INP-WealthPk

Hifsa Raja

Equities plummeted 865 points after the State Bank of Pakistan unexpectedly raised the policy rate by 100 basis points to 16%. As a result, the benchmark KSE-100 index of the Pakistan Stock Exchange (PSX) ended the week 41,071, down by 865 points, from the previous session of 42,936 points. WealthPK recently spoke to Muhammad Imran, Manager of Float Securities, about how the policy rate hike would affect the markets.

WealthPK: How does the policy hike affect the investor confidence?

Muhammad Imran: Investor confidence was shaken when the State Bank of Pakistan abruptly raised interest rates by 100 basis points as the benchmark KSE-100 index opened in the negative territory as expected, shedding a lot of points.

WealthPK: Which sectors contributed negatively to the market on the first day after the announcement of interest rate increase?

Muhammad Imran: Cement, E&P, banking, fertiliser and technology & communication were among the sectors that contributed negatively to the stock performance following the unexpected policy rate increase.

WealthPK: Which industry will be more impacted by this policy rate increase?

Muhammad Imran: The manufacturing sector would be affected the most as importing raw materials would become more costly amid high borrowing costs.

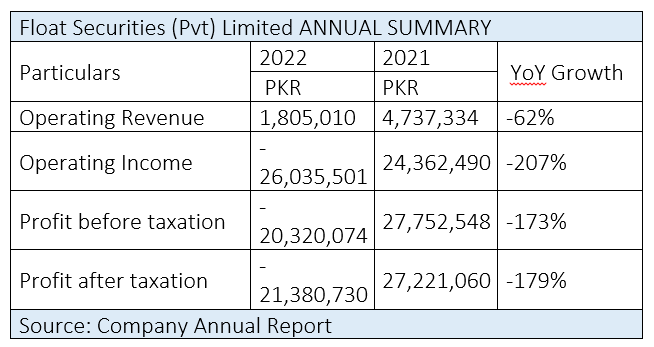

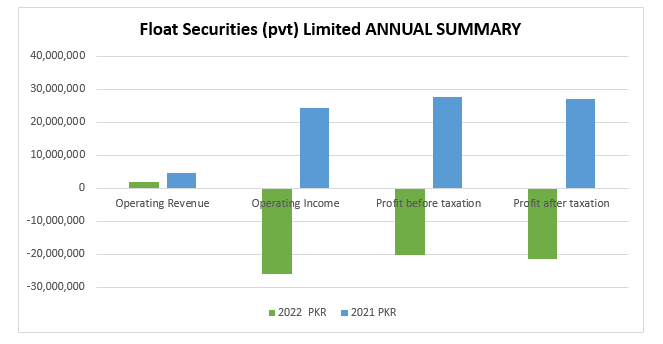

Float Securities Annual Performance

Float Securities Private Limited’s operating revenue dipped 62% to Rs1.80 million in the fiscal year 2021-22 from Rs4.73 million in FY21.

The company suffered an operating income loss of Rs26.03 million, or 207%, in FY22 compared to Rs24.36 million profit in FY21. The firm also sustained a loss-before-tax of Rs20.32 million in FY22 compared to a before-tax profit of Rs27.75 million in FY21, posting a 173% negative growth year-on-year. Similarly, the after-tax loss stood at Rs21.38 million in FY22 compared to an after-tax profit of Rs27.22 million in FY20, showing a 179% growth in loss.

Float Securities was incorporated with the Security and Exchange Commission of Pakistan on December 3, 2007. The company obtained membership of the Lahore Stock Exchange on April 8, 2009 and later also became a member of the Karachi Stock Exchange on April 6, 2010. The company’s memberships of KSE and LSE were converted into TREC (Trading Rights Entitlement Certificates) as part of the Stock Exchange’s Corporatisation, Demutualisation & Integration Act, 2012. The company became TREC holders of the Pakistan Stock Exchange on January 11, 2016 after the integration of Pakistan’s all stock exchanges – KSE, LSE & Islamabad Stock Exchange – into PSX. The company’s active PSX TREC is 141.

Credit : Independent News Pakistan-WealthPk