INP-WealthPk

Ayesha Mudassar

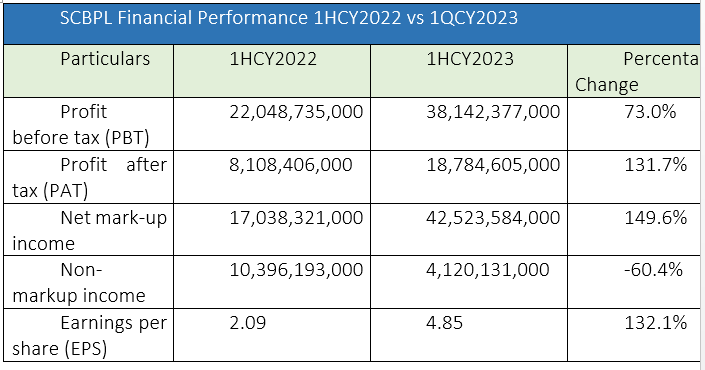

Standard Chartered Bank (Pak) Limited (SCBPL) declared a record profit-before-tax (PBT) of Rs38.1 billion for the first half of 2023, with an impressive growth of 73% over the same period last year, reports WealthPK. According to the financial results submitted to the Pakistan Stock Exchange (PSX), the bank reported a profit-after-tax (PAT) of Rs18.8 billion for 1HCY23 versus PAT of Rs8.1 billion over the corresponding period of last year. SCBPL announced the earnings per share (EPS) of Rs4.85 for the first six months of 2023.

The net markup income surged 150% to Rs42.5 billion, reflecting proactive balance sheet management, higher interest rates and pricing discipline. However, non-markup interest income for the first half of CY23 reached Rs4.1 billion, representing a 60% year-on-year decrease. Furthermore, operating expenses increased 27% to Rs8.5 billion, in line with inflation, while impairments plunged by 99% to a net release of Rs12 million, as the bank adopted a prudent risk approach and recovered bad debts. The bank’s total revenue grew 70% to Rs46.6 billion, with positive contributions from all segments. The record performance reflected the bank's resilience, solid foundations, and progress toward achieving its strategic priorities.

Quarterly profitability review

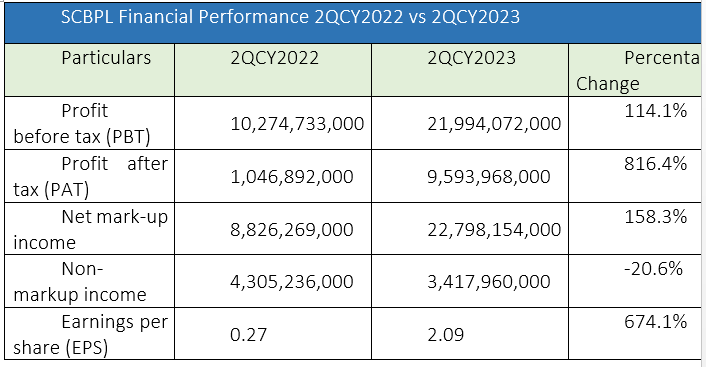

SCBPL witnessed an astounding profit growth of 816.4% for the quarter ending June 30, 2023, as it declared a PAT of Rs9.5 billion during this period compared to Rs1.04 billion over the same quarter of the previous year. The main factor that contributed to this record profit was a massive increase in net markup income during the quarter under review.

Moreover, SCBPL announced an EPS of Rs2.09 for the quarter, compared to Rs0.27 in the corresponding quarter last year.

SCBPL- historical financials

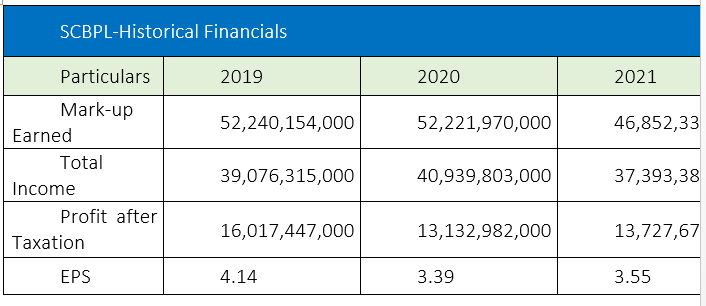

Historical analysis of SCBPL shows that in the last four years, the bank earned the highest markup in 2022. The bank’s interest income, a major source of revenue, showed a strong performance in this period. However, the bank experienced two declines in its markup earnings in 2020 and 2021. SCBPL earned a total income of Rs39.1 billion in 2019, Rs40.9 billion in 2020, Rs37.3 billion in 2021 and Rs62.6 billion in 2022. The bank hit the highest four-year PAT in 2022 amounting to Rs19.8 billion. The bank earned a net profit of Rs16.1 billion in 2019, Rs13.1 billion in 2020, and Rs13.7 billion in 2021.

The bank posted the highest four-year EPS of Rs5.13 in CY22. However, SCBPL experienced a decline in EPS in 2020.

Credit: INP-WealthPk