INP-WealthPk

Qudsia Bano

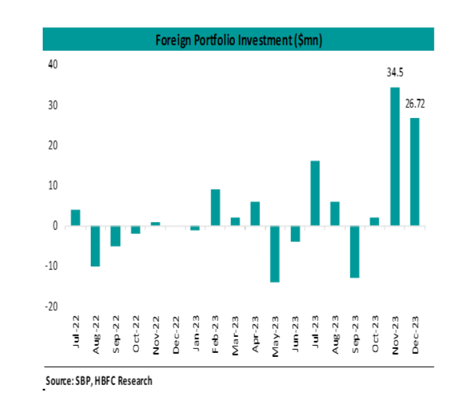

In a promising turn of events, Pakistan has achieved a notable increase in Foreign Portfolio Investment (FPI) signalling renewed confidence among global investors. The broader spectrum of investment inflows, , which includes both Foreign Direct Investment (FDI) and FPI, is playing a pivotal role in reshaping the country's economic narrative, reports WealthPK. Particularly striking is the remarkable surge in FPI, soaring from a modest USD2 million in October to an impressive USD34.5 million in November 2023. This substantial year-on-year increase reflects a clear and tangible interest in Pakistan's market.

Beyond the injection of capital, this surge is making significant waves in the local stock market, which has witnessed a remarkable uptick of 55% in the fiscal year 2024 to date. FPI refers to investment in a portfolio of assets, such as stocks and bonds, in a country by foreign investors. Unlike FDI, which involves acquiring a significant ownership stake in a business, FPI allows investors to buy into financial assets without directly participating in the management of companies. This type of investment brings several potential benefits for Pakistan's economy.

Talking to WealthPK, Adviser Securities and Exchange Commission of Pakistan (SECP) Dr. Syed M. Abdul Rehman said, "The surge in FPI evidences the attractiveness of Pakistan's financial markets. As foreign investors channel funds into stocks, bonds, and other financial instruments, it not only injects capital into the country but also has a cascading effect on various economic facets. The local stock market, witnessing a remarkable uptick of 55% in the fiscal year 2024 to date, reflects the immediate impact on market dynamics." "Additionally, the influx of foreign capital enhances liquidity in the financial sector, providing more resources for lending and investment. This, in turn, fosters economic growth, supports job creation, and contributes positively to the overall economic sentiment. The ripple effects of increased FPI extend beyond the financial markets, potentially influencing other sectors and strengthening Pakistan's position in the global economic landscape," said Abdul Rehman. "FPI brings not only the much-needed capital but also introduces a dynamic element to our financial markets.

The positive momentum in the stock market reflects the immediate impact, but the long-term benefits include improved liquidity, diversified investment sources, and enhanced market efficiency. This surge, if sustained, can play a pivotal role in fortifying Pakistan's economic resilience and attracting further foreign interest in the years to come," said Muhammad Talha, Portfolio Manager at Al Habib Asset Management Limited. "Beyond the immediate impact on the stock market, increased FPI can stimulate capital formation, facilitate access to diverse funding sources, and promote a more vibrant and liquid financial sector. This influx of foreign capital can contribute significantly to economic growth, supporting businesses and infrastructure development, and fostering a conducive environment for further investments. However, the policymakers must maintain the conditions that attract and retain foreign investors, ensuring a sustained positive trajectory for Pakistan's economic prosperity," according to Talha.

inpCredit: INP-WealthPk