INP-WealthPk

Ayesha Mudassar

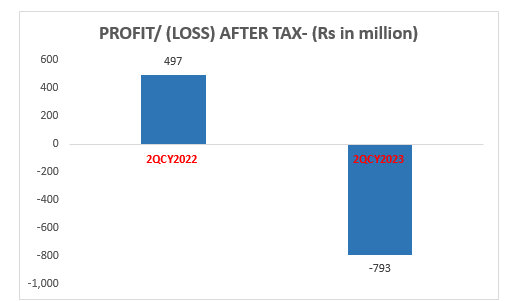

Summit Bank Limited’s (SMBL) financial performance took a prominent hit as it

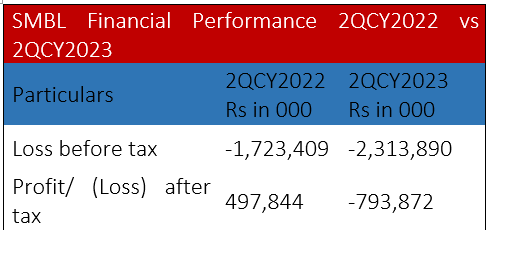

suffered a loss-after-tax of Rs793 million during the second quarter of 2023, against a Rs497 million profit-after-tax reported over the corresponding period of 2022, reports WealthPK.

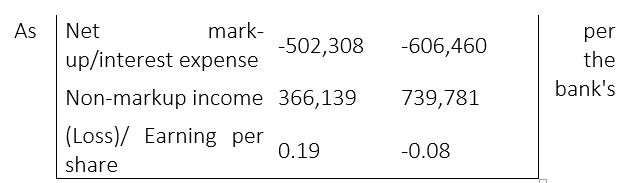

quarterly report, the bank also posted a loss-before-tax of Rs2.3 billion in 2QCY23 versus a loss of Rs1.7 billion during the same period last year. Moreover, SMBL announced a loss per share of Rs0.08 for the period under review. The bank’s interest expense witnessed growth, reaching Rs606 million in 2QCY23 compared to Rs502 million in 2QCY22. Furthermore, the non-markup interest income for the period jumped to Rs739 million, representing a 102% year-on-year increase.

The continuous focus of the bank on investing in its digital financial avenues, combined with efforts to diversify revenue streams, facilitated a robust fee income growth of 29% to reach Rs148 million in 2QCY23 from Rs115 million over the corresponding period of last year. Foreign exchange income decreased by 5% to Rs225 million for the second quarter of 2023 from Rs238 million over the corresponding period of 2022. Dividend income plummeted by 77% during the period under review. Furthermore, the total assets crossed Rs240 billion, and deposits reached Rs141 million as of June 2023.

Six months analysis

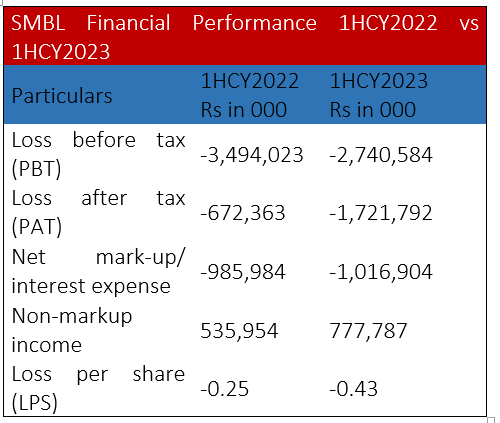

Summit Bank Limited’s financial performance kept a downward trajectory during the six months ending on June 30, 2023. The bank’s loss-after-tax soared to Rs1.7 billion in the first half of the calendar year 2023 (1HCY23) from a loss of Rs672 million over the corresponding period of last year. However, the loss-before-tax dropped from Rs3.4 billion to Rs2.7 billion in the comparable period, indicating a significant improvement in the bank’s financial performance. The bank’s interest expense stood at Rs1.01 billion in 1HCY23 against Rs985 million in 1HCY22. SMBL announced a loss per share of Rs0.43 for the first six months of 2023.

Bank description

Summit Bank was incorporated in Pakistan as a public company limited by shares on December 09, 2005, under the now repealed Companies Ordinance, 1984. SMBL is committed to actively contributing to the development of the economy through strengthening financial inclusion and providing banking services across the country.

Credit: INP-WealthPk