آئی این پی ویلتھ پی کے

Ayesha Saba

Pakistan should seriously implement structural and tax reforms, as suggested by the IMF, to tackle issues like heavy reliance on costly fuel imports, water and energy shortages in the agricultural sector, lack of investment in public welfare, and a political elite prone to corruption. Dr Khaqan Najeeb, renowned economist and former advisor to the Ministry of Finance, said this while talking to WealthPK. “Pakistan’s foreign financing inflows have historically been constrained by political instability, security concerns, governance issues, and perception of an uncertain business environment.” “Investors are often wary of these challenges, which have led to a risk premium associated with investing in the country,” he said. “Furthermore, during FY23, Pakistan experienced disastrous floods along with rising commodity prices worldwide. An inconsistent policy response, involving monetary tightening, new subsidies, and an informal exchange rate, saw the foreign exchange reserves depleting.”

He elaborated that, “Prior to seeking assistance from the IMF, Pakistan was facing severe economic challenges, including the balance of payments crisis, a widening fiscal deficit, and dwindling foreign exchange reserves.” “The IMF played a crucial role in strengthening Pakistan’s financial stability by releasing $1.2 billion in July as the first instalment of a $3 billion Standby Arrangement. The program provided Pakistan with the much-needed financial support to meet its external debt obligations and avoid default,” Dr Khaqan added. Continuing, he said, “There is a need to find a way to curb the informal inflow and outflow of foreign reserves if Pakistan is to see economic growth.” He suggested that the government should actively promote investments from overseas Pakistanis and encourage their participation in diverse sectors, including agriculture, tourism, and infrastructure development.

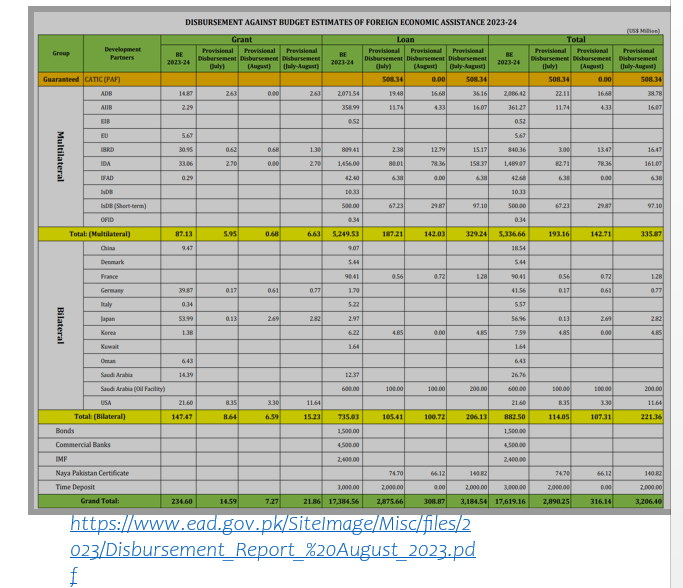

Moreover, according to him, the government must concentrate on a number of crucial areas in order to increase the economy’s reliance on remittances, including lowering the cost of remittances, making the process more transparent, and increasing access to formal financial institutions such as banks. During the first two months (July-August) of FY23-24, Pakistan saw a significant surge in foreign financing, exceeding $5.41 billion. This represents a remarkable contrast to meagre $439 million received during the corresponding period in the previous fiscal year. As per the monthly report on Foreign Economic Assistance (FEA) released by the Economic Affairs Division (EAD), the combined

FEA for July and August witnessed an astonishing increase of 630 percent, totalling $3.2 billion. Multilateral institutions emerged as the key financial supporters, with the World Bank leading the way, providing $178 million in loans during the initial two months of the current fiscal year. According to WealthPK research, the other significant contributors included the Islamic Development Bank ($87 million), the Asian Development Bank ($39 million), the Asian Infrastructure Investment Bank ($16 million), and the International Fund for Agricultural Development ($6 million), while the United States contributed approximately $12 million.

Credit: INP-WealthPk