INP-WealthPk

Ayesha Mudassar

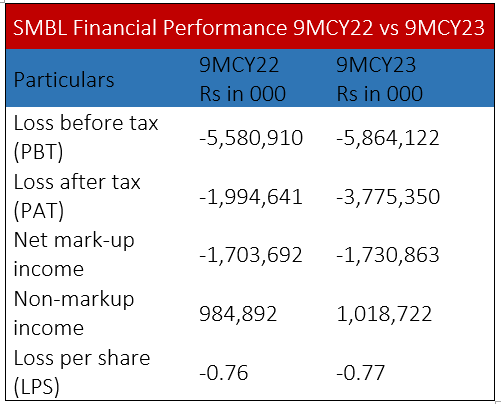

Summit Bank Limited’s (SMBL) financial performance took a prominent hit as it posted a loss-after-tax of Rs3.7 billion during the first three quarters of 2023 against a net profit of Rs1.9 billion during the corresponding period of the previous calendar year, reports WealthPK.

As per the bank's third quarterly report, the bank also posted a loss-before-tax of Rs5.8 billion in 9MCY23 versus a loss of Rs5.5 billion during the same period last year. Moreover, SMBL announced a loss per share of Rs0.77 for the period under review. However, the bank’s non-markup income witnessed growth, reaching Rs1.01 billion in 9MCY23 from Rs984 million in 9MCY22. The continuous focus of the bank on investing in its digital financial avenues, combined with maintaining diversification of revenue streams facilitated a robust fee income growth of 32%, which reached Rs439 million during nine months of calendar year 2023 from Rs333 million over the corresponding period of last year. Foreign exchange income increased by 16.8% to reach Rs722 million for the period ending September 30, 2023 from Rs618 million for the period ending September 30, 2022. Dividend income, however, plummeted by 97% during the period under review.

Three months analysis

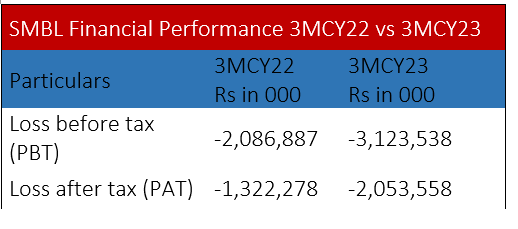

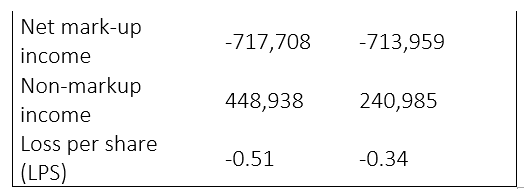

For the three months of the calendar year ending September 30, 2023, Summit Bank Limited’s financial performance kept a downward trajectory. The bank reported a loss-after-tax of Rs2.05 billion for the three months of calendar year 2023 compared to a loss of Rs1.3 billion over the corresponding period of last year.

Furthermore, the loss-before-tax increased from Rs2.08 billion to Rs3.1 billion, indicating a significant hit in the bank’s financial performance. The bank’s interest expense stood at Rs713 million in 3MCY23 against Rs717 million in 3MCY22. SMBL announced a loss per share of Rs0.34 during this quarter.

Bank description

Summit Bank was incorporated in Pakistan as a public company limited by shares on December 09, 2005, under the now repealed Companies Ordinance, 1984. SMBL is committed to actively contributing to the development of the economy through strengthening financial inclusion and providing banking services across the country.

Credit: INP-WealthPk