INP-WealthPk

Fakiha Tariq

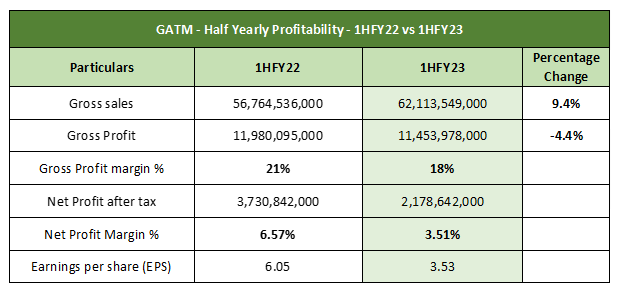

Despite growth in revenue, Gul Ahmed Textile Mills Limited’s (GATM) semi-annual profits declined due to low profitability in the second quarter of the ongoing fiscal year 2022-23 compared to the corresponding quarter of the previous fiscal, WealthPK reports In the first six months (July-December) of FY23, GATM posted a 9.4% growth in sales and a 4.4% decline in gross profit as compared to the same period of FY22. In 1HFY23, GATM posted gross sales of Rs62 billion in comparison to Rs56 billion in 1HFY22. However, the gross profit dropped to Rs11.4 billion in 1HFY23 from the gross profit of Rs11.9 billion in 1HFY22. The company had posted a net profit of Rs3.7 billion in 1HFY22, which declined to Rs2.1 billion in 1HFY23.

The company’s gross profit and net profit ratios were calculated to be 18% and 3.51%. GATM posted earnings per share of Rs3.53 in 1HFY23 compared to EPS of Rs6.05 in 1HFY22. Gul Ahmed Textile Mills Limited is a well-known name listed in the textile composite sector on the Pakistan Stock Exchange (PSX) under the symbol of ‘GATM’. With a market capitalisation of Rs12.2 billion, GATM is the eighth-largest company of its sector.

Incorporated in 1953, GATM is a huge conglomerate of five wholly-owned subsidiaries and multiple associate companies operating at the local and international level. Quarterly analysis reveals that GATM enjoyed more profits in the first quarter (July-Sept) of FY23 compared to the second quarter (Oct-Dec). The company performed poorly in 2QFY23, reducing its overall semi-annual earnings.

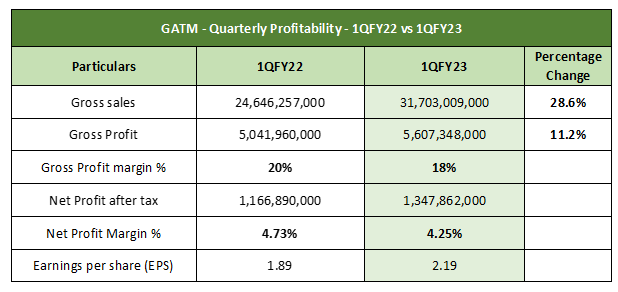

GATM – 1QFY23 (July to Sept)

In the first quarter of FY23, GATM’s sales increased by 28.6% and the gross profit by 11.2% as compared to the same period FY22. It posted sales of Rs31 billion and a gross profit of Rs5.6 billion, resulting in a gross profit ratio of 18% in 1QFY23.

The company posted a net profit of Rs1.3 billion and a net profit ratio of 4.25% in 1QFY23. It reported EPS of Rs2.19 in 1QFY23.

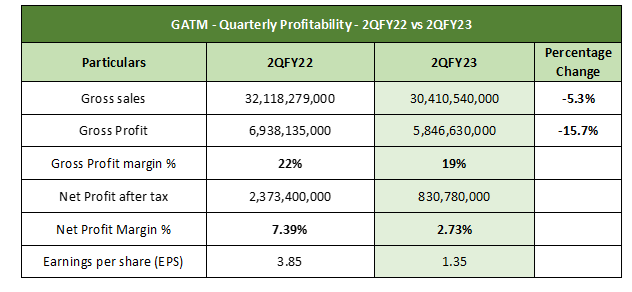

GATM – 2QFY23 (Oct to Dec)

In the second quarter (Oct-Dec) of FY23, GATM’s sales decreased by 5.3% and the gross profit by 15.7% as compared to the same period of the last fiscal (FY22). GATM posted sales of Rs30 billion and a gross profit of Rs5.8 billion, resulting in a gross profit ratio of 19% in 2QFY23.

The company’s net profit dropped to Rs830 million in 2QFY23 from Rs2.3 billion posted in 2QFY22. The net profit ratio remained 2.73%. The company posted EPS value of Rs1.35 in 2QFY23.

Credit: Independent News Pakistan-WealthPk