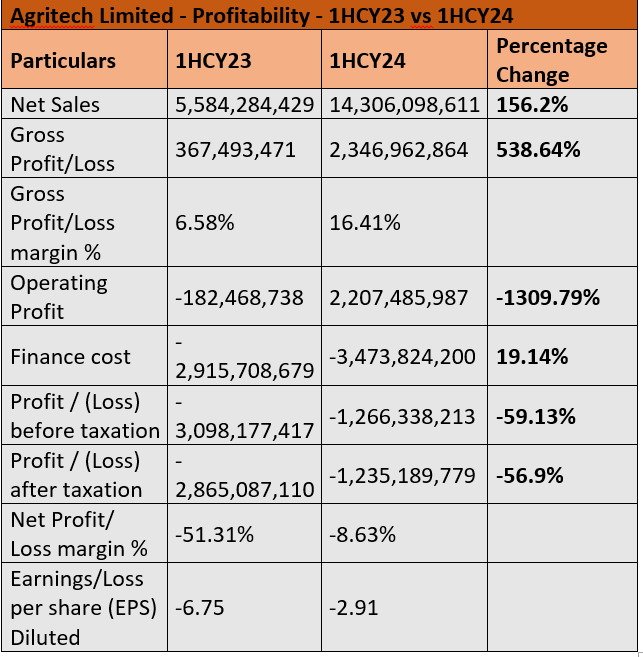

Agritech Limited (AGL) posted a remarkable 156.2% upsurge in net sales and a huge 538.64% leap in gross profit in the first half of the ongoing calendar year 2024 compared to the same period of CY23, thus enabling it to bring down its net losses considerably during this time, reports WealthPK. The company’s improved performance was attributed to the stable gas supply from the government unlike the previous year when gas supply to its urea plant was halted for two months. Additionally, the rising demand for urea enabled the company to sustain consistent urea production since March 2023 with no additional gas supply interruptions. Likewise, Agritech recovered from an operating loss of Rs182.47 million in 1HCY23 and posted a whopping Rs2.21 billion operating profit in 1HCY24. The gross profit margin jumped from 6.58% in 1HCY23 to 16.41% in 1HCY24, indicating enhanced operational efficiency and better cost management.

However, finance costs increased by 19.14% during the period. The company managed to trim loss-before-tax by a significant 59.13%. As a result, the net losses dropped to Rs1.23 billion in 1HCY24 from Rs2.8 billion over the same period last year. The firm also managed to considerably bring down the net loss margin and the loss per share during the period under review.

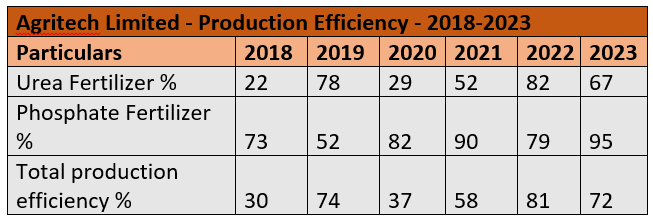

Production efficiency (2018-23)

The company’s urea fertilizer production efficiency has shown significant volatility over the past six years, with a surge from 22% in 2018 to 78% in 2019. However, this was followed by a sharp decline to 29% in 2020, indicating potential operational challenges. The urea production efficiency rebounded to 52% in 2021 and peaked at 82% in 2022, indicating successful operational adjustments. However, in 2023, the efficiency dropped to 67%.

Phosphate fertilizer production efficiency showed a more stable upward trend, with a slight decline to 79% in 2022 from 90% in 2021 but a significant improvement to 95% in 2023. Overall, AGL reported the highest total production efficiency of 81% in 2022 and the lowest of 30% in 2018.

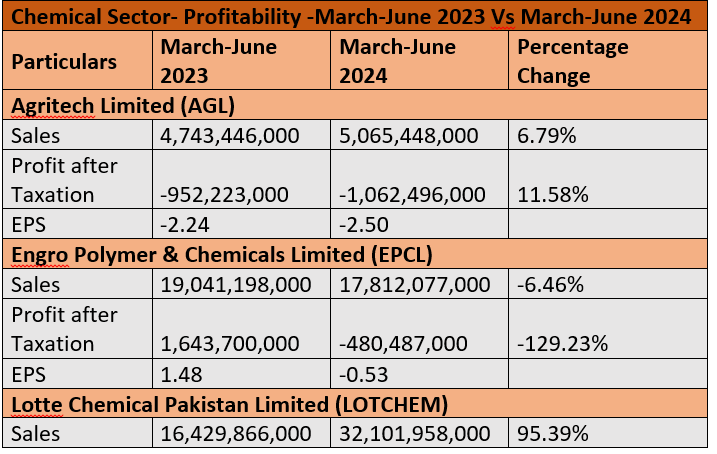

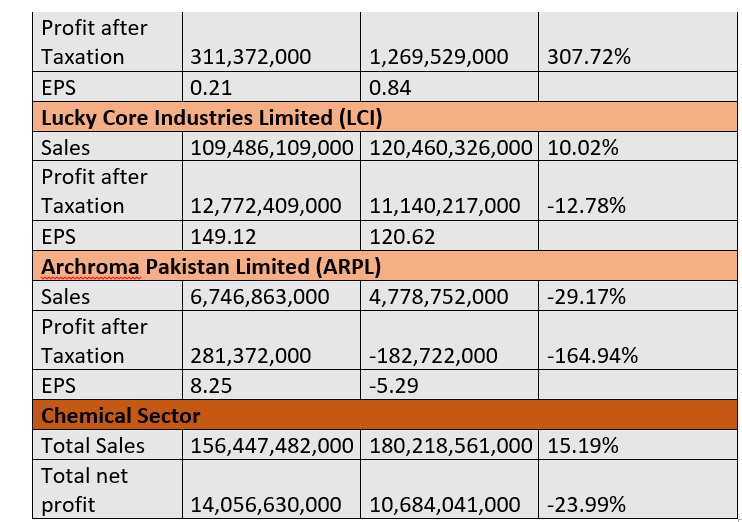

Chemical sector

The chemical sector had mixed profitability outcomes between March and June 2024 compared to the same period of 2023. Although total sales of the sector increased by 15.19%, the overall net profit dropped by 23.99%. AGL, Lotte Chemical Pakistan Limited (LOTCHEM) and Lucky Core Industries Limited (LCI) reported 6.79%, 95.39%, and 10.02% increase in sales, respectively, during the period under review. However, the sales of Engro Polymer & Chemicals Limited (EPCL) and Archroma Pakistan Limited (ARPL) declined by 6.46% and 29.17%, respectively. Only AGL and LOTCHEM recorded a net profit growth of 11.58% and 307.72%, respectively. EPCL, LCI, and ARPL observed 129.23%, 12.78% and 164.94% contraction in net profit, respectively.

Future outlook

AGL’s future success relies on the steady availability of gas/RLNG for its urea plant. Fertilizers, especially urea, play a vital role in crop production and yield improvement. The growing demand for urea underscores the importance of local production over expensive imports. The company’s urea plant is expected to operate consistently, and the provision of system gas supplies at a uniform price could enhance profit margins. Additionally, the company is anticipating to efficiently implement the approved Scheme of Arrangement in collaboration with its lenders.

Company’s profile

AGL was established in Pakistan on December 15, 1959. The primary activity of the firm is the production, sale and marketing of fertilizers. It mainly produces urea and granulated single super phosphate fertilizer.

Credit: INP-WealthPk